Today, Prosper officially announced their new investor user interface. The new modern site now ties in with the new Prosper logo and color scheme released earlier this year. I spoke with Stephen Smyth, Director of Product Management at Prosper to get a walkthrough of the changes. We also reached out to Prosper CEO Aaron Vermut for comment on the new website:

From the very beginning, retail investors have been part of Prosper’s DNA. As our business grew so did our investor base. We began to attract a broader, more diverse group of investors who wanted multiple ways to invest in our product. No matter what type of investor uses our platform, retail or institutional, both groups have the same desires—they want to build a diversified portfolio that generates an attractive yield as well as monthly cash flow. By launching our new and improved retail investor experience, we’re proud to be making good on our commitments to enhancing our customer experience.

Probably most apparent with the new Prosper is the focus on simplicity. It is now much easier to find what you are looking for and the streamlined experience is going to be a welcome change for new Prosper investors. Some functionality remains the same albeit with a facelift, but the two main areas that were completely overhauled were the account dashboard and auto invest.

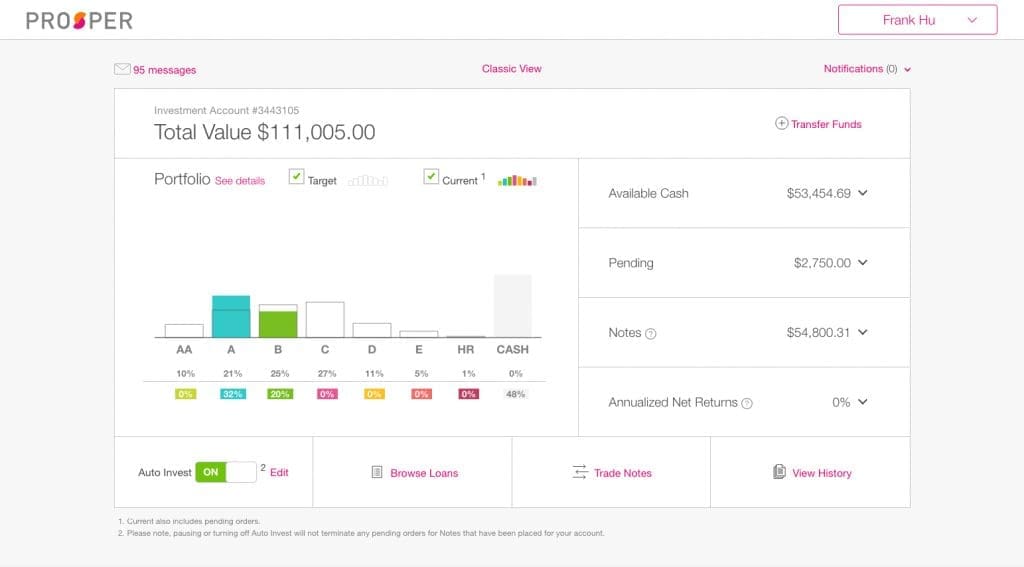

Upon logging into your Prosper account you will be presented with the brand new dashboard and account overview page. Users will see their current loan allocation across grades as well as target allocation if auto invest is enabled. A snapshot of your portfolio is also broken down by cash, pending notes, notes held in your portfolio and annualized net returns.

The new Auto Invest feature is linked directly from the account dashboard as shown above and Prosper notes it is now four times faster. One important thing to note is that the new Auto Invest feature is completely separate from Automated Quick Invest which was available on the previous version of Prosper’s website. Automated Quick Invest is still available and functioning but can only be accessed by clicking the Classic View link at the top of the page. Although Stephen wouldn’t comment on future product features it is likely that Automated Quick Invest may go away at some point down the road with Auto Invest being its replacement.

