Many investors like the simplicity, ease and liquidity of investing in a publicly traded fund. There are currently five closed end funds that are publicly listed on the London Stock Exchange and focus on the marketplace lending industry. In this post we’ll share the details of each fund and dig into the differences between them. As you will note from the table below, most of the funds are trading at significant discounts to their NAV. The Funding Circle SME Income Fund trades closest to it’s NAV at a 2.5% discount as depicted below.

[table id=51 /]

*NAV performance YTD through time of writing on August 2, 2016, dividends excluded.

P2P Global Investments

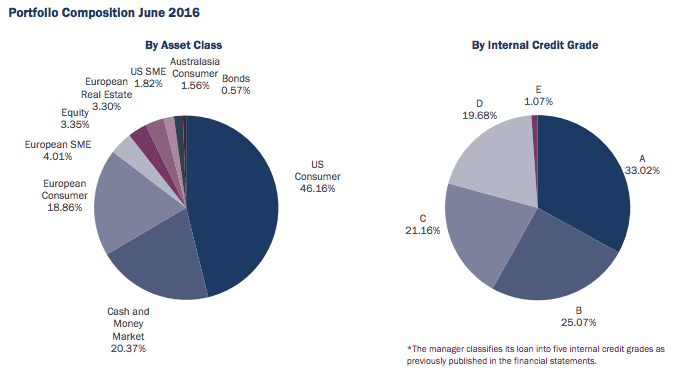

The P2P Global Investments fund is managed by Eaglewood and was the first UK listed fund in marketplace lending. They focus both on consumer and SME loans originated from platforms in the UK, US and Australasia. Their target net annualized return to investors is 5-15% and 85%+ of net income is distributed as a dividend. The fund may also invest in equity stakes in P2P platforms. The pie chart below shows that much of their fund is highly tilted towards both European and US consumer loans which account for 18.86% and 46.16% respectively of the portfolio total.

Latest P2P Global Investments newsletter.

Victory Park Capital Specialty Lending

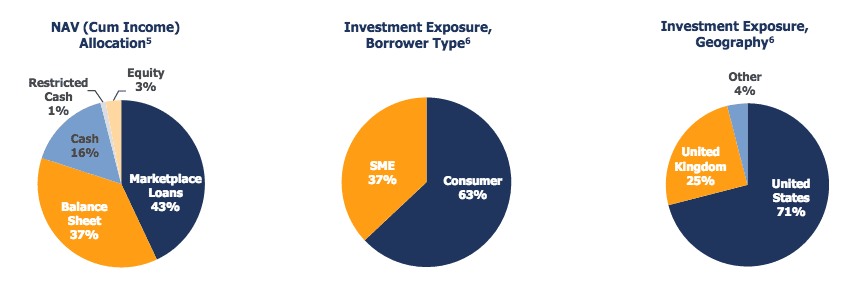

The fund run by Victory Park also focuses on the major markets for marketplace lending: US, UK, Europe and Australia. They invest in both consumer and small business loans in ranging credit bands. 71% of the portfolio is allocated to US loans and 25% is allocated to the UK. Compared to P2P Global Investments above Victory Park has much more allocated to SMEs, making up 37% of their investment exposure.

Latest VPC Specialty Lending newsletter.

Ranger Direct Lending

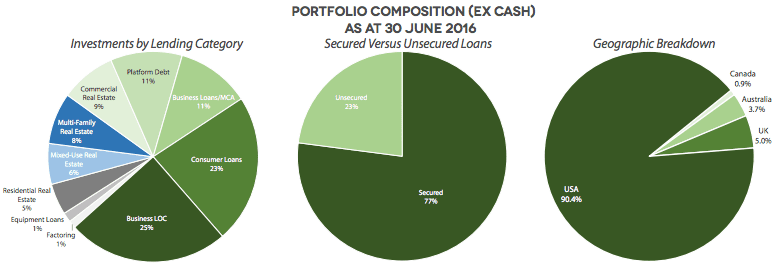

The Ranger Direct Lending Fund focuses on SMEs, real estate and consumer loans. The loan portfolio is made up of approximately 75%+ secured loans and is diversified across many platforms. The fund currently allocates 90% to the US and has the highest allocation to real estate of any of the public funds. Targeted unlevered returns are between 12%-13% with a 10% targeted dividend on issue price when fully invested and leverage applied.

