The CEO and Founder of NerdWallet talks fintech, consumer finance and the changes that are coming

Ten years ago there was nowhere to go to compare consumer finance products via an independent site. Whether it was credit cards, personal loans, saving accounts you were pretty much on your own when it came to research. Today it is very different.

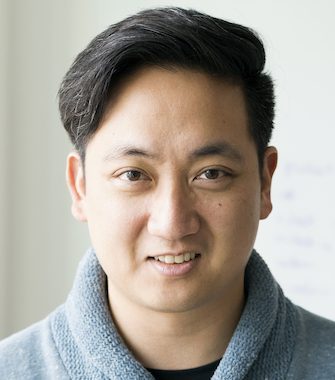

My next guest on the Lend Academy Podcast is Tim Chen, the CEO and Founder of NerdWallet. In less than a decade Tim and his team have built NerdWallet into one of the trusted names in consumer finance. Their independent reviews of financial products are read by around 100 million people annually.

In this podcast you will learn:

- How NerdWallet got started.

- The different verticals they cover in consumer finance.

- How NerdWallet is different to the likes of Credit Karma and Bankrate.

- The kinds of fintech solutions that Tim finds most exciting.

- The consumer finance categories where they receiving the most traffic today.

- What goes into the NerdWallet Rating?

- How they decide which companies make it into their categories.

- How their business model works.

- How they find their customers and why they don’t do much paid marketing.

- Why consumers continue to make bad financial choices.

- Tim’s view on the impact of the growing number of digital banks.

- The scale that NerdWallet is at today.

- Why they are not looking to expand internationally.

- Their split between mobile and desktop users.

- What Tim and his team are focused on over the next 12 months.

Download a PDF of the transcription of Podcast 196 – Tim Chen.

Click above to Read Podcast Transcription (or read Full Text Version Below)

PODCAST TRANSCRIPTION SESSION NO. 196/TIM CHEN

Welcome to the Lend Academy Podcast, Episode No. 196. This is your host, Peter Renton, Founder of Lend Academy and Co-Founder of the LendIt Fintech Conference.

(music)

Peter Renton: Today on the show, I’m delighted to welcome Tim Chen, he is the CEO and Founder of NerdWallet. Now NerdWallet has become a bit of a juggernaut in recent years where they have massive amounts of information on anything to do with consumer finance and they really are becoming one of the most trusted brands in consumer finance.

I wanted to get Tim on the show to talk about the background of NerdWallet, what it does, how it works with many of the fintech players today, the impact of fintechs have on consumers and what else is needed to really help consumers make good financial choices. We also go into some depth about their model and about how they have the wall between editorial and any revenue kind of opportunities, we talk about that in some depth as well, and he talks about his vision for the future of consumer finance. It was a fascinating interview, I hope you enjoy the show.

Welcome to the podcast, Tim!

Tim Chen: Thanks for having me.

Peter: Okay, so I like to get these things started by giving the listeners a little bit of background about yourself. So why don’t you just share some of the things you did actually before you started NerdWallet.

Tim: Sure, my career is one of Wall Street and Main Street really. So I started off life as an equity analyst on the sell side and then on the buy side at a hedge fund investing in public companies. I think this is a pretty unique background in the sense that it really gave me a view into the competing interest of say like business profits versus consumer welfare. So in a way learned at the time was there was a lot of industries where consumers reigned supreme and businesses compete purely based on price, but then there’s also other industries where businesses have moats that allow them to really avoid competition and make big and sustainable profits over time.

So I spent most of my time actually trying to like dissect and understand those situations and we would tend to investment in businesses that were misunderstood, in one direction or another, and were therefore mispriced. I see certain industries…you know, at the time I really noted certain industries that were really great businesses at the expense of consumer welfare so things like education, health care and financial services and, you know, in the back of my mind the entrepreneur in me always had the ambition to make a difference in one of those areas and that was kind of where the seed was planted.

So I was fired in 2008 from my job when the recession hit which was a complete shock at the time, but it was also incredibly liberating having a year/two years to really focus on pursuing my dream at that point and that’s really where I got started. You know, during that time, one door closed and another one opened. My sister randomly called me one day and asked me for help finding a credit card and I said, sure, let me Google that for you.

I thought I’d get back to her with a response in 30 seconds, but I really found a bunch of marketing materials rather than analysis that I thought was helpful so I created a spreadsheet and that spreadsheet turned into NerdWallet. It got forwarded around to a few friends, quickly realized that, you know, this problem with shopping for credit cards really applied to all financial products in the sense that there is not a great source where you can equally compare all your different options so that’s really where NerdWallet started.

