I know I am very late with this regular feature but better late than never as they say. I have been sharing my detailed quarterly returns with readers since 2011 and I will continue to do so for the foreseeable future. What started out as one LendingClub account in 2009 has now grown into 16 accounts across several different kinds of investments.

The good news is the slight uptick in returns that I experienced in Q3 continued into Q4 with my best quarterly return number in over a year. While I am still not happy with where these returns are today I am pleased with the upward trend of the last two quarters.

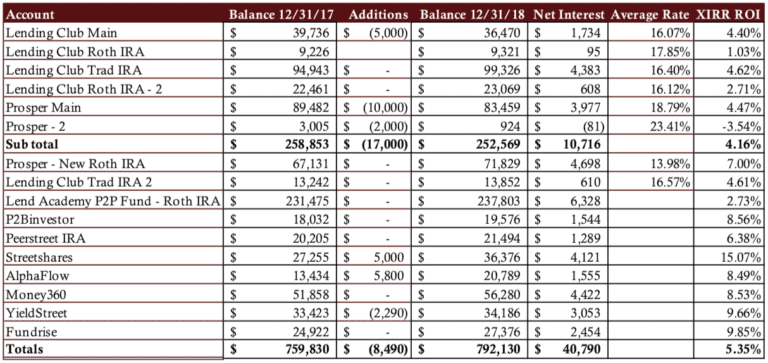

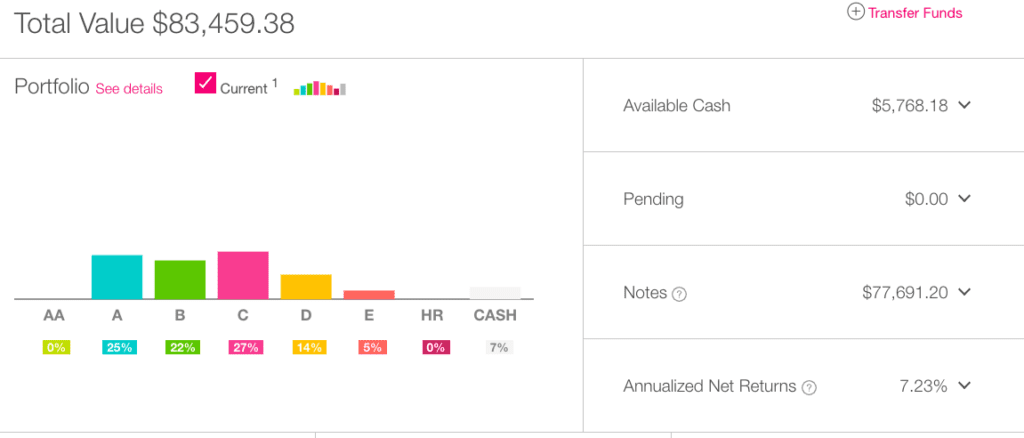

Overall Marketplace Lending Return at 5.35%

My overall returns for the calendar year in 2018 of my marketplace lending investments stood at 5.35%. This is up from 4.77% that I reported in Q3 and 4.46% in Q2. Interestingly, my original six LendingClub and Prosper accounts jumped considerably from 3.19% in Q3 to 4.16% in Q4. We are finally seeing the benefit of some changes that the companies made to their underwriting in 2017.

My lone holding in double figures is Streetshares as once again it is my top performing investment by far. But several of my newer investments have been performing well as I consider high single digit returns to be an excellent result these days.

Now on to the numbers. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way for individual investors to determine their actual return.

- The six older accounts have been separated out to provide a level of continuity with my earlier updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

