Interest rates, the stock market and the effects of China on our economy have been all over the headlines as of late. August in particular was a bad month for the stock market, but what about other asset classes? Just last week we happened upon a tweet by Cullen Roche stating:

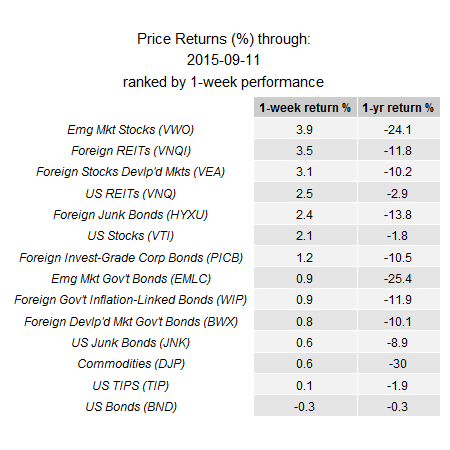

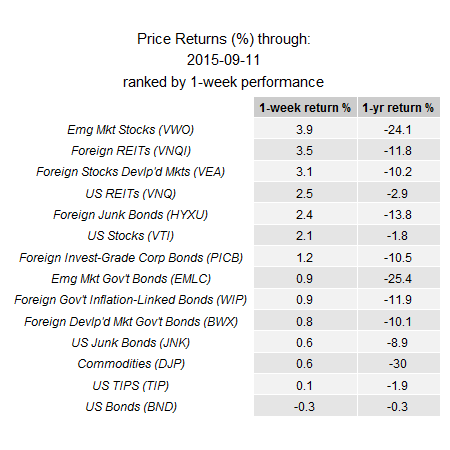

This is kind of amazing. Every single major asset class has negative 1 year returns.

It was accompanied by the below image, which shows tickers for all of the major asset classes including stocks, bonds, REITs, commodities and US TIPS. The returns of each of these for the year ending September 11th was negative.

I recently wrote about marketplace lending and stock market volatility, but the data above is not limited to the stock market. Although there may be some similar funds that have a positive return, the point here is that the public markets are increasingly correlated. When one asset class goes down, they all can perform poorly. For those of us investing in Lending Club and Prosper, data like this certainly makes p2p lending look more appealing.

Now if we were to go into a recession, it is very likely that your p2p lending returns will decrease and possibly even go negative if we have a deep recession. However, we are not in a recession, in fact the economy is still chugging along reasonably well but the public markets tend to react with fear whenever some kind of bad news hits – whether it be a possible China slowdown or a Federal Reserve rate hike. P2P lending returns suffer no such volatility – as long as unemployment rates stay steady and we don’t actually fall into a recession p2p lending returns are likely to remain stable.

I looked at both my Lending Club and Prosper statements over the same period to see what my returns have been to compare. Keep in mind that my returns shown below are still probably higher than what they will be once my account has fully aged. I expect both accounts to fall within the 9% range.

Lending Club Results 8/31/2014 – 8/31/2015

- Average Age: 13.8 Months

- Average Interest Rate: 17.57%

- XIRR Return: 10.5%

Prosper Results 8/31/2014 – 8/31/2015

- Average Age: 10 Months

- Average Interest Rate: 17.12%

- XIRR Return: 13.5%

These results are typical for a Lending Club and Prosper investor. In our diversification post, we showed that every single Prosper investor since July 2009 with more than 100 loans has achieved a positive return. Lending Club states their number to be 99.9% of investors.

I own a wide variety of index funds similar to the ones shown in the 1 year performance image above including US Stocks, International Stocks, Bonds and REITs. My overall portfolio is down 9.5% since last year. I am personally okay with seeing losses as I have a long investment horizon. I refrain from trying to time the market, but not everyone can do so. It seems that an investment like p2p lending may help people from selling their investments when they are down, something that has been proven over the long term to be a poor investment decision.

Seeing some volatility in the market as of late has given me more confidence in my decision to invest in both Prosper and Lending Club. It is nice to know that although I have paper losses elsewhere, I still have p2p lending accounts with a positive return that are providing consistent cash flow.