Peter: Okay, okay. So then so you started off was it purely just a….when you launched, was it just a credit card comparison site? Was that how it launched or what, tell us a little bit about those early days.

Tim: Sure, you know, that’s exactly right. It really was a spreadsheet that I transcribed into a web app where you could, you know, kind of talk about two or three important pertinent questions about yourself and then we’d give you the short list of things that match your needs. You know, in our consumer research we started to find consumers didn’t want all the information, they wanted to be understood and they wanted the few options that mattered.

So in the example with credit cards, people are typically either trying to establish credit, lower their interest payments or earn more rewards so it’s kind of important to know where they’re starting from and then we might ask a follow up question and maybe another one after that.

Peter: Right, you go on to the site today and you…it’s quite impressive actually the breadth of information that you guys provide…so when did you start to move just beyond the credit cards? When did you decide that you were going to cover everything pretty much?

Tim: Right, we really had to focus on credit cards for the first three years to find our footing, and then we really started expanding after that, but knew from the start that this was a big problem in all verticals. Today we cover, you know, 10 plus verticals, basically any popular consumer finance product we try to give great analysis and help you shop it easily.

Peter: Right, right. So when you’re describing your company today, I mean, how do you describe it, because you sort of…you are doing a lot of different things here so tell us what you say.

Tim: Yeah, we help consumers make smart money moves and there’s two big problems that consumers face today. The first is it’s really hard to shop. Consumers leave about $55 billion a year on the table by not having the best financial products and there’s a lot of reasons for that, but we try to remove as much friction as possible from that process.

The other big challenge consumers face is that money is just so complicated that they don’t even know when they should be making smart money moves.

So for example, you know, if you sign up for a great financial adviser or just have a friend who’s really into this stuff, they might let you know, hey, tax time is coming, put money on an IRA or gosh, you’re probably overpaying for that mortgage or that auto insurance policy so these things aren’t things that you actually think to do, but when you start building a relationship with us, when you tell us more about yourself, we’ll start proactively letting you know that it’s time to think about these things in a just in time fashion.

Peter: Right, right, okay. So then obviously there are other companies offering services like this, Credit Karma comes to mind, we had Ken Lin on the show last year and there’s also…Bankrate for simple comparison shopping so how do you differentiate yourself from the others in this space?

Tim: Yeah, so we like to think that we have, you know, next level consumer trust. We believe we’re the most trusted brand out there when it comes to financial shopping and education. You know, over 100 million people a year come and get help from us every year and I think the reason that we’ve achieved these things is because our entire ethos is centered around that first spreadsheet I was just mentioning, we don’t market to our consumers, we give them useful information and I think they can really feel that.

So we’ve maintained an editorial independence over the years and it’s very apparent. So, for example, I was in a meeting yesterday with a potential partner and we let them know that our editorial team needs to vet them before we can consider adding their product to our site. We’ve turned down partnerships before when we don’t feel like they, you know, aren’t consumer friendly or are one of the better products in the category and so that’s a big part of what we do and also the thing about segments.

You know, there’s different needs for different types of people and one way I think about the American consumer is that about half of them are paycheck to paycheck and the other half have financial choice, right, and these are two very different mindsets. I mean, we spend so much time doing consumer research and sitting in people’s living rooms and trying to understand their needs.

The paycheck to paycheck half really cares about will I qualify, what’s my credit limit, how can I get to that next paycheck. The people with choice have a completely different set of concerns, they have too many choices, they have, you know, ten different financial apps, they’re trying to figure out how to plan with this extra money, how much do I put away, how do I create a plan that will get me to retirement.

And so if you think about the behavior between these two different groups, they gravitate towards different financial solutions and I would say that NerdWallet does cover/span both groups, but a lot of the most complex decisions actually come when you have choice. That’s really when you say, well gosh, I know I can qualify for a lot of great mortgages, where do I go, how do I actually find the best options out there. That’s why you would proactively go to a site like NerdWallet at that point.

Tim: You see a lot of fintech innovation also on the paycheck to paycheck side. You see things like, you know, the solutions I find exciting are things like, get my paycheck early, micro investing, save the change, free credit score. Things like this are really helpful to try to make things a little bit better, but they answer different consumer needs.

Peter: Right, that’s interesting. You’ve had this company now, you know, for about ten years and when you started the word fintech didn’t exist and now it’s pretty commonplace. You’ve seen sort of the evolution of the products that you’re recommending.

I’m curious to see, you know, where is the innovation happening that is most impactful. I mean, you mentioned a couple of them there, but when you’re looking at sort of the different segments that you cover and I see them on your website right here, the top of your home page there, where do you think in the broad categories that’s most exciting as far as fintech innovation?

