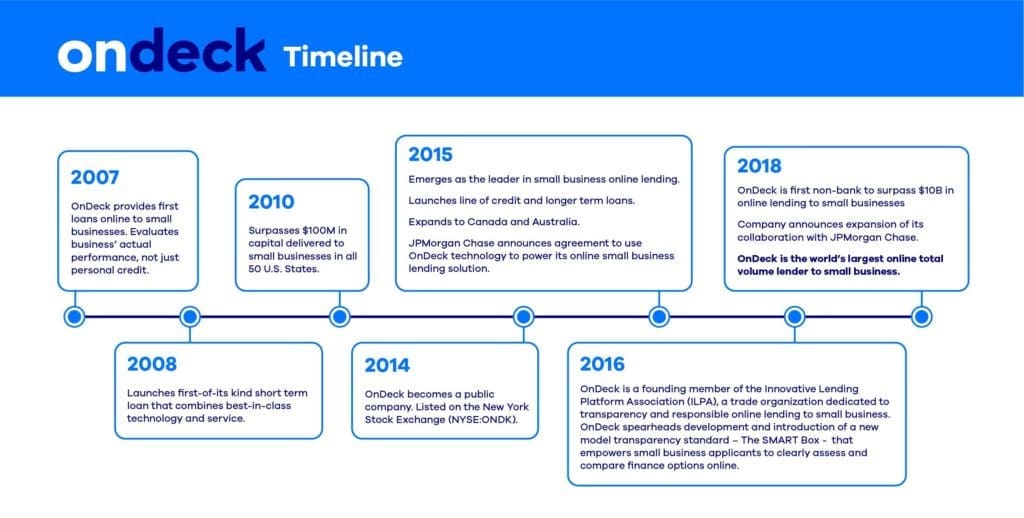

Back in 2007, OnDeck started making loans to US small businesses. Since then, the company weathered the financial crisis, lending to small businesses at a time when few were. In 2010, they surpassed the $100 million mark. Fast forward to today and the company officially crossed $10 billion in originations. This makes OnDeck the world’s largest non-bank online lender to small businesses by total volume.

It’s interesting to look back at OnDeck’s history and see how far they have come. The marketplace in 2007 was vastly different than it is today and they still managed to lend $100 million in the first three years. Consumer lending companies Lending Club and Prosper were just getting started so lending online to a small business was a novel idea. Small businesses have embraced online loans over the years as evidenced by OnDeck originating $2.1 billion in 2017 alone but there is still room for growth. In 2017, 24% of small businesses who were seeking credit applied online compared to 21% in 2016. CEO Noah Breslow provided the below comment as part of the press release:

If reaching $10 billion dollars in total loan volume online tells us anything, it’s that the days of old-fashioned lending to small businesses are numbered. We created OnDeck because we believed the Internet could revolutionize and speed up the way underserved small businesses access capital. Today, we are helping to fill a credit gap across hundreds of industries by providing fast, secure and transparent loans that enable small businesses to grow, generate economic activity and create jobs. We look forward to providing billions more in financing and powering the small business lending migration to the online model via our OnDeck-as-a-Service platform.

I expect that we will see a steeper curve in the adoption of online small business loans going forward but it’s difficult to predict just how long it will be until a majority of small businesses seek financing online. In my opinion it will depend largely on the way in which OnDeck and other online lenders reach new customers. The company has had a longstanding partnership with JP Morgan Chase through their OnDeck-as-a-Service platform and another large partnership is in the works. We have yet to hear just how big of an impact these sources are having on OnDeck’s business, but working with institutions that have a large customer base could play a significant role in scaling originations even further.