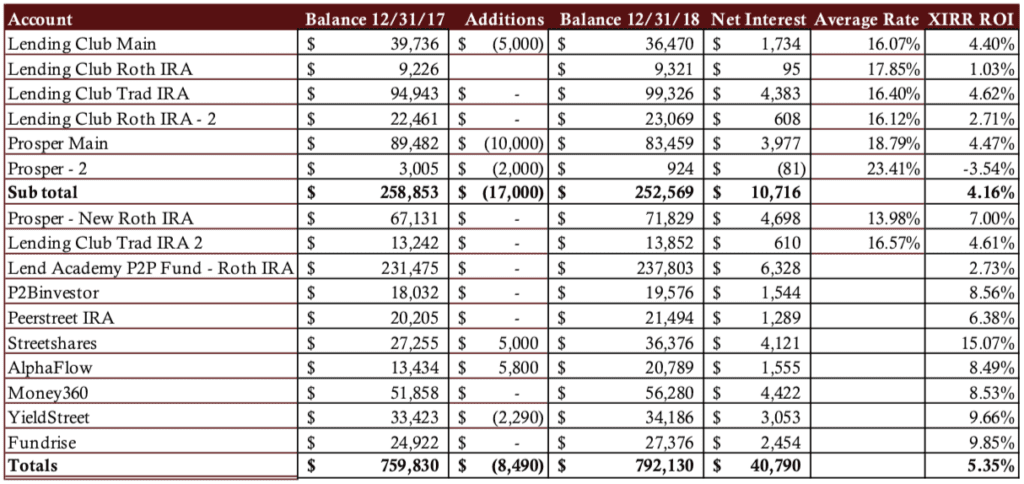

LendingClub

The above screenshot is from my original LendingClub account that was opened in 2009. This is a taxable account and for those people following along closely you will notice that the value of this account is much lower than last quarter. I have decided to liquidate my taxable account and move to other kinds of investments that receive better tax treatment. So, I stopped reinvesting my earnings in September last year and made my first withdrawal of $5,000 from this account in December. I will continue to draw down this account but will maintain my reinvestment program in all my other LendingClub accounts as they are all IRA accounts.

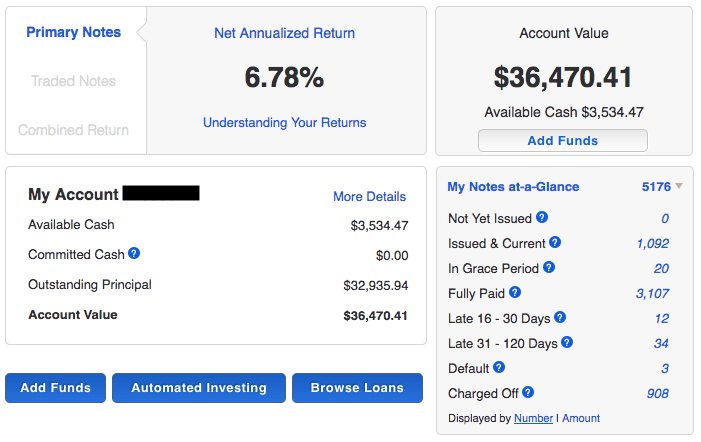

Prosper

I opened my main Prosper account in 2010 and I have built it up to be my largest position among my taxable accounts. Needless to say, come tax time I always more than max out my $3,000 in deductible losses with this account. So, I have also made the decision to liquidate my Prosper taxable account. This is on a similar timetable to my LendingClub account. And like LendingClub I am continuing to reinvest my IRA account. Speaking of which, my Roth IRA at Prosper was my best performing account in my personal loan investments returning 7% in 2018. From day one I always maintained a less aggressive approach with this account and it has been my best performing investment for some time as far as LendingClub and Prosper goes.

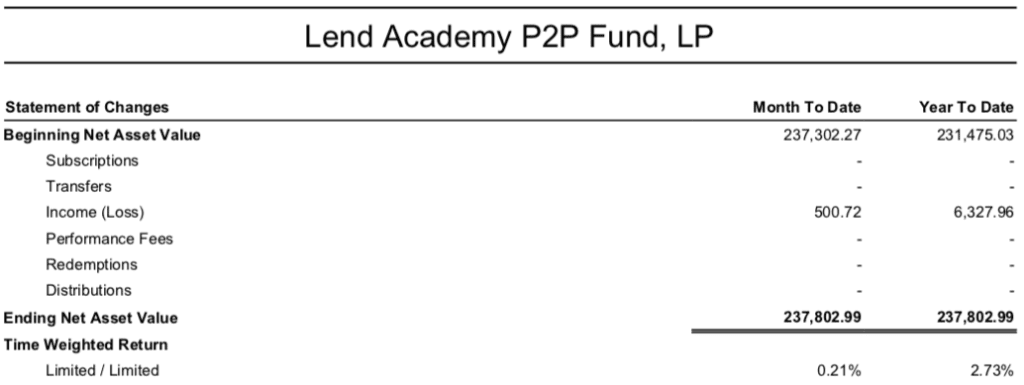

Lend Academy P2P Fund

I am not going to sugar coat it. I have been disappointed in the returns recently from the Lend Academy P2P Fund, managed by our sister company NSR Invest. While we maintained a positive return we are lagging most of the LendingClub and Prosper investments that I manage myself. I am hoping for better things from this holding in 2019.

