One of the most popular features on Lend Academy is my quarterly return updates. I provide everyone with a look inside my own personal portfolios and share exactly how they are doing. I am committed to maintaining this transparency because I know that investment return is what interests most readers.

Before I get started I want to point out one thing for some of our newer readers. My six main accounts have been established a long time. My main Lending Club account is approaching five years old now and at Prosper it is almost four years old. These accounts are mature and have suffered hundreds of defaults. The returns are now relatively stable as you can see if you compare the results to my previous returns.

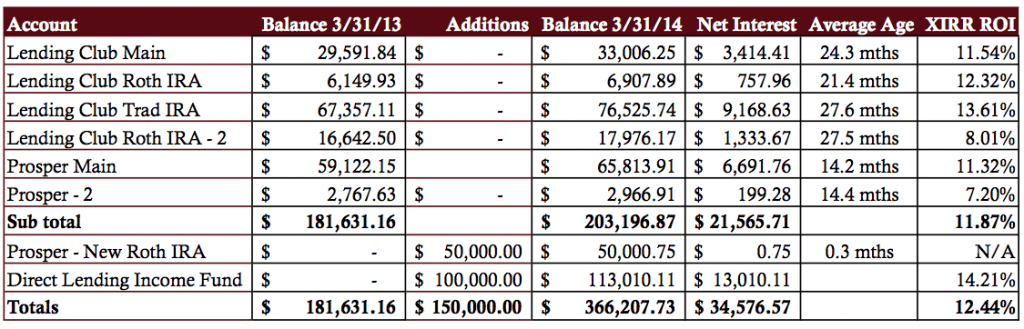

Overall P2P Lending Return Now at 12.44%

Long time readers will notice something different in the table below. I have included my six regular accounts at Lending Club and Prosper but there are two new line items that have not been included before. I opened my first IRA account at Prosper in February with a $50,000 rollover. That account was around 70% invested by the end of March. Also, for the first time I have included my investment in the Direct Lending Income Fund (profiled here). It has been almost a year since I opened that account and it has been performing very well and I am including it here to give readers a more complete picture of my p2p lending investments.

I am separating out these two new investments so readers can see the overall impact they have. Interestingly, my overall return on my six main accounts has remained very steady since my fourth quarter update – it is at 11.87% now up from 11.85% in December. The Direct Lending Income Fund is the only reason my returns have increased to 12.44%.

You can click on the image below to see it at full size. You can also click here to see the table with the regular and adjusted/seasoned returns columns.

Here are a few points to keep in mind as you are looking at the above table.

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Age column shows how old, on average, the notes are in each portfolio. Because I am reinvesting all the time this number changes slowly.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The two new accounts have been separated out to provide a level of continuity with my previous updates.

- I do not take into account the impact of taxes.

As I do every quarter I will now delve into each account in a little more detail.

Lending Club Main

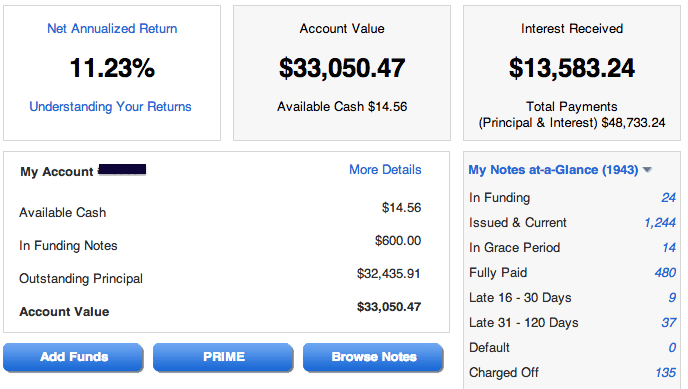

This is my original account that was opened back in June 2009 with just $500. Over the years I added an additional $24,000 to bring my total investment here to $24,500. Like many investors when I started I invested in a conservative way, focusing on B and C grade loans with some As. But for several years now I have been focused on the C-G grade loans because I am comfortable with being a little more aggressive.

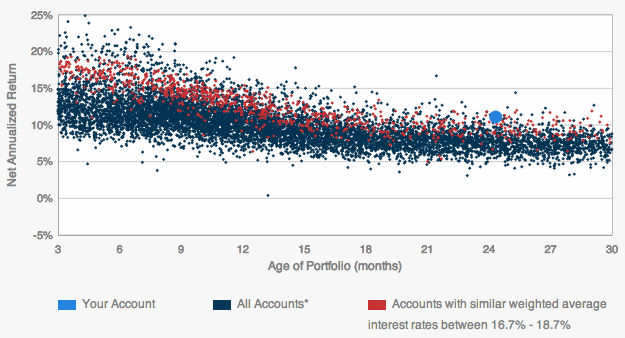

One useful feature that Lending Club introduced late last year is the Understanding Your Returns page. There is a link to that page on the main Lending Club account screen underneath the NAR number and it shows you how you are doing compared to other similar investors. You can see my large blue dot in the graphic above. The red dots are those accounts with a similar weighted average interest rate (so they are similar in risk) and the dark blue dots are all accounts. I have filtered the image above for those accounts with at least 500 notes.