Tim: Yeah, so I think that segment framework is an important way to think about this. If you look at the $55 billion that Americans are wasting every year by not shopping for financial products, I think that really is more weighted towards consumers with choice and the reason is because they are the ones that have substantial deposits earning 0% interest at a money center bank, right. They’re the consumers that have, you know, the largest loans and things like that, that they should probably think about optimizing their insurance policies, etc. and so innovation there is really giving consumers easier comparison, better choice, better rates.

And then if you look at the paycheck to paycheck side, I also think the innovation there is very important as well. It’s not as big from a dollar impact perspective, but it maybe means a lot more to those consumers. And so I think things like early paycheck are great, you know, you can get a couple of hundred extra bucks. Instead of going to the payday lender, you can go through one of these great services that gives you your paycheck early.

I do think that fintech is more of a Band-aid in those situations than an ultimate solution in the sense that fundamentally, the consumer has a revenue issue and they have an expense issue and this may give them an extra couple of hundred dollars of float, but it’s not going to solve their core problems, but it’s a good attempt nonetheless.

Peter: Okay, so I want to sort of dig in a little bit here into your website. You have a massive amount of content. When I started sort of tooling around this over the last couple of days, it was really staggering to me how much you’ve written about all the different financial products and the different categories. So I guess, I mean, the first question is around, you know, I’d be curious ….credit cards is on the left, on the top left of your site, is that where you still get the most traffic and the most interest in the credit card category?

Tim: Yeah, so we’re actually quite diverse right now. Our biggest category, in terms of traffic I believe is still credit cards, but it’s less than 20% of our overall traffic.

Peter: Interesting.

Tim: You know, people have pretty diverse financial needs and the source of that complexity comes from our tax code, from the fact that there’s over 10,000 banks and credit unions out there with different products. These things are really complicated so actually the more financial choice you have, the more complex your money management problem becomes. That’s a big part of why there’s so much content, we don’t write it just to write content, we’re trying to cover all the areas that someone may care about.

Peter: Right, right. And you also have…I noticed many of your products or I would even say, most it seems like, have a NerdWallet rating and you mentioned you have to get your people in there before you can take on a partner, but what goes into that NerdWallet rating?

Tim: Sure, so these ratings are different by vertical and they’re driven by our editorial team which is completely independent from our business. If you take the example of personal loans, some of the things that they care about include things like origination and late payment fees, impact on credit scores, transparency of loan terms, repayment options, customer support and, you know, if the lender has faced government scrutiny from regulators in the past five years, we might factor that in as well.

So there’s kind of like a broad swath of factors that matter and you’d see a completely different set of factors on credit cards, for example, so we try to really tailor it to what consumers need. The consumer insight here is really that, you know, consumers are overwhelmed with choice, they need that proxy for trust that can help them understand where the red flags are, where the pros and cons are and so that can help them shortcut their decision and that’s what we provide.

Peter: Right, right. And so I’m looking at the personal loan category right now and I’ve actually got it up with debt consolidation loans and you’ve got many of the companies that the listeners would know well like SoFi, like LightStream, Marcus, Best Egg, Avant, Upstart, Prosper, etc. so I’m curious about a couple of things here.

What does it take to get included in here because you don’t have everybody, there’s certainly some companies that I thought you would have had that you didn’t, and others that are a little bit of a surprise that you do have, so what does it take to get in a list in a particular category?

Tim: Yeah, that’s driven by the editorial team so, you know…I know, for example, that they place extra scrutiny on 36%+ lenders and things of that nature. I’m not super in the weeds in terms of how they make all of these determinations, but it’s really driven by some of those factors I discussed.

Peter: Right, right. And then I am curious about the business model then, I mean, obviously you can go and you can check your rate and you can stay on NerdWallet while you’re putting in all of this information, is your revenue model purely based then on a successful application or a successful kind of conversion shall we say at these companies, or just tell us a little bit about how it works.

Tim: Yeah, that’s partially right. In most cases, we’re a matchmaker so we get paid when a customer either opens or funds an account, depending on the vertical, and yeah, I think that’s a win-win for the consumer and the bank. You know, both people are getting either a great product or a great customer that really understands the product that they’re about originate. For example, we hear on the credit card side that because consumers understand the product they’re getting into, these things are more likely to remain top of wallet for them and have a longer life span. So I’m really happy about the work we do there.

Peter: Okay, so then is it possible then…do you have a revenue partnership with every single product that you endorse here, or are there some that you recommend that you don’t have a revenue partnership with. You said there’s a wall between editorial and the business side so I’m just curious about how that particular piece works.

