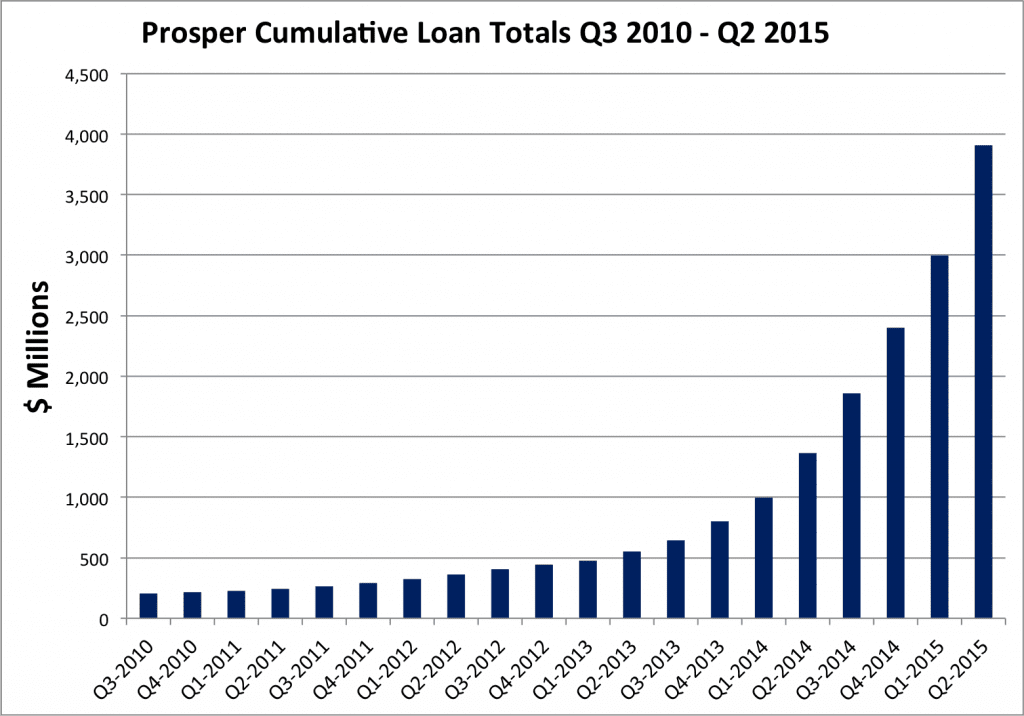

Prosper has had yet another big quarter. In Q2 they issued $912.4 million in new loans and today they announced that they have crossed $4 billion in total loans issued. I caught up with Aaron Vermut, the CEO of Prosper, earlier this week to get an update on what has been happening there.

The first thing he said was that the second quarter numbers were significantly ahead of their plan. The growth was driven by better execution and more productive partnerships. He also said they have improved their loan verification procedures significantly and their listing to loan ratio is now over 70% – meaning borrower listings that turn into funded loans. Their goal is to do more automated verification so they can scale loan volume without having to add new employees at the same pace.

Prosper Now Employs 456 People

Speaking of employees Prosper now employs 456 people in three locations: San Francisco, Phoenix and Salt Lake City. This is up from 230 people at the end of December. They have doubled the engineering team and have also brought their customer experience group in-house and have built that team to 68 people in short order.

On the investor side they have also started to make some changes. The investor signup process has been improved with a much more streamlined investor funnel. But when I asked about the retail investor experience Aaron admitted they were running behind on improvements here. He said they are moving from .Net to Java code and this is a huge undertaking. They also want to make sure they add a rich feature set when they make the improvements to the investor experience.

Despite the fact that there have been no enhancements for retail investors in a long time Aaron reported that investor demand is still strong. In June 2015 they had double the number of new investors sign up when compared to June 2014 and retail investor inflows are 10 times outflows.

I also asked Aaron about the lack of download data available now for investors. You used to be able to download the entire loan book on Prosper and do your own analysis. That stopped in January, due to Prosper wishing to protect their data from competitors. Aaron was pretty clear the transparency that we all enjoyed is not coming back any time soon, or ever, because he views their underwriting models as one of their key competitive advantages.

Competitors will no longer be able to re-engineer their credit model as they have done in the past. And one of the unfortunate consequences of this decision is that retail investors won’t be able to do their own data analysis on the loan history. Aaron also mentioned that a new version of their credit model is coming out in the next few weeks and this will be a major update.

While I can’t dig into the data to provide more commentary on their originations in the previous quarter it is clear that Prosper continues to execute well. I would like to have seen more progress for retail investors but we will just have to continue to be patient there.