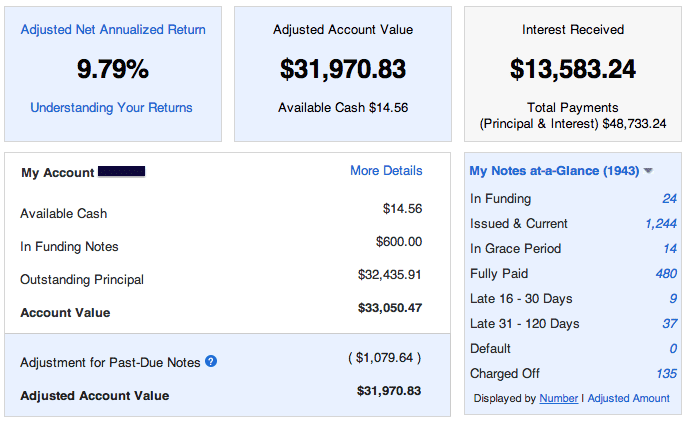

One of the other changes that Lending Club implemented late last year was the introduction of Adjusted Net Annualized Return. This is where Lending Club discounts your percentage return as well as the value of all the notes in your portfolio based on their late status. For example, the value of a note that is 16-30 days late will be discounted by 49% based on Lending Club’s default settings. This has the effect of reducing the expected dollar value of your account and the return percentage. You can easily toggle between regular and adjusted returns on the screen with the On/Off button on the main account screen.

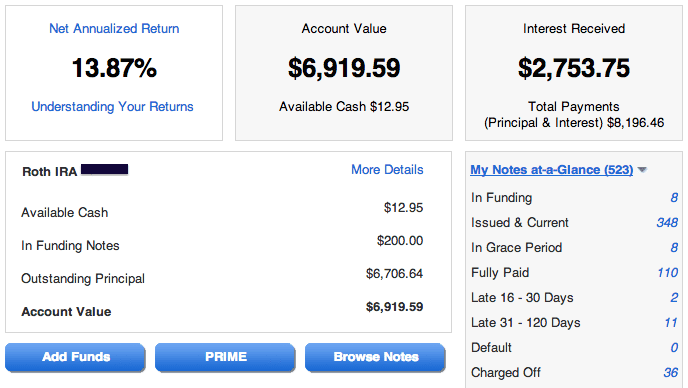

Lending Club Roth IRA

I opened this IRA account in April 2011 and my strategy here has been completely focused on the D-G grade loans with 60% of the portfolio in D-grade loans. Consequently, it has a weighted average rate of 18.94% which is the highest of any of my Lending Club accounts. I was pleased to see my XIRR ROI climb in the past quarter a full percentage point as I received fewer defaults. I added another $5,500 to this account in April when I made my 2013 IRA contribution.

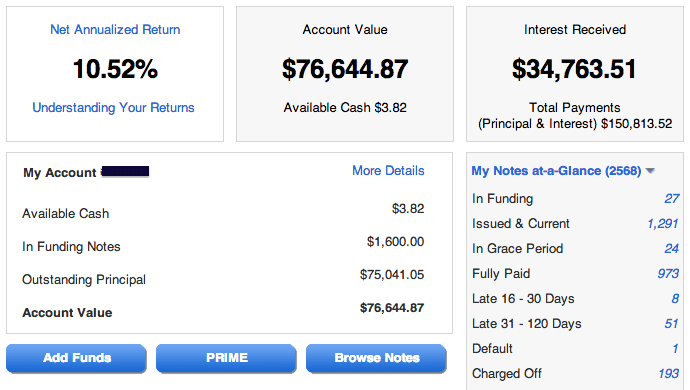

Lending Club Traditional IRA

This is my largest account at Lending Club or Prosper and it also happens to be my best performing account. This account is in my wife’s name, I opened it in April 2010 when I rolled over several 401(k)’s and IRA’s that my wife had accumulated over the years. The total initial deposit was $53,274 and I have not added any money since the account was opened.

This account began as a Lending Club PRIME (now called Automated Investing) account with a moderate risk approach – so it was primarily B and C grade loans. All those initial loans have since matured and for the last two and a half years I have been focusing completely on the D-G grade loans. The returns for this account continues to be very high with a real return of 13.61% in the past 12 months, down from 13.88% three months ago. I think the returns here will continue to decline slowly before stabilizing in the 11.5%-12.5% range. But right now this is my best performing account at either Lending Club or Prosper.

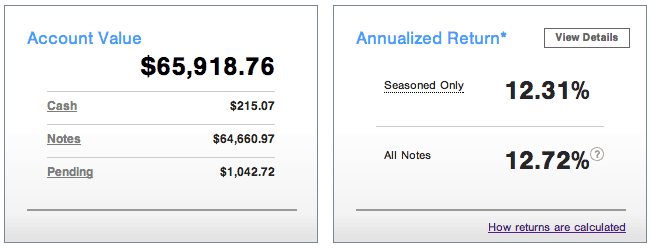

Lending Club Roth IRA – 2

This is my wife’s Roth IRA account that was opened at the same time as her traditional IRA in April 2010. This was a Lending Club PRIME account until about eight months ago when I decided I wanted to get more aggressive with it. Although when Lending Club enhanced their PRIME service last December to allow custom saved searches I switched it back to PRIME. Now, it runs my Super Simple Lending Club filters and the returns are slowly but steadily edging up.