Tim: Yeah, we do recommend products that we do not have a partnership with. I think most partners or most financial institutions at this point that we think are great, we do have a commercial partnership with, but there are definitely exceptions.

Peter: And then obviously someone comes in and you said yourself that if you don’t like the product, whoever it is, you’re not going to put it on. I imagine there would be some pressure…I mean, you’ve got potentially…if you have a large customer that you know that you could send thousands and thousands of people to, how do you decide…like the editorial comes in and I’m just curious, to say right, we’re happy to forego that million dollars in revenue that we’re going to get this year because we don’t feel like it’s a good fit, I mean, how do those conversations go?

Tim: (laughs) So there is a healthy internal tension there. You know, the only reason that we…I guess there’s an interesting nuance here. The only reason we even have the optionality of doing this is because most of our customers come organically. We’re not paying for these customers and as a result, we have a lot of flexibility of being consumer friendly and consumer first in terms of how we make these recommendations.

So there’s definitely huge pockets where we are under-monetizing and, you know, it caries a lot by vertical. I would say that in an area like personal loans, we do tend to think that because there are so many partners that have great products, we will integrate with as many of them as possible to provide as much choice as possible. There are certain areas where the editorial team might feel strongly that we shouldn’t be promoting certain types of products and that may be either baseline interest rates or terms or just like a history of issues that consumers have run into.

Peter: Right, I notice here you don’t have payday loans, for example. You have bad credit loans, but they’re still sub 36% on your site so obviously that’s a category that you’ve decided not to pursue, right?

Tim: Correct, yes.

Peter: Okay, okay, interesting. So I want to go back to something you said earlier. I’m just curious, you said that there was this statistic you quoted, I think it was $55 billion that consumers are wasting on bad financial choices. How did you get that number and what does that actually…I mean, where does that come from?

Tim: Yeah, so our editorial team did some analysis on that so just to give you an example, right. I think $19 billion of that comes from deposits that are in accounts that are not earning the highest yield you could get. There’s a big business around money center banks collecting deposits and the rates are much lower than what you would get through an online high-yield savings account so that alone accounts for $19 billion a year.

Peter: Right, right, that makes sense. It’s amazing to me that people will still put money in their local bank that’s paying 0.1% when you can get 20 or 30 times that elsewhere. Okay, like today, I’m interested in the fact that there’s so much more happening online today so you’ve got a lot more…it’s possible for you now to have all of these online savings accounts which I guess there were to some extent when you first launched, but certainly a lot more choice now.

As you see a lot of this move towards digital and move towards mobile, how is that impacting your offerings? I presume it makes it easier to provide a lot more choice for consumers, but just curious to get your take on the sort of movement where all the major banks, not only that, there’s a lot more to digital banks coming to the fore…how is that impacting you guys?

Tim: Yeah, we think that the entrance of all these new fintech or digital banks is great for the consumer. It increases choice, they tend to be, you know, very digitally enabled banks and that makes integrations with us extremely easy. You know, we’re seeing consumers really gravitate towards them. I think what you’re looking at a couple of years down the road, is this increasing convergence towards one place to manage your money and that’s really what NerdWallet is building.

Imagine you login to this one place and there’s increasing digital integration with all these banks and services, you can get loans or deposits that are best for you when you need them, we’ll proactively make recommendations when you should be thinking about things that you wouldn’t even think to think about. I think it’s inevitable that we head in that direction, we’re already racing there, and maybe a third of the way there.

Peter: Okay, that makes sense. So then you said earlier that you don’t really pay for your customers who come to your site, or pay for your visitors, I mean, is that purely because the vast majority are coming either from the search engines or from word-of-mouth. I mean, what do you do proactively to try and reach new users?

Tim: You know, search engines and word-of-mouth are huge and the flip side of that is we invest almost everything we make back into building great products. We have a huge number of product, engineering, design, user research and content folks who are constantly trying to figure out how to improve our product and I think that really drives a lot of that word-of-mouth. There’s always the other organic traffic channels, we are starting to pick up and do brand advertising, TV, out of home and digital as well, but the thing that’s making that a lot more efficient for us is the fact that customers trust our brand so much and we’re so pervasive in organic areas as well.

Peter: Right, that makes sense, that makes sense. So then can you give us a sense of the scale you guys are at, I mean, how many people are registered on NerdWallet or give us some sense of that.

Tim: Sure, we serve over 100 million people a year, in terms of registered members, we’re at a few million now and yeah, both numbers are growing quickly. Our goal is really to become the de facto destination for making smart money moves and I think we’re well on our way there. This is really just within the United States where we’re solely focused today.

