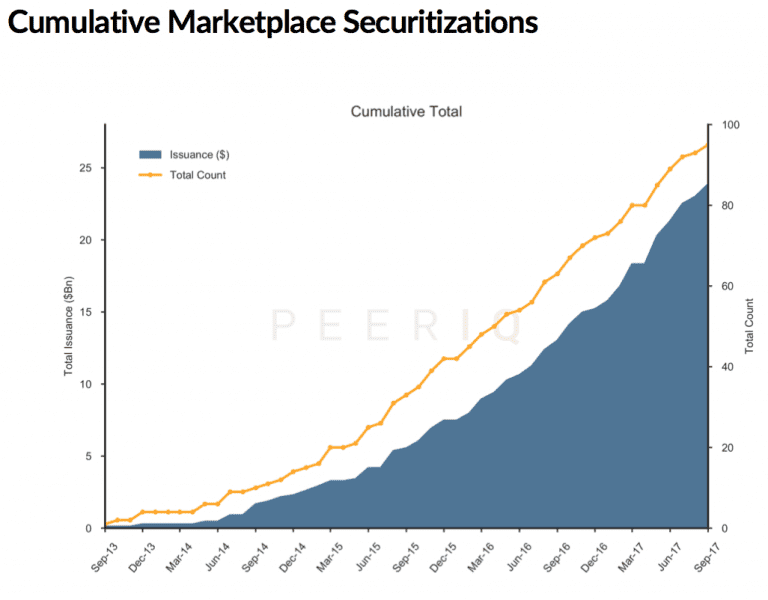

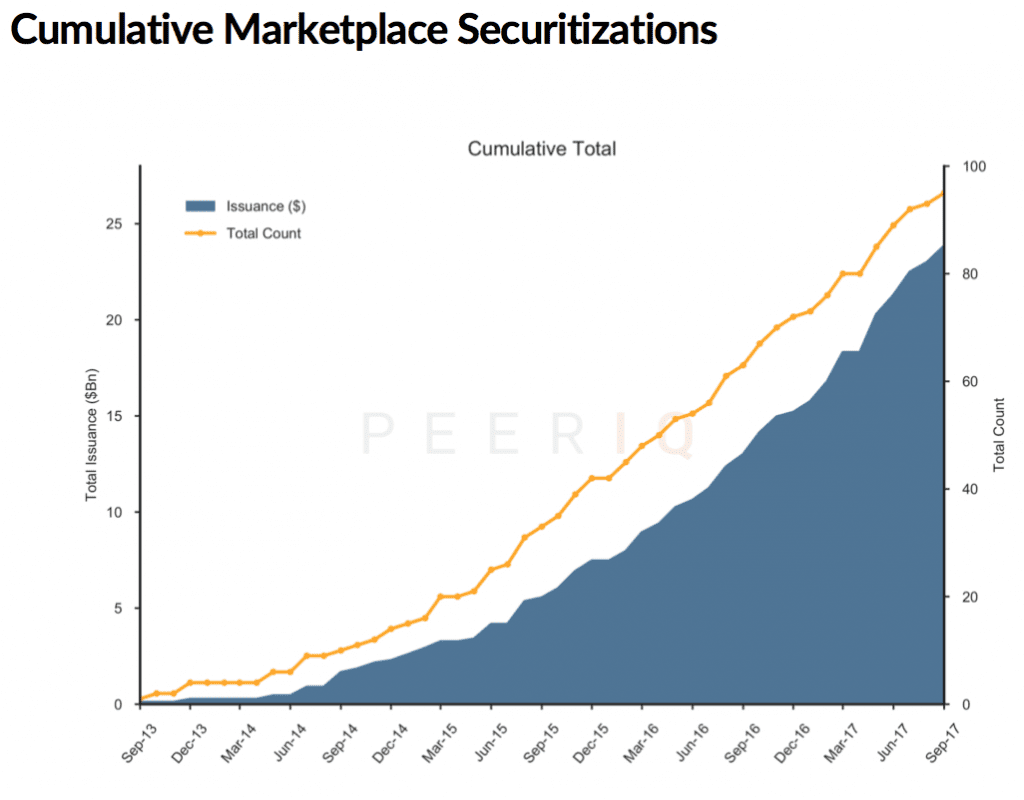

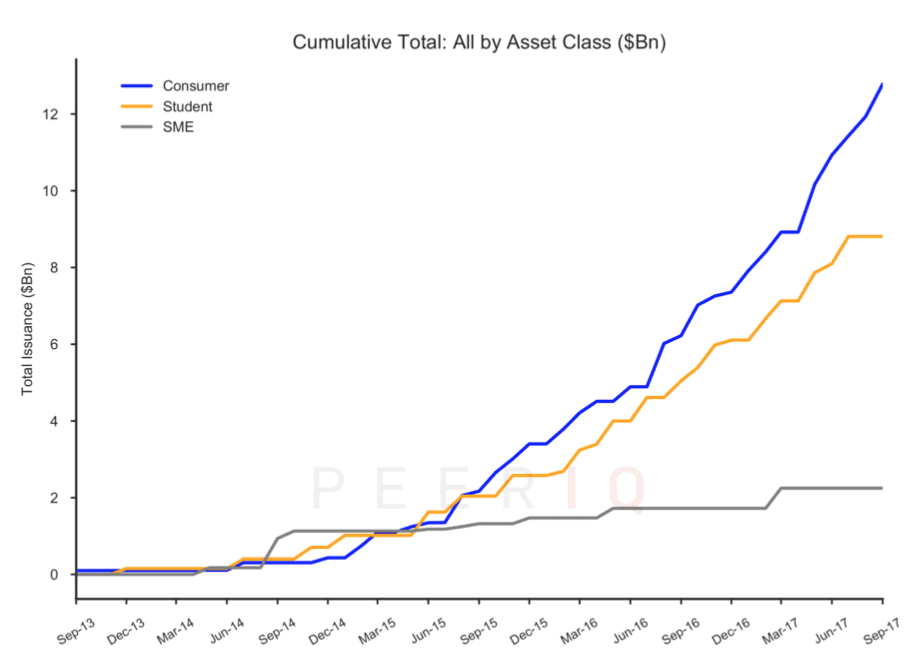

PeerIQ has released their latest marketplace lending securitization report for the third quarter. Total issuance for the quarter was $2.6 billion, down from $3.0 billion in the previous quarter. This represents an increase of 7.6% from the prior year period. Total issuance to date is now $23.8 billion across 96 deals. The breakdown of securitizations by asset class is shown below:

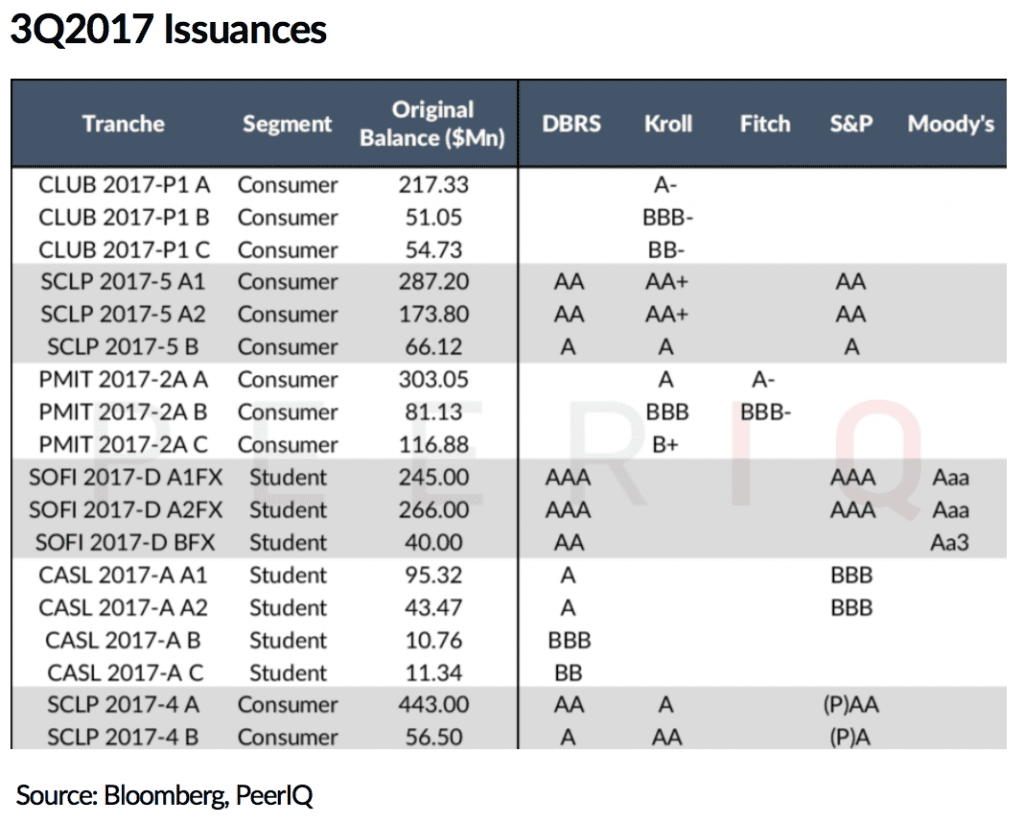

One of the indicators of the maturation of marketplace lending is that for the second quarter in a row all deals were rated. As usual SoFi led the way as far as total volume goes closing two consumer deals and one student loan deal. Both Lending Club and Prosper issued a securitization and College Avenue issued their first ever student loan securitization. This was Lending Club’s first securitization of prime loans, with borrowers having a weighted average FICO of 692.

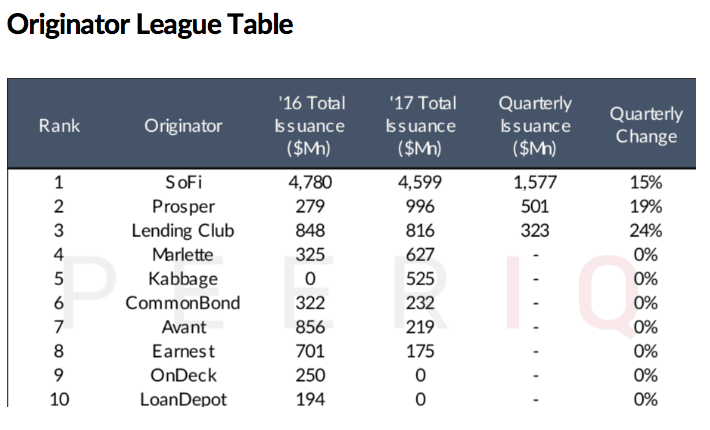

The below league table shows the top ten originators and total securitizations across 2016 and 2017 to date.

PeerIQ noted several other takeaways for the quarter which are further explained in the report:

- Credit support requirements remain stable as rating agencies get more comfortable with collateral performance. We see deterioration in credit performance, but investors are well protected due to structural features and senior tranches deleverage rapidly to gain greater protection. Demand remains robust in this sector.

- In related news, Goldman Sachs purchased $300Mn of solar loans from Mosaic. It would be interesting to see if they would participate in future Mosaic securitizations, as they have in the Marlette transactions.

- 3Q17 saw a benign macro environment and low volatility. The Fed announced the beginning of its balance sheet reduction program to start in October, and prepared the market for an interest rate hike at the December meeting.

Conclusion

This is just a taste of the information that PeerIQ includes in their reports. Every quarter they do a great job of putting this information together and providing their perspective on the securitization market. You can download the full report on the PeerIQ website.