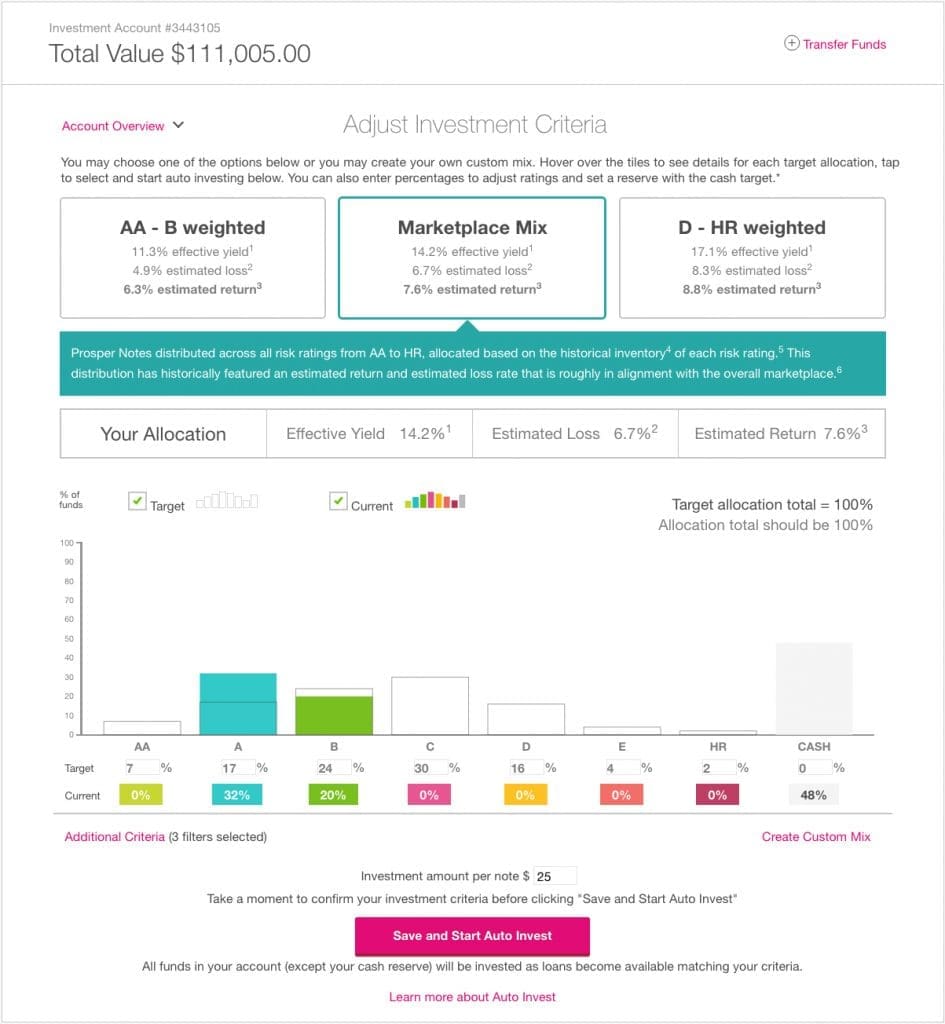

The interface of Auto Invest is extremely simple to setup and understand. Users are presented with three options: AA – B weighted, Marketplace Mix and D-HR weighted. You can simply select one of the presets that fits your risk tolerance or create a custom mix of loans you’d like to invest in. Charts showing current versus target allocation give you an idea of the portfolio changes based on options selected. In addition, there is a link to additional criteria which allows access to several filters that users have historically used to invest: Loan Term, Employment Status, Debt/Income Ratio and Public Records.

While from the user perspective it may seem that the new website is simply a new skin, Stephen noted that these changes also included significant backend work which also extended to the auto invest tool. The website performance and reliability should be much improved as a result.

Another change worth mentioning is that the new site is now optimized for mobile web. The interface is similar to viewing it on the desktop and allows for all of the same functionality. Lastly Prosper has now included an inline help bar at the bottom of the page. Searching will allow users to quickly lookup answers to questions and view the original article on the subject. If you still need help, a simple contact form is available to get in touch with the Prosper team. Several of the other pages linked from the account overview page have also been updated to reflect the new look.

Conclusion

The new website is a huge step forward for Prosper and it’s great to see that Prosper invested in improving the individual investor’s experience. Over the coming months we will see a number of other elements added to the site and the few existing legacy pages will also be modernized.