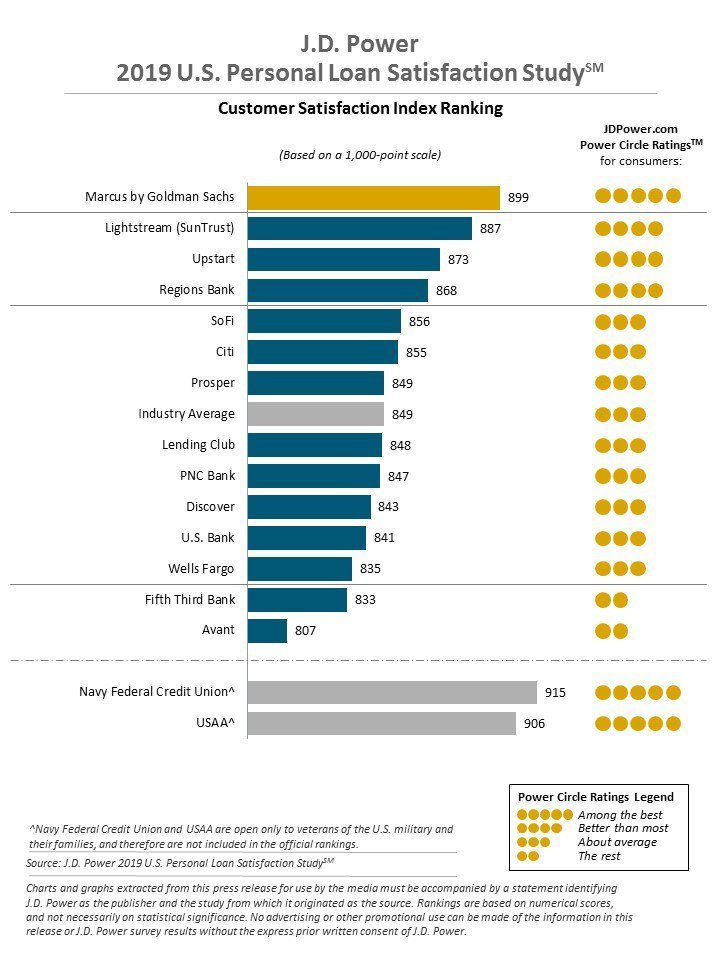

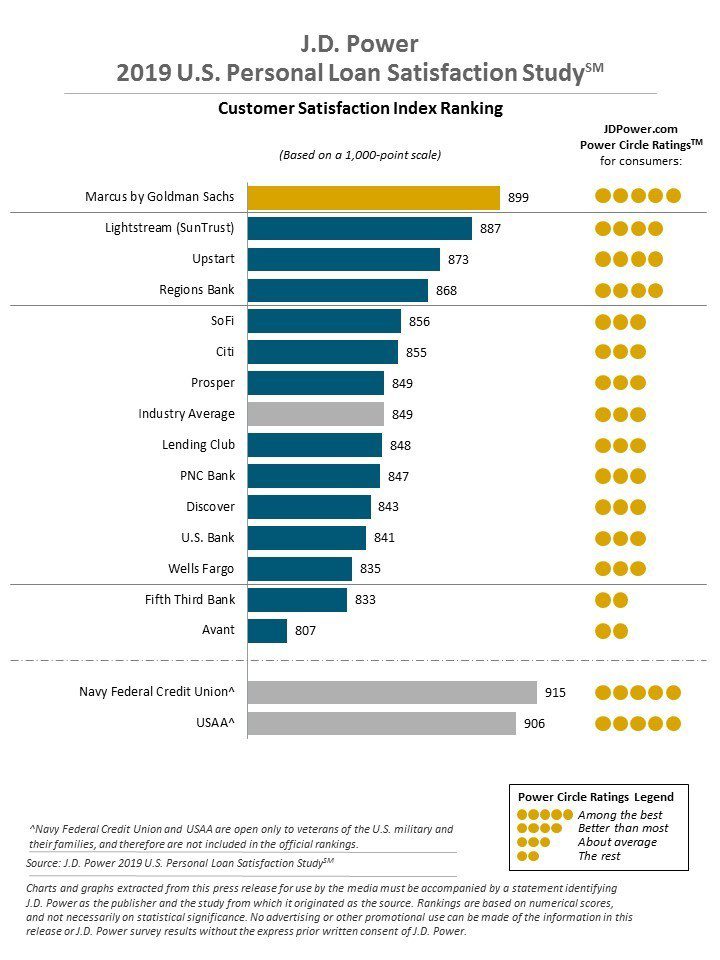

Last week J.D. Power released a study on personal loan satisfaction. At a time when credit card debt is rising and in turn personal loan volume is reaching an all time high there are no shortage of options for consumers. The J.D. Power 2019 Personal Loan Satisfaction Study found that many alternative lenders are winning on customer satisfaction against many traditional banks but there are also some names that may surprise you.

There are many factors at play, but most often these companies have superior digital experiences and faster time to fund. Topping the list is none other than Marcus by Goldman Sachs which beat out the pioneers of online lending such as Lending Club and Prosper. What’s surprising here is that their personal loan product was released most recently out of all of the companies which shows the careful approach they took when they entered the personal loans business back in 2016. Lightstream (a division of SunTrust) and Upstart rounded out the top three.

This is the inaugural study for J.D. Power so it will be interesting to see how the results shift over the coming years as the banks who have ranked lower work to improve their offerings. The survey was based on responses from 3,413 personal loan consumers. You can access the 2019 report on the J.D. Power website.

Below are other key findings of the survey:

- Alternative lenders pose threat to HELOC market: Overall customer satisfaction with personal loan providers is 853 (on a 1,000-point scale). By contrast, the average customer satisfaction score among HELOC customers in the recent J.D. Power 2019 Home Equity Line of Credit Satisfaction StudySM is 834, with lower satisfaction correlating to fewer customer referrals.

- Customers perceive lenders as profit driven: When rating brand image, customers have clear perceptions that all lenders are relatively profit driven, with significantly deeper concern among customers of alternative lenders. Similarly lacking across the board are positive customer perceptions of reasonableness of fees and competitiveness of rates. Alternative lenders also rate significantly below their bank competitors in these two areas.

- Digital applications lead to better understanding and higher satisfaction: Digital is the most common channel used for a personal loan application, with 40% of personal loan customers applying entirely online. Overall satisfaction is highest among personal loan customers in the digital-only segment (886), which also has the highest percentage of applicants who indicate that they completely understood the application (91%). A complete understanding of the application is associated with a 137-point increase in customer satisfaction.

- Fast and efficient funding is critical: Receiving loan approval within two days is associated with a 55-point jump in customer satisfaction, and receiving funds within two days of approval is associated with a 50-point jump in customer satisfaction. By contrast, customers report the total average time for HELOC funding to be approximately 26 days from the time of application.

- Customers will consider alternate products: Despite the reported benefits, customers choosing personal loans are still not locked in to the product when shopping for their loan. Nearly half (47%) of such customers also considered competing products; 28% considered credit cards; 17% considered personal lines of credit; and 13% considered HELOCs.