Back in April 2018 we shared that LendingClub had provided us with $5,000 to start a brand new LendingClub account. We wanted to both report on the new investor experience and also share the performance of the account over time. In the last blog post I included a video which went through LendingClub’s automated investing tool. Before we get into the details of the account I also want to mention any changes that happened within the quarter that LendingClub investors should be aware of. On May 8th, 2018 LendingClub announced interest rate changes:

Effective May 8, 2018, interest rates on the LendingClub Corporation (“LendingClub”) platform have been updated. The changes are an increase of 0.12% for loan grades A2-A5, 0.15% for loan grades B1-B5, and 0.45% for loan grades C1-C5.

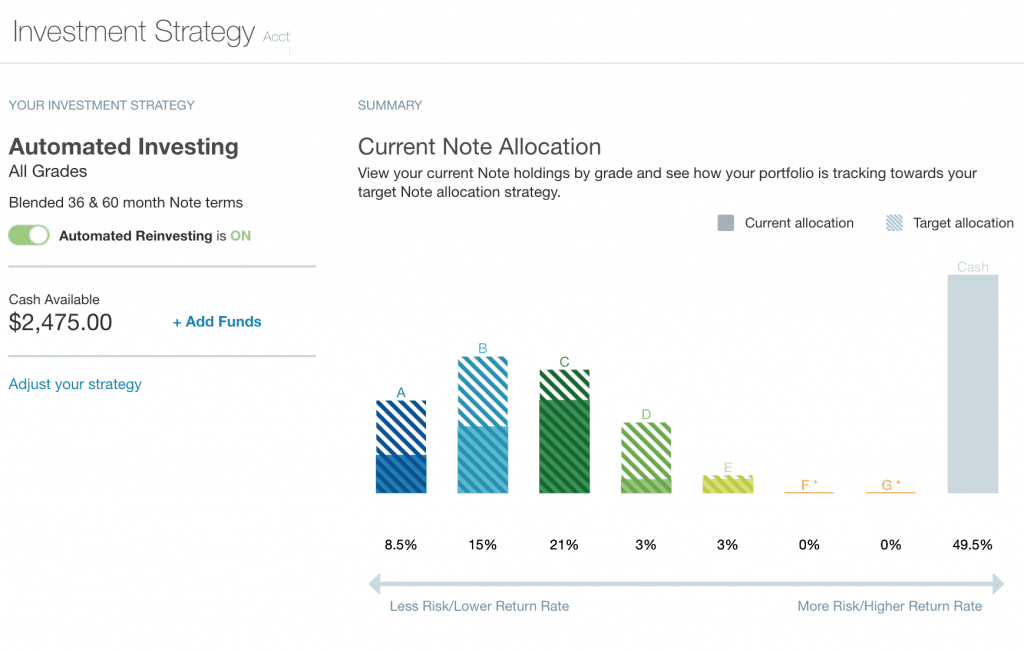

As a reminder, this account was setup to invest in LendingClub’s suggested ‘All Grades’ automated investing strategy. Below is a screenshot of my target allocation shortly after account setup with about half of my capital allocated to LendingClub notes.