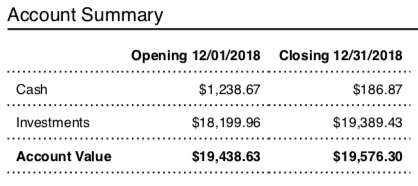

P2Binvestor

Asset-backed small business lender, P2Binvestor, continues to be a very consistent performer. They invest in primarily short term loans backed by accounts receivables, although they have recently expanded into longer term loans. They also have a unique “unitranche” bank partnership product and I am invested in a few of these loans now (full disclosure: I am on the advisory board of this Denver-based company).

PeerStreet

I have been invested with real estate platform Peerstreet now for almost three years. While many platforms have struggled in the real estate niche Peerstreet has been a consistent performer. Their CEO recently penned a blog post sharing the fact that they recently crossed $2 billion transacted on their platform. They also went into some depth on their performance giving a breakdown of all the defaults they have received since day one. If only all platforms were this transparent.

Streetshares

Once again my top performing investment by a long way is Streetshares. I invest primarily in one and two year small business term loans with an average interest rate of around 20%. Losses continue to perform better than expected which is why I continue to add to my position here. I set my auto invest on and invest across the risk spectrum.

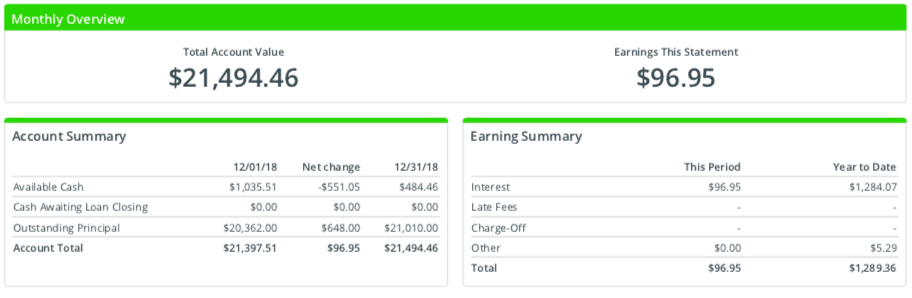

AlphaFlow

Real estate platform AlphaFlow invests across a variety of platforms offering short term fix and flip loans. Unlike investing on the platforms themselves you can build a diversified portfolio with a relatively small amount of capital. My account with just over $20,000 has 112 notes invested across 17 states. I am comfortable paying them a fee to screen the very best real estate deals across the industry.

Money360

The Money360 fund is my lone investment focused on commercial property. The fund invests primarily in bridge loans in the $3 million to $25 million range for commercial buildings across a variety of property types: office, retail, self storage, hospitality, industrial, multi family, manufactured housing and special purpose.

