Today Prosper sent an email to their retail investors notifying users of a change in calculating Annualized Net Return and Seasoned Annualized Net Return. The company recently discovered an error in their calculation which they are now correcting. The note to investors clarified that no other parts of the account were impacted including payments, deposits, monthly statements, tax documents, and note and loan level information – including estimated returns.

We reached out to Prosper to get more information on how stated investor returns were affected. If you login to your Prosper account and view more information about how returns are calculated you’ll see the following statement:

To calculate annualized net returns, a total gain or loss is calculated by summing all payments received (including investor rebates received from Prosper) net of principal repayment, credit losses and servicing costs. The gain or loss is then divided by the average daily amount of principal outstanding to get a simple rate of return. This rate is annualized by dividing by the dollar weighted average Note age of your portfolio in days and multiplying by 365. The calculation (i) excludes Notes bought or sold on Folio; (ii) only includes Notes issued after July 15, 2009; and (iii) is updated monthly.

The Seasoned Annualized Net Return is the same calculation but only includes notes that are at least 10 months old. Prosper clarified that the method of calculating returns is the same and that the error was with the inputs into the calculation. The majority of investors will see a corrected annualized net return lower, although in some cases returns were understated or not impacted at all. We learned that the error was discovered a little over a week ago and the company has been working on a fix since then. The time period that returns have been misstated ranges between investors but is up to several quarters.

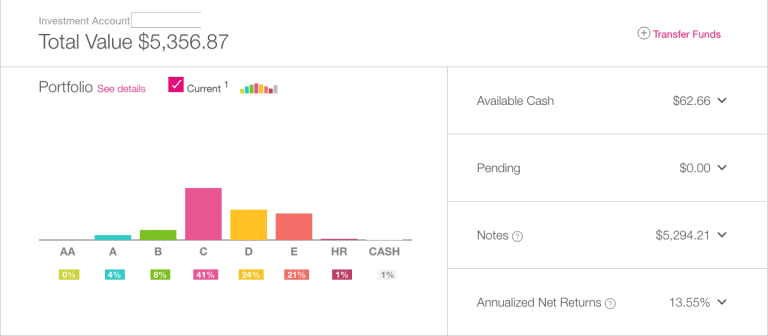

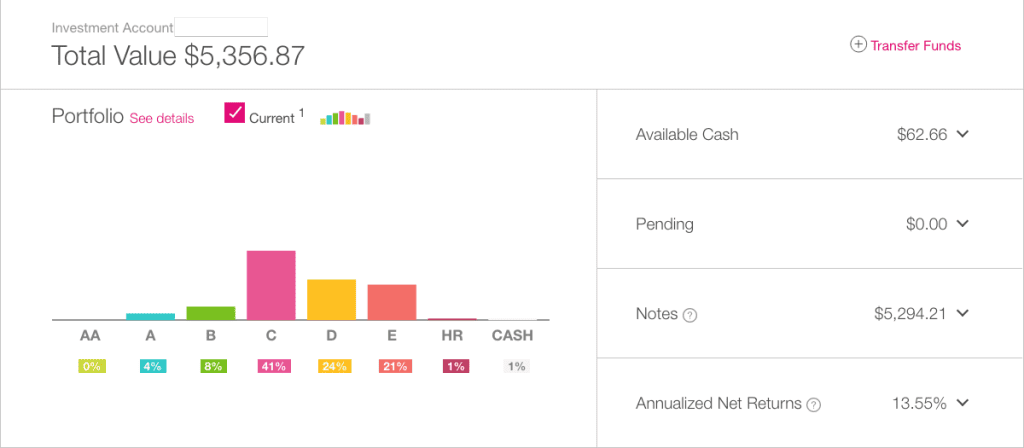

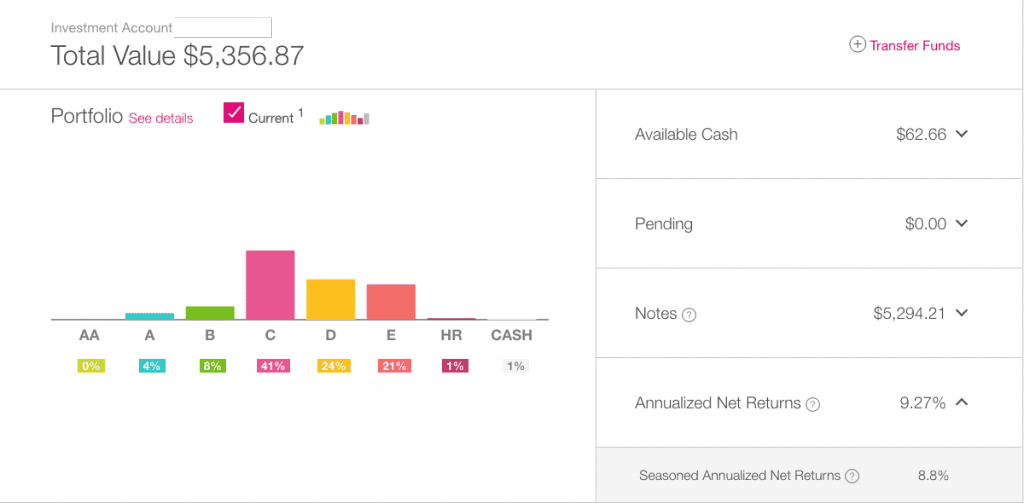

I took the below screenshots from my account showing the original net annualized return and the corrected net annualized return. In my account the stated annualized net return dropped from 13.55% to 9.27%.

Conclusion

In the past p2p lending investors have relied on different ways to calculate returns outside of what the platforms provide. This is because calculating returns is complex and there is no consensus on what method is best. At Lend Academy we prefer using XIRR in addition to platform stated returns to calculate returns in our own portfolio. We wrote a post last year on the different ways of calculating returns with Lending Club and Prosper. However, many investors rely solely on the stated returns provided by the platforms. Although it is disappointing that Prosper had an error in their calculations we are glad they were transparent about the issue and addressed it head on with the retail investor community.