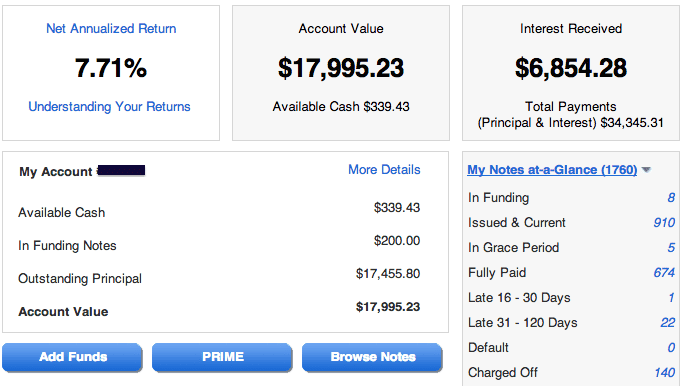

Prosper Main

I opened my first Prosper account in September 2010 with $1,000 and over the next two and half years added regularly to this until I had deposited $50,000. I will no longer be depositing any new money, though, as this is a taxable account and I am placing all my new investments going forward into my IRA.

This account has been focused on C, D and E grade loans from the beginning and for a while I had returns in the high teens. But, like all my accounts, defaults have impacted returns and now they have settled in to the 11-12% range.

Prosper – 2

This account is a good example of what can happen when you are not fully diversified. This has been something of an experimental account for me. It is a taxable account in my wife’s name where I have invested just $2,000. I have been very aggressive in this account with a weight average interest rate of 26.6%, the highest of any of my accounts. But at a value of around $3,000 this is not as diversified as I would like with only 147 active notes right now.

In the last 12 months my real return has dropped from 15.6% to just 7.2% today. There have been a rash of defaults in the last few months that have dramatically impacted returns. I like to have at least 200 notes in an account, preferably more, to be completely diversified. But I am going to leave this account as is and see if I can get it back to double figures. I expect it will continue to be quite volatile.

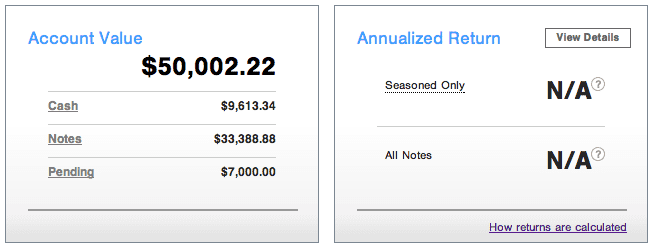

Prosper – New Roth IRA

Last quarter I opened a brand new Prosper account. I rolled over part of my IRA into Prosper and began investing. I decided with this account that I wanted to be a little more conservative. Every other account I own is investing aggressively in the highest interest loans. I think it is prudent to balance this out a little with a less aggressive account. So, this new Prosper account will be investing across the board from AA-HR, but with an emphasis on A, B and C grade loans. This account will be managed by Lend Academy Investments, my new investment company, in our balanced SMA offering.

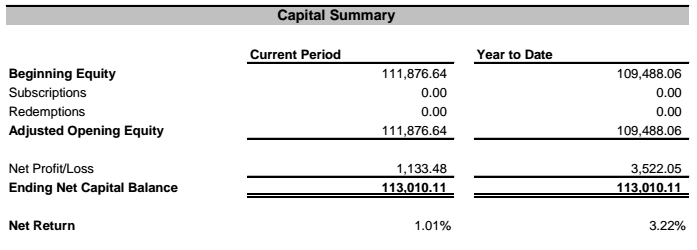

Direct Lending Income Fund

Also new with the quarterly update is my investment in the Direct Lending Income Fund. This fund invests in small business loans, primarily short duration loans of 12-18 months, which I consider a nice diversification away from consumer loans. I made this investment in May of last year so I have had nearly a year of performance in this fund. This is a taxable account, so come tax time I have a hit on the interest earned here but I am very happy with how this fund has been performing. As I said earlier it is the only reason that my overall return have increased from 11.85% to 12.44%.

Final Thoughts

Overall, I continue to be very pleased with these investments. I am not investing new money in any other asset class, only p2p lending these days, as I continue to ramp up the percentage of my assets here. Overall, these accounts are aggressive and I am investing knowing full well that during a recession the riskiest loans will likely be hit the hardest. This is one of the reasons I wanted to balance things out a little with a less aggressive account – my new Prosper IRA.

As I do every quarter I want to highlight the net interest number, a total of $34,577 now. While I realize a good chunk of this is taxable this is the real return on my investments. The percentage interest numbers are nice to highlight but it is the dollars earned in interest that is money in your pocket.

I will be happy to field any questions or comments below.