Securitization continues to grow for the marketplace lending sector. As they do at this time every quarter PeerIQ released their Securitization Tracker today. It showed another strong quarter with $4.3 billion of total issuance. This total was up 34% from Q1 2017 but down slightly from the record total in Q4 2017.

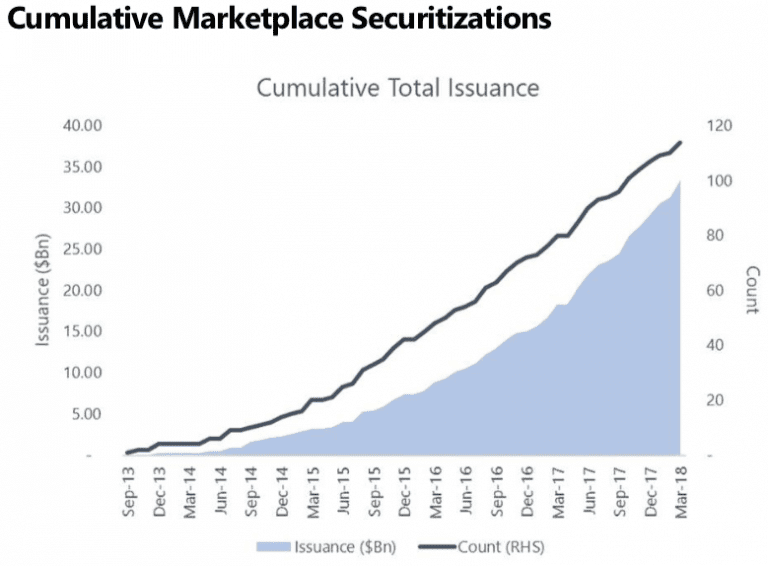

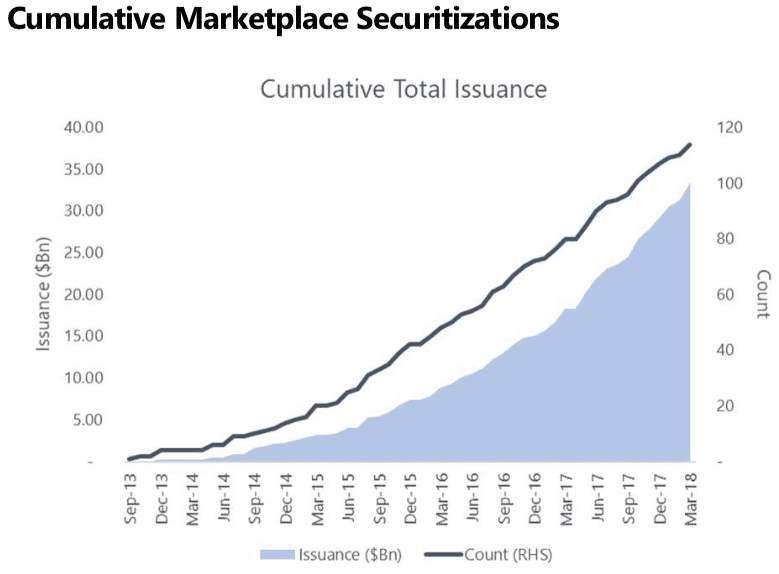

The cumulative total of all marketplace lending securitizations to date is now $33.4 billion across 114 deals as demonstrated in the above graphic.

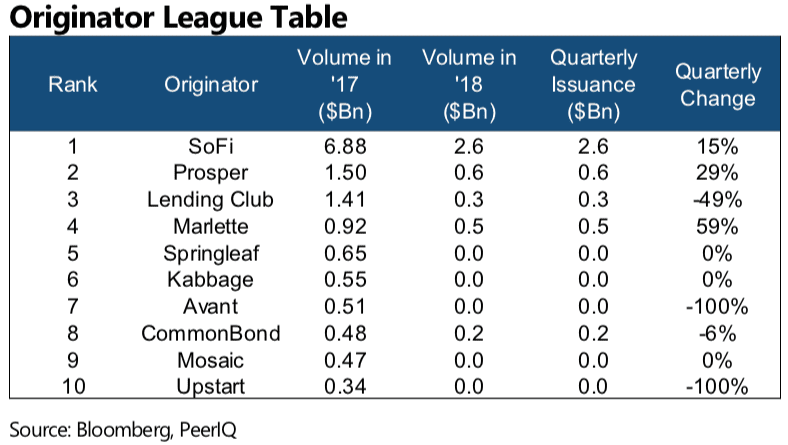

SoFi lead the way again with $2.6 billion or around 60% of the market with two huge student loan deals and a consumer loan deal. Regardless of the challenges they have had over the past year they have continued to execute very well on the securitization front. Below is the league table for 2017 and Q1 2018 for the marketplace lending sector.

Here are some of the other findings from this quarter’s report:

- We observed an unprecedented 21 months of non-stop issuance – Markets remain in a “risk-on” mode and MPL investor appetite continues to grow.

- Spreads tightened this quarter, amidst rising rates and increased volatility, and we saw deals price at record tights – Average spreads at issuance are tighter in the consumer and student spaces across credit tranches.

- All deals this quarter were rated – DBRS continues to lead the rating agency league table, while Kroll dominates the unsecured consumer sub-segment and we continue to see increased engagement from the top 3 ratings agencies.

- Tranches continue to get upgraded – Ratings’ Agencies have upgraded 33 consumer MPL tranches and 51 student MPL tranches so far.

- Goldman Sachs, Deutsche Bank, and Morgan Stanley continue to top the issuance league tables with over 55% of MPL ABS transaction volume.

- With the potential for policy error on interest rates, regulation and trade expect a volatile credit environment in 2018.

- We should also see emerging ABS issuers like Upgrade.

You can download the report for free from the research page at PeerIQ.