Peter: Does that mean you’re not looking internationally in the short to medium term?

Tim: Yeah, that’s right. You know, we think that there’s a long way to go between the current state of, you know, basically doing all of your money stuff in one place and where it’s going to be in three to five years. We think we can make a lot of that progress in the US. There’s a lot of things to figure out still…I mean, there’s a lot of marketplaces where the shopping experience still isn’t where we think it will go. Mortgages come to mind, that’s still very complicated and complex and we think there’s a lot of work to be done there.

Peter: Right. Yeah, on mortgages, obviously there are some of the newer fintech players that are coming in that are trying to make a difference there and there is a lot of friction so what you’re saying is…I mean, I guess how closely embedded are you with these companies, like mortgages or even personal loans or what have you where you’re really trying to work with them to improve the funnel, improve conversions and improve the user experience because it seems like there’s…some of these companies really just refine the user experience down to a very limited amount of moves on the users’ behalf. So how integrated are you into the needs of your partners there?

Tim: We’re working with the major players there. I’d characterize jt really as being in the first or second inning so we’ve got a long way to go, but I think there’s the will on both sides that continue to push those integrations so I think it’s just a matter of time.

Peter: Right, right. So then are you looking to replace like Mint as well? You said you want to be the one-stop shop where someone manages their entire financial life so are you looking to really work on the expense side as well as the lending and investing side?

Tim: Yeah, that’s exactly right. So I think about the different pieces of what you just described is you know, there’s shopping, there has to be a marketplace for all the financial products out there so that the consumer really has choice, right. The other piece is not just choice, but convenience so can we help consumers see all their stuff in one place, help them budget, help them move money around, pay bills, do what they need to do. So that all has to happen under one umbrella.

Peter: Right, right. So what about…we haven’t talked about mobile, I just want to touch on that really quickly. Are you primarily finding people coming to you on mobile now or is still kind of desktop, web-based, how are people interacting with you?

Tim: Yeah, we crossed over into the majority mobile maybe a few years ago, but desktop is still a hugely important. I mean, we actually find that the time of day people are most engaged is, you know, in the middle of the work day during the work-week. I think that’s sometimes when you think they go and check in on your money, so yeah, desktop is hugely important for us as well, it kind of varies by vertical. You know, things that you couldn’t imagine doing on your phone five/seven years ago are now majority mobile like say credit cards, but there are still things like mortgages that you really want to be sitting at a computer to do.

Peter: Yeah, at least today, let’s hope it won’t be that way much longer, but…anyway, we’re almost out of time, so you’ve painted a bit of a future where NerdWallet could sort of be the hub of someone’s financial life. So I’m curious…let’s just take a shorter term approach like what are you doing over the next 12 months to try…what are you focusing on to really move the needle in that direction?

Tim: Yeah, it’s really some of the things I mentioned. It’s really driven by choice and convenience so we think we have a long way to go, in terms of improving our marketplaces to make them really easy for consumers. On the convenience side, we’re investing in our member experience. I’m trying to figure out…you know, from a consumer perspective how to make it obvious when they should be making smart money moves and then trying to take the friction out of making some of those smart money moves.

Peter: Okay, well it’s a fascinating space and it’s amazing how far we’ve come, but as you say, it’s still in the first or second inning so I think in a few years down the track we’ll look back at today and think we were quite rudimentary, but…anyway, I really appreciate you coming on the show today, Tim, thanks a lot.

Tim: Thanks for having me, Peter.

Peter: See you.

You know, it really is interesting to me this whole idea of this personal financial hub where we all go to manage our financial lives. Now banks are vying hard to maintain this sort of dominion over the consumer and have them be the financial hub. But then you’ve got others that are out there like SoFi in the fintech space or Personal Capital that are also trying to do this and then you’ve got the sort of third party companies like NerdWallet or Credit Karma that are seeking to kind of become this hub.

It’s going to be interesting, it’s going to be great for the consumer and I think there’ll be more than one winner here obviously, but there’s going to be…in the near future, you’re going to be able to have companies like NerdWallet that will be able to not just be your personal financial hub, but proactively make sure that your finances are being managed optimally and I think that’s going to be great for the consumer.

Anyway on that note, I will sign off. I very much appreciate your listening and before I go just one more thing, I really would appreciate it if you would go to Apple Podcasts or Stitcher and give a short review to the Lend Academy podcast. It helps other people discover the show. So on that note, I will sign off. Thank you for listening and I will catch you next time. Bye.[/expand]

You can subscribe to the Lend Academy Podcast via iTunes or Stitcher. To listen to this podcast episode there is an audio player directly below or you can download the MP3 file here.