There was an interesting article in Bloomberg yesterday on Marcus. Bloomberg cites sources claiming that Marcus will be scaling back on its origination goals for next year. Now, we don’t know exactly what the origination goals were or what they have been scaled back to, we only know that their origination goals are now less than originally planned.

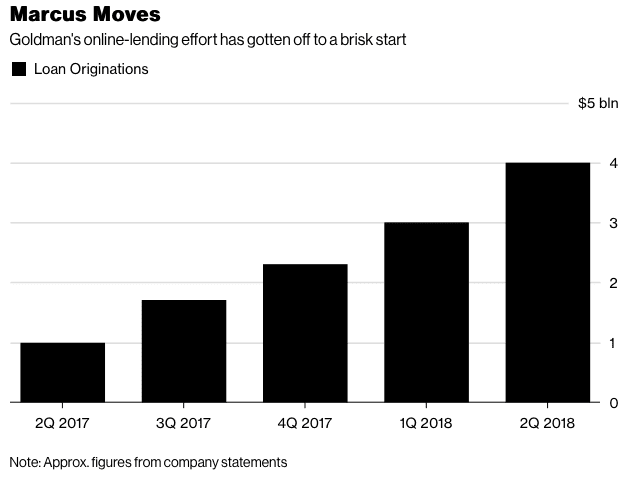

As we reported last year Marcus was the fastest company ever to $1 billion in loan originations, they passed that milestone in just eight months. Since then they have continued this frenetic pace, passing $4 billion in Q2 of this year, in under two years. No company has ever grown their personal loan book so quickly.

From the Bloomberg piece:

The reduction in 2019 plans is based on current market conditions for consumer lending and could still change, said the people, who didn’t provide exact figures. A spokesman for Goldman Sachs declined to comment.

It is not surprising that they are putting the brakes on somewhat. We are very likely late in the credit cycle and Marcus wants to get ahead of any possible downturn. They hold these loans on their own balance sheet so we don’t have much of a window into loan performance so far. The Goldman Sachs CFO did say that defaults are running at around 5% and other Marcus executives have said that defaults are in line with expectations.

I don’t think this changes Goldman’s approach with Marcus. The new CEO, David Solomon, has indicated his commitment to the online bank as an important part of Goldman’s future growth. It is good not to get ahead of yourself, we have seen what can happen when online lenders put origination growth as the major focus. It is very easy for underwriting standards to slip in the pursuit of ever more borrowers.

We should find out more on the Goldman Sachs Q3 earnings call coming up soon. But this pullback in growth is probably a good thing for Marcus in the long run.