Latest Ranger Direct Lending newsletter.

GLI Alternative Finance

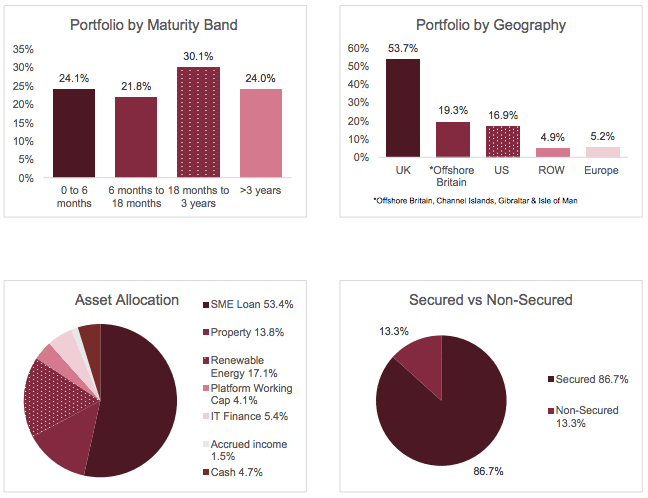

GLI Alternative Finance focuses on investing in a range of SME loan assets, diversified by asset class, geography and duration. The fund focuses mainly on investments in UK which makes up 53.7% of their portfolio. Similar to other funds, GLI may also make investments in third party alternative lending platforms or related opportunities. The target dividend yield for the fund is 8%.

Latest GLI Alternative Finance newsletter.

Funding Circle SME Income Fund

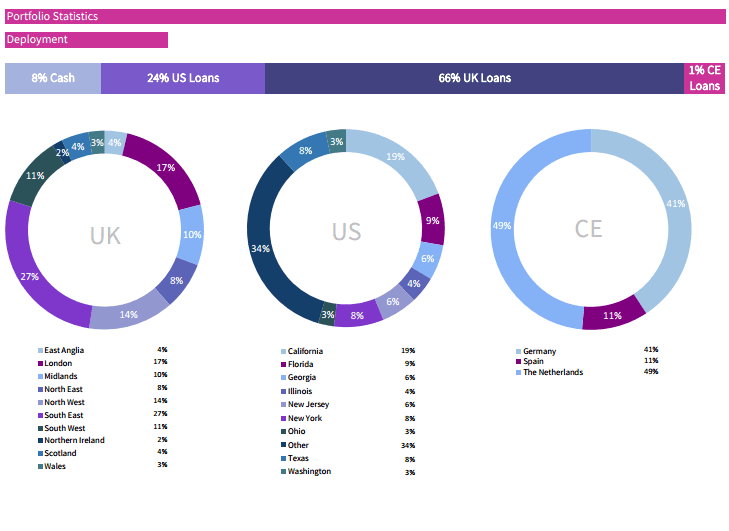

Out of all of the publicly listed funds in the UK, the Funding Circle SME is the most unique. It was created by the Funding Circle team for the sole purpose of funding SME loans on the Funding Circle platform. There are no management fees or performance fees, the only fee is the 1% platform servicing fee, which is the same fee all investors pay on the platform. Funding Circle operates in many regions including the UK, US and Continental Europe. Given that Funding Circle first began in the UK it isn’t a surprise that UK loans make up 66% of the portfolio followed by 24% in the US. The fund targets a total return between 8% and 9% per annum.

Latest Funding Circle SME Income Fund newsletter.

Conclusion

The UK has led the way when it comes to offering investment opportunities for retail investors. Many investors will prefer to invest via these funds rather than opening accounts at various p2p lending platforms. But, as with investing directly in loans, there is certainly risk involved.

It has been a rough year when looking at the performance of the trading price of each of the funds, but it’s important to remember that these funds also pay dividends. If you’re interested in digging into the performance further, I recommend reading the newsletters linked below each summary.

Over the last year we have covered many of the companies who planned to launch similar products in the US namely Van Eck and Direct Lending Investments. Unfortunately, the regulatory environment in the USA makes it difficult to launch products like the UK funds we have covered here. No closed end funds have officially launched here and it could prove difficult to launch such a fund given the current market, but eventually these same types of funds will likely be available to US investors.