The marketplace lending industry globally has seen rapid growth over the past few years but originations have been pulling back as of late. This has been apparent in the US and now a report from the UK Peer-to-Peer Finance Association (P2PFA) shows originations down slightly in Q2 2016.

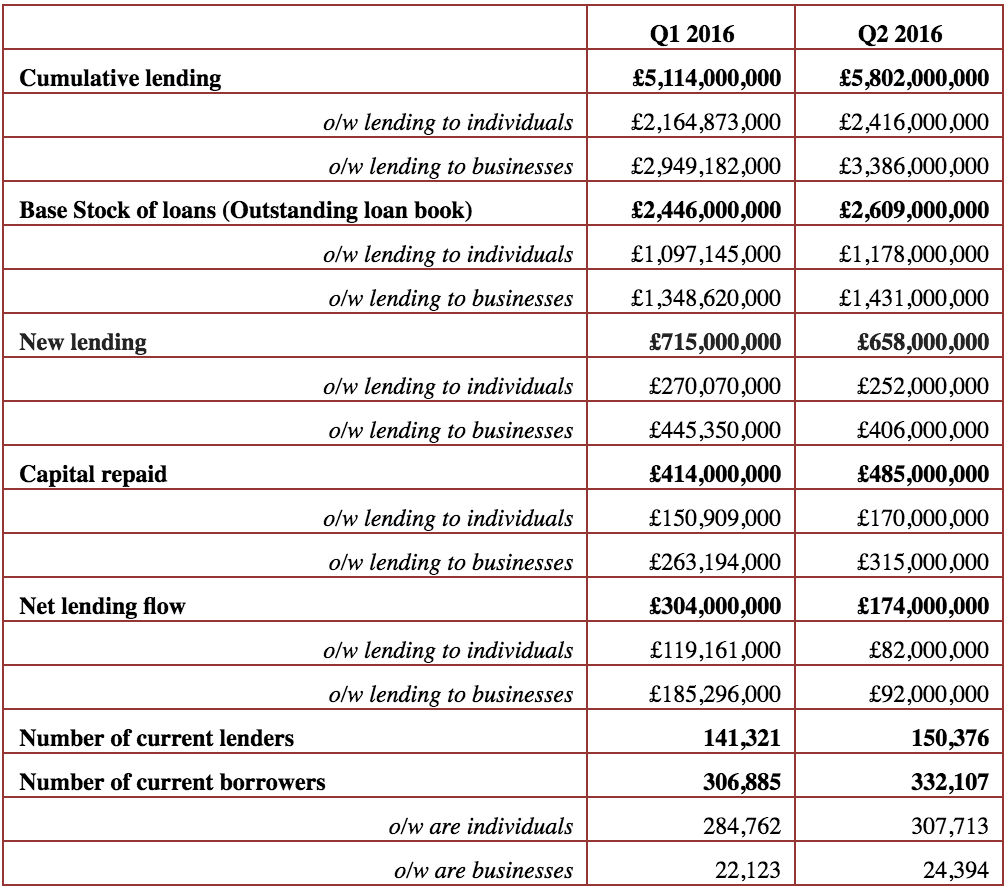

Cumulative lending by the sector in the UK since inception now totals £5.8 billion for the eight member P2PFA companies, with £658 million coming in Q2 2016. This quarterly origination number is a decrease of 8.3% from Q1 2016 which came in at £715 million. The full breakdown provided by the P2PFA is shown below.

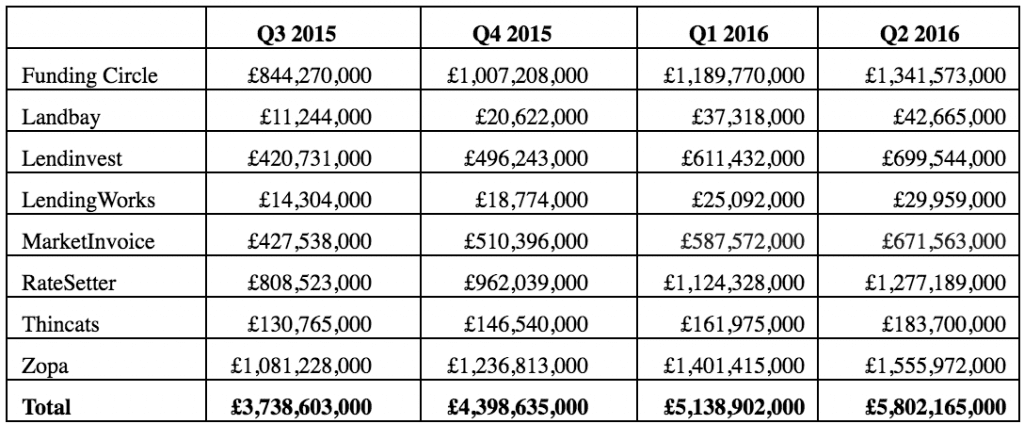

Below is a breakdown of cumulative originations by many of the top marketplace lenders in the UK with Zopa, Funding Circle and RateSetter leading the way.

Christine Farnish, the Chair of the Peer-to-Peer Finance Association stated:

The main story behind these latest figures on peer-to-peer lending is the continued expansion in the number of investors and borrowers – with more than 150,376 lenders and 332,107 borrowers currently using P2PFA platforms. More borrowers – both individual and businesses – underscores that peer-to-peer lending is now a mainstream alternative finance product, engaging an increasing number of participants.

This pullback is certainly not good news for the marketplace lending industry in the UK. While Christine Farnish put a positive spin on the numbers it is clear that the fact that originations are down in Q2 means that some investors are likely becoming more cautious. Having said that originations do remain higher this year compared to last year. It will be interesting to see how this plays out in the coming quarters but this could be just a temporary stabilization of loan originations.