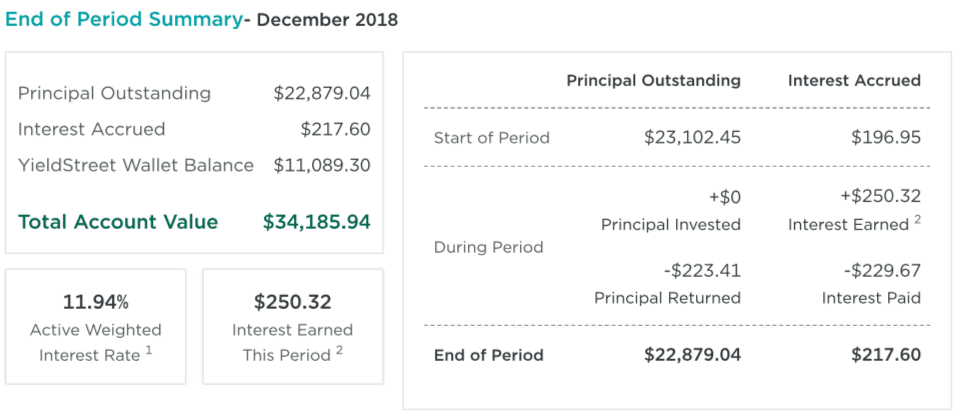

YieldStreet

YieldStreet is an interesting platform. They try to find unique investment opportunities that are not readily available elsewhere. I have invested in a portfolio of litigation pre-settlements and in the first week of January I invested in a loan for a shipping tanker. These are not investments I can find at other platforms. New this past quarter at Yieldstreet was the addition of the Yieldstreet wallet. They pay interest (2.2% as of this writing) while your cash is parked so I didn’t mind keeping over $10,000 there as I waited to deploy my capital into the next deal.

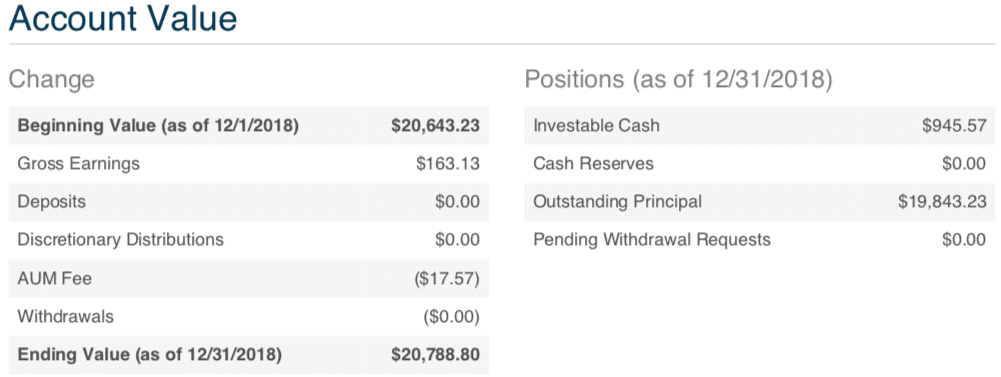

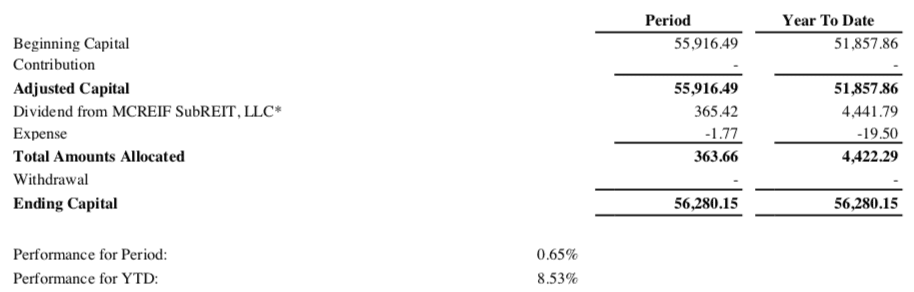

Fundrise

Fundrise is a real estate platform focused on the individual non-accredited investor. I opened up my account there three years ago and I continue to be impressed with their consistent returns. I am invested in their Income eREIT fund which is currently invested in 57 projects, primarily multi-family home construction. New investors can get started with just $500 and choose between Supplemental Income, Balanced and Growth.

Final Thoughts

The rebound in my Prosper and LendingClub accounts has been a long time coming. But as I said in my update a year ago I expected the new underwriting models rolled out in the second half of 2017 would make improvements. They need to continue to make improvements here so all my accounts can return above 5%. Right now, only one of my eight accounts held at these two companies is returning higher than that.

Regardless of how they perform I will be moving my taxable money out of personal loans and into other asset classes. As you can there are plenty of other good options today and I like having a more diversified portfolio across a number of uncorrelated asset classes.

Finally, I will highlight my Net Interest number. This is the money that my portfolio actually earned in the past year. I am happy to say this number has ticked up significantly since it bottomed out in Q2 2018. The net interest earned in 2018 was $40,790.

As always feel free to share your thoughts in the comments below.