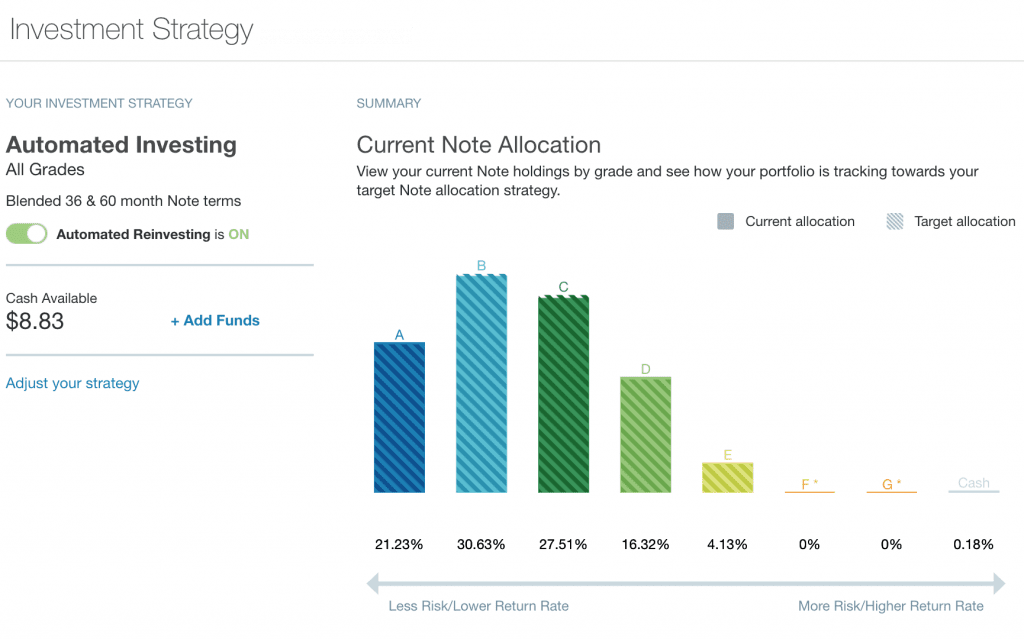

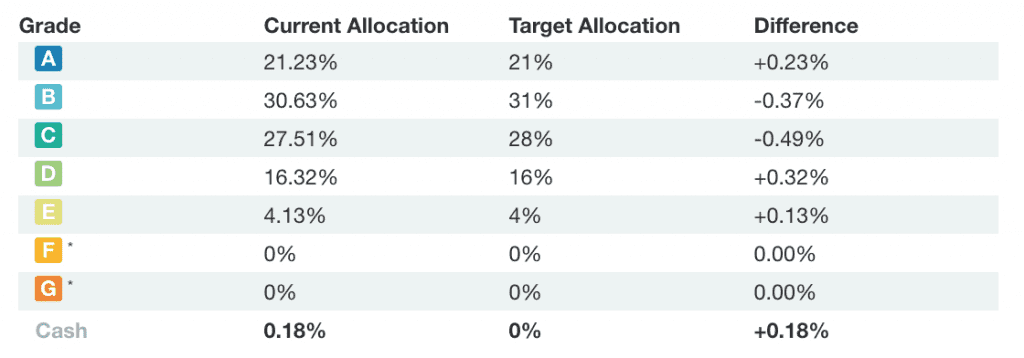

Below is a screenshot as of today with all $5,000 invested which now closely resembles my target allocation.

You’ll notice that investing across LendingClub’s All Grades is skewed towards being conservative as opposed to allocating the same percentage across loan grades. Nearly 80% of my loans in this account are A, B or C grade loans.

