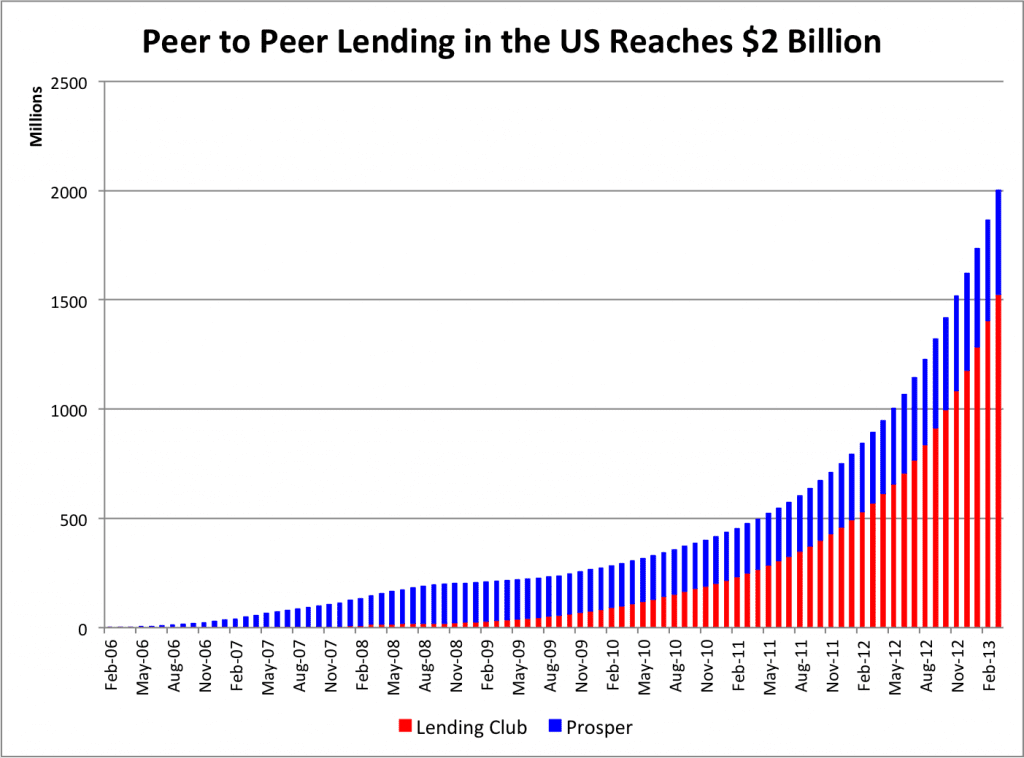

This morning Lending Club and Prosper crossed another major milestone. There have now been more than $2 billion in total loans issued by both companies. This comes just ten months after they crossed $1 billion.

As you can see from the above chart, which shows total loan volume since Prosper launched in February 2006, Lending Club has been the primary driver of growth in the last couple of years. The total loan volume issued since inception stands at $1,525 million at Lending Club and $477 million at Prosper translating to a 76% market share for Lending Club. If you look at the second billion by itself the difference is even more stark: Lending Club issued $869 million to Prosper’s $132 million.

With Lending Club’s rapid growth and early signs of a turnaround at Prosper (which I will be covering in my end of month post tomorrow) we may cross $3 billion here within six months. Wow.