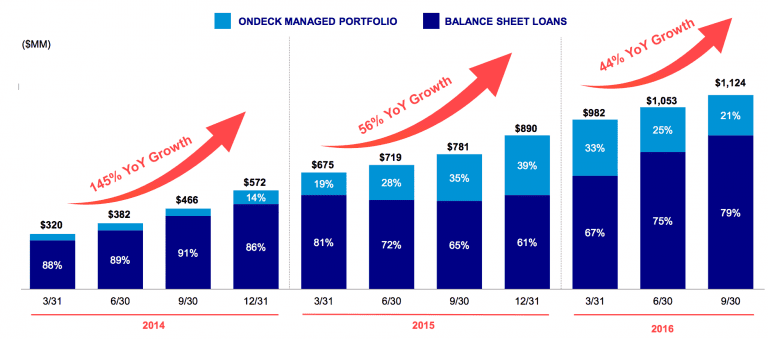

This morning OnDeck released their Q3 2016 earnings. The company continues to increase originations which were $613 million for the quarter, up from $590 million in the second quarter. The trend of holding more loans on their balance sheet continued in Q3. The distribution of OnDeck’s managed portfolio versus balance sheet loans is highlighted below with 79% of the portfolio being balance sheet loans, up from 75% in the prior quarter.

While at a glance the financials shared by the company today may look troubling compared to last year, it’s important to understand that this is in part due to the shift from selling loans on the marketplace to increasingly holding loans on balance sheet. This has played out over the past two quarters to a greater degree than we’ve seen in the past. Noah Breslow, OnDeck’s CEO was quoted in the press release alluding to this fact:

…While we made progress on several fronts and remain well-positioned to execute on our strategy, our financial comparisons continue to be affected by our planned and previously communicated reduction in Marketplace sales and its resulting accounting impact.

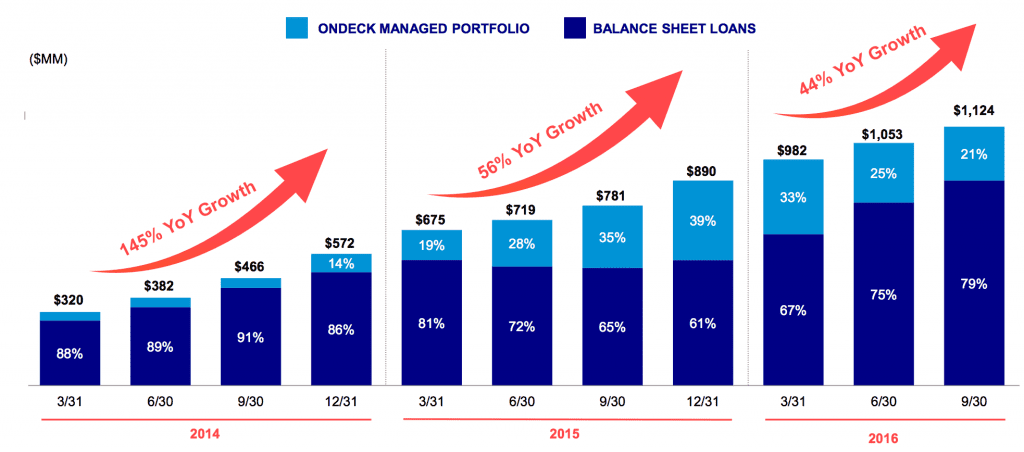

The important metric which reflects OnDeck’s sale of loans to investors is their Gain on Sale Rate, shown below.

Marketplace Gain on Sale Rate equals our gain on sale revenue from loans sold through OnDeck Marketplace divided by the carrying value of loans sold, which includes both unpaid principal balance sold and the remaining carrying value of the net deferred origination costs. A portion of loans regularly sold through OnDeck Marketplace are or may be loans which were initially designated as held for investment upon origination. The portion of such loans sold in a given period may vary materially depending upon market conditions and other circumstances.

Financial highlights from the press release:

- Gross revenue was $77.4 million for the quarter, up 15% from the prior year period.

- Net revenue was $32.3 million for the quarter, down 30% from the prior year period.

- GAAP net loss attributable to OnDeck common stockholders was $16.6 million for the quarter, compared to net income of $3.7 million in the prior year period.

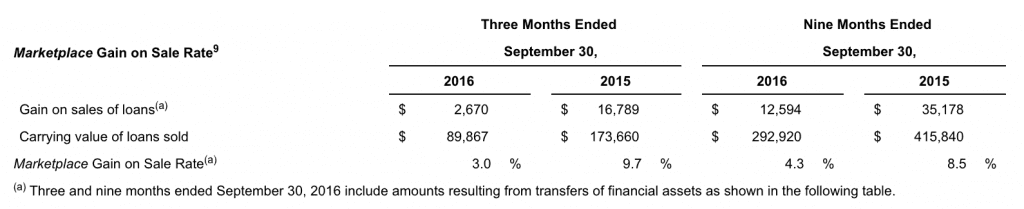

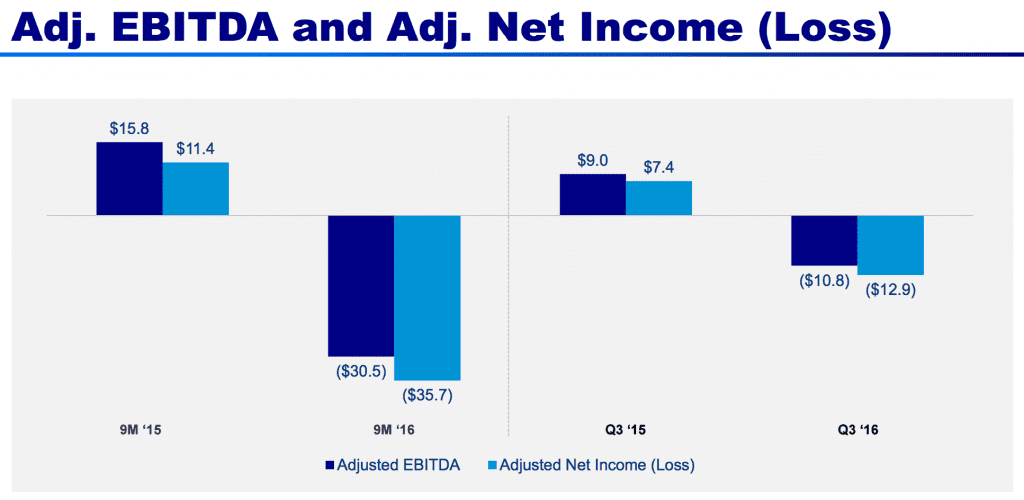

- Adjusted EBITDA was a loss of $10.8 million for the quarter, compared to positive $9.0 million in the prior year period.

- Adjusted Net Loss was $12.9 million for the quarter, compared to Adjusted Net Income* of $7.4 million in the prior year period.

OnDeck reiterated full-year guidance for 2016 and highlighted their recently closed $100 million warehouse facility. Other topics were the rebranding that rolled out in August, the recent partnership with Shark Tank star Barbara Corcoran and the SMART Box, which was announced last week by the Innovative Lending Platform Association. The company shared that they are seeing stable trends in the industry with no evidence of a declining macroeconomic environment. The company did note that they are tightening lending standards and raising rates in some pockets. OnDeck’s 15+ Day Delinquency Ratio remained below prior year levels but increased sequentially from historic lows. The company now holds provisions for loan losses of $36.6 million which is up from $16.2 million from the prior year period. OnDeck’s stock price closed at 4.09, down 9.51% for the day.

Highlighted below are a few questions from the Q & A that have been summarized:

Q: In the call you touched on credit quality. Can you provide any color on any increase in delinquencies specific to a geography or industry?

A: Delinquency numbers are better than they were a year ago. We aren’t seeing anything from a particular geography or industry. We concluded that the natural return of roll rates are returning after historical lows. We are adding to collections staff and taking a proactive approach.

Q: Do you expect your provision rate expense to stay stable?

A: The reserve ratio over the longer period has been consistent. Provision rate takes into consideration changes in expectations over prior periods and is not specific to a quarter.

Q: The SMART Box is a proactive initiative. Are there regulatory pressures to increase this? How big of an impact will this have on originations?

A: The SMART Box is us being proactive rather than responding to any state or federal regulators. We don’t see it driving a shift in originations one way or another because loan structure and value to customer is high. Our NPS remains high. The SMART Box will be rolling out soon.

Q: Where do you stand on new partnerships?

A: Nothing to report but we have a robust pipeline of conversations with banks and non-banks.

Q: Appetite from investors seems weak, what are the conversations with investors?

A: Market conditions didn’t worsen or improve materially. The stability is a positive sign. We are selling more of a platform mix to marketplace buyers and they are very receptive given reduction of volatility.

Q: Any more detail on how things are progressing with the JP Morgan partnership?

A: We have no additional information and plan to do a larger roll out later. We feel good with where we are at.

Conclusion

What has been hurting OnDeck is the reduction of revenue from sold loans on the marketplace. It’s clear that the market sees the decrease of gain on sale revenue as a negative even though the company will see revenue over the coming months as borrowers repay their loans. Overall investor sentiment is certainly something that we keep a close eye on; if there is a shift it will likely be reflected in OnDeck’s numbers in the coming quarters. It will also be interesting to hear from Lending Club, who reports Q3 earnings on Monday, November 7th.

Disclosure: Peter Renton, the founder and CEO of Lend Academy, owns ONDK stock.