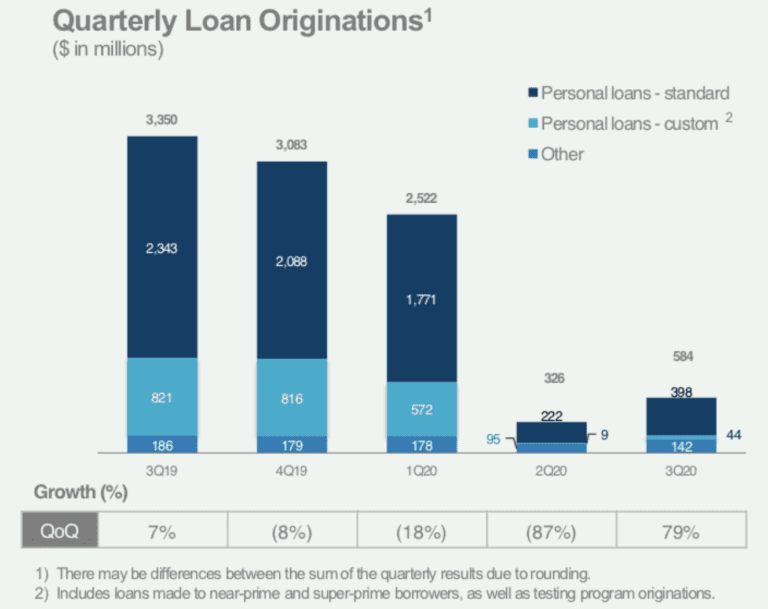

