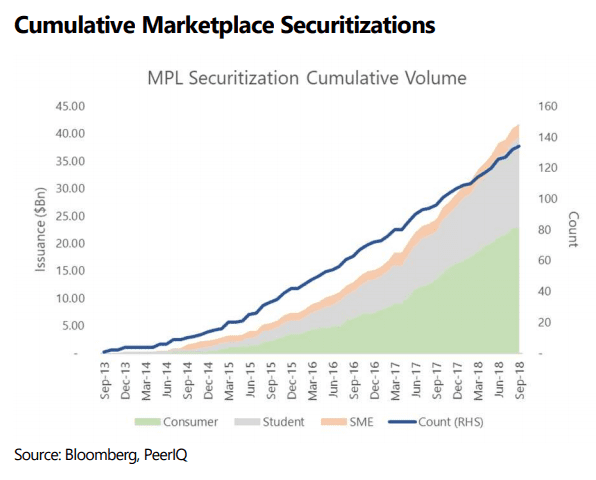

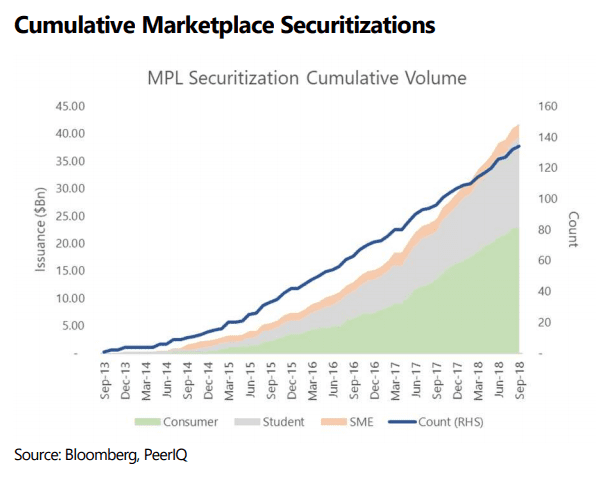

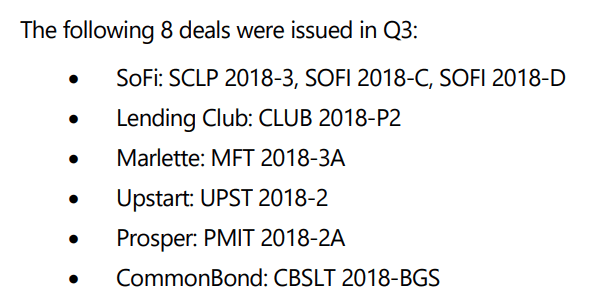

Every quarter we look to PeerIQ to give us the pulse on the marketplace lending securitization market. Today they released their report for Q3 2018. A total of eight marketplace lending securitizations were issued in the third quarter, totaling $3.5 billion. This is the fifth highest level of quarterly issuance which is noteworthy given that the summer is typically a slower period for issuance. This is an increase of 35% from the prior year period. It’s hard to believe that total marketplace lending issuance to date stands at $41.9 billion across 134 deals.

There has been a shift with spreads tightening and yields falling on new deals, a reversal from prior quarters. PeerIQ noted that all-in yields on consumer deals decreased 2 basis points from 3.72% to 3.7% and student deals decreased 100 basis points from 4.5% to 3.5% over the previous quarter.

Ratings agencies have also continued to upgrade deals with 52 consumer tranches and 67 student tranches. Credit enhancements levels have deteriorated in 8 SME, 4 consumer and 2 student loan tranches.

Not surprisingly, SoFi continues to lead the way in issuance and made up over half of the issuance in Q3 2018. at $1.8 billion. ($546 million in consumer and over $1 billion in student)

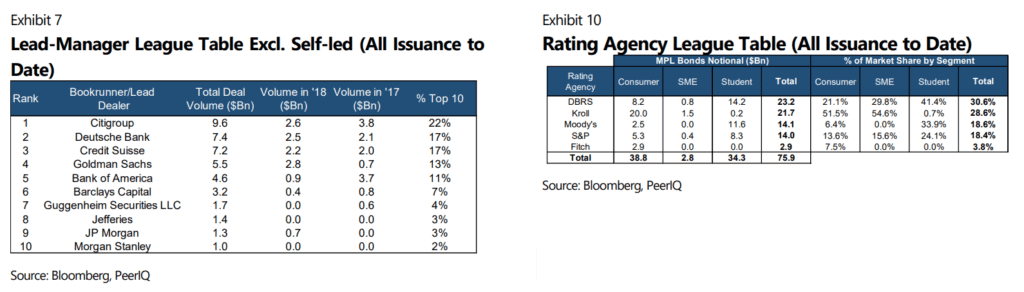

All deals in the quarter were rated with DBRS leading in the rating agency league table, followed closely by Kroll. DBRS leads with student loan securitzations ($14.2 billion) and Kroll leads in consumer rated deals ($20 billion). Citigroup, Deutsche Bank and Credit Suisse combined make up 57% of marketplace lending transaction volume. PeerIQ noted that both Citi and Credit Suisse are increasing their activity in the fintech space with Credit Suisse offering risk retention solutions on securitizations.

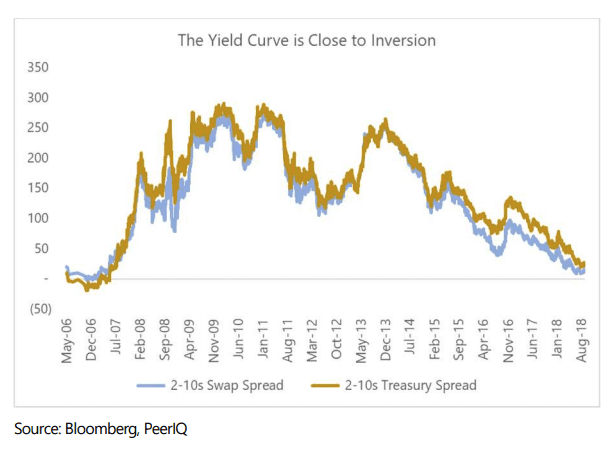

PeerIQ also discussed the current state of the economy. Unemployment is low and the economy grew by 4.2% in Q2 2018. All signs point to a healthy US consumer who has a strong appetite for debt. Consumer credit outstanding reached an all time high of $3.9 trillion in July. The Fed also has continued to raise rates this year, with 2-3 expected for next year. However, many are watching the spreads between long and short term borrowing which in the past has been indicator of a recession. With more rate hikes on the way it is expected that we will see an inverted yield curve.

If you’re interested in learning more about the current trends in the securitization market you can download PeerIQ’s Q3 2018 Marketplace Lending Securitization Tracker for free.