LendUp has long been a champion of the non-prime consumer, what is known as the emerging middle class. They have offered small dollar loans since their founding in 2012 and they started a credit card business for this segment that was spun out a couple of years ago.

But like many other fintechs they want to provide more for their customers. And the reality is, for their target market, there are few fintechs offering a full suite of services.

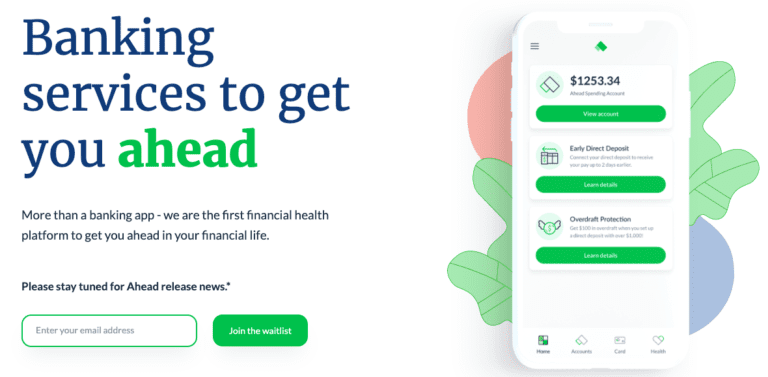

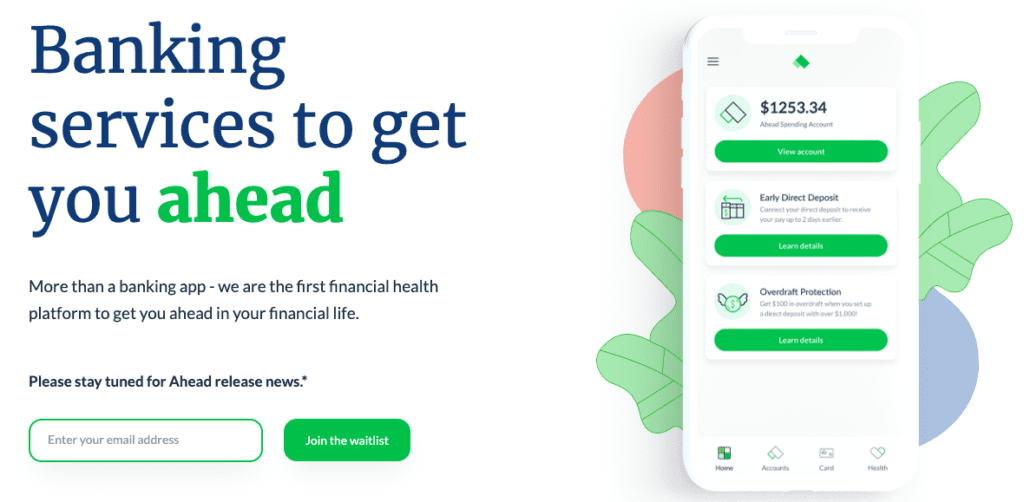

Today, LendUp announced a new initiative called Ahead Financials. This will be a complete digital banking and financial health platform for their core market, the emerging middle class.

I caught up with CEO Anu Shultes last week to discuss Ahead Financials and what they are trying to accomplish. She said their customer base has a bank account but pays too much in fees, making them unable to deal with a $200 emergency expense. So, Ahead’s digital banking offering will have no fees along with $100 overdraft protection, fee free ATM access and early access to paychecks.

Anu was quick to point out that this is just an initial product set, they will be building out a full set of features tailored to their target market after they launch. Speaking of which, they intend to launch in a limited way before the end of the year and then a full launch in Q1 next year.

One of the differences between Ahead and other digital banking offerings is the focus on financial health and financial literacy. Their customers will have access to a Ahead Financial Personal Trainer as well as a gamified approach to building credit scores. They say the key is to make it part of the customer experience, so people don’t know they are learning.

There will be no separate team for Ahead, at least initially. Everything will be run by LendUp executives with Anu calling the shots as CEO. As to why they decided to go with a separate brand rather than use LendUp, Anu said that they wanted to maintain LendUp with a focus on lending.

With nearly one million customers LendUp has a large customer base for Ahead digital bank accounts. Eventually, they want to move beyond their customer base and, in fact, to even move beyond underbanked consumers into the broader market. Everyone wants to get ahead so their brand has potential to move into the mainstream.

Ahead will be partnering with Sutton Bank and Visa to deliver their digital banking services.

My Take

Ahead will be entering into a competitive market. While LendUp’s core customer base is the underbanked there will be some overlap with other digital banking offerings. But this is probably the largest market segment of all so there will be room for multiple winners here.

I am most interested in what they are doing with financial literacy. This is what is most needed and, if you can gamify a financial literacy offering so people learn without have to sit down and watch a video, that could be game changing.

There is so much work to be done here so I applaud LendUp for making this a central part of the introduction of the Ahead Financials brand. Because in the end we want and need people to make choices that help their long-term financial health. In the meantime, getting rid of all the fees that banks charge will make a real difference.