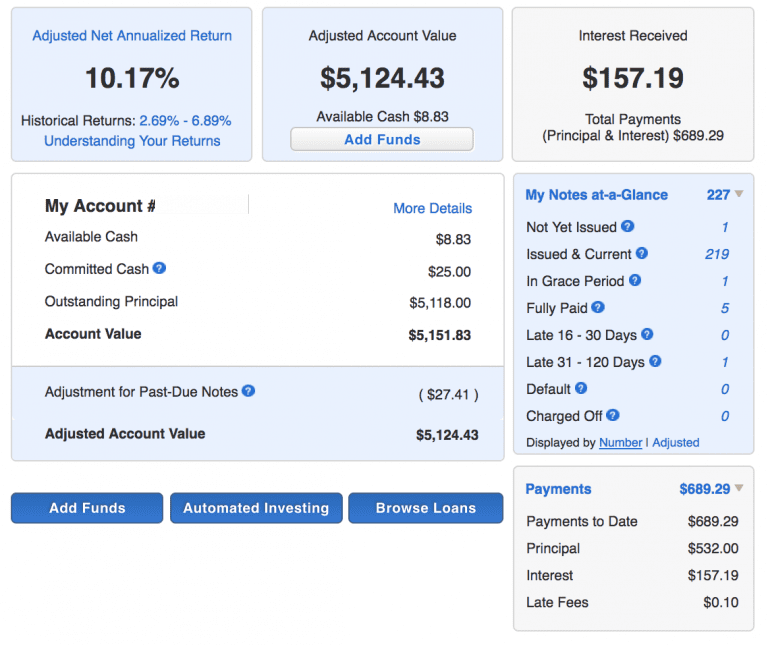

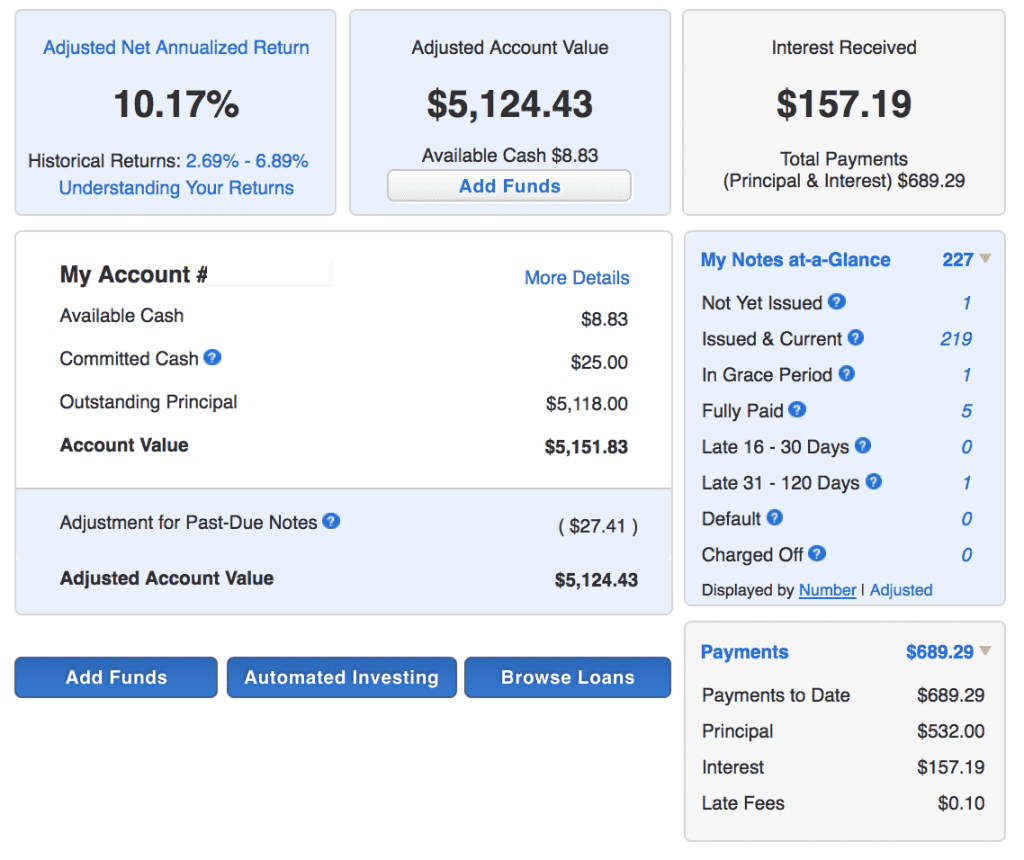

At time of account opening, LendingClub noted historical returns range from 2.94% – 6.98%. This has decreased slightly based on the most up to date historical returns. Below is a snapshot of my LendingClub Summary. It’s important to note that Adjusted Net Annualized Return is not a good metric until the loans have seasoned. As we move further along in this experiment we will start to get a better idea of where returns are trending and will begin to include return calculations using XIRR.

Conclusion

The current status of my LendingClub account is very typical for new investors. A handful of loans have been paid in full while just a couple have entered either grace period or the late 31-120 days stage. A majority of the loans are issued and current. As loans begin to season we will see more enter grace period at which point some borrowers will catch up on their payments and some will ultimately become late and eventually charge off. We’ll publish our next update in early October to provide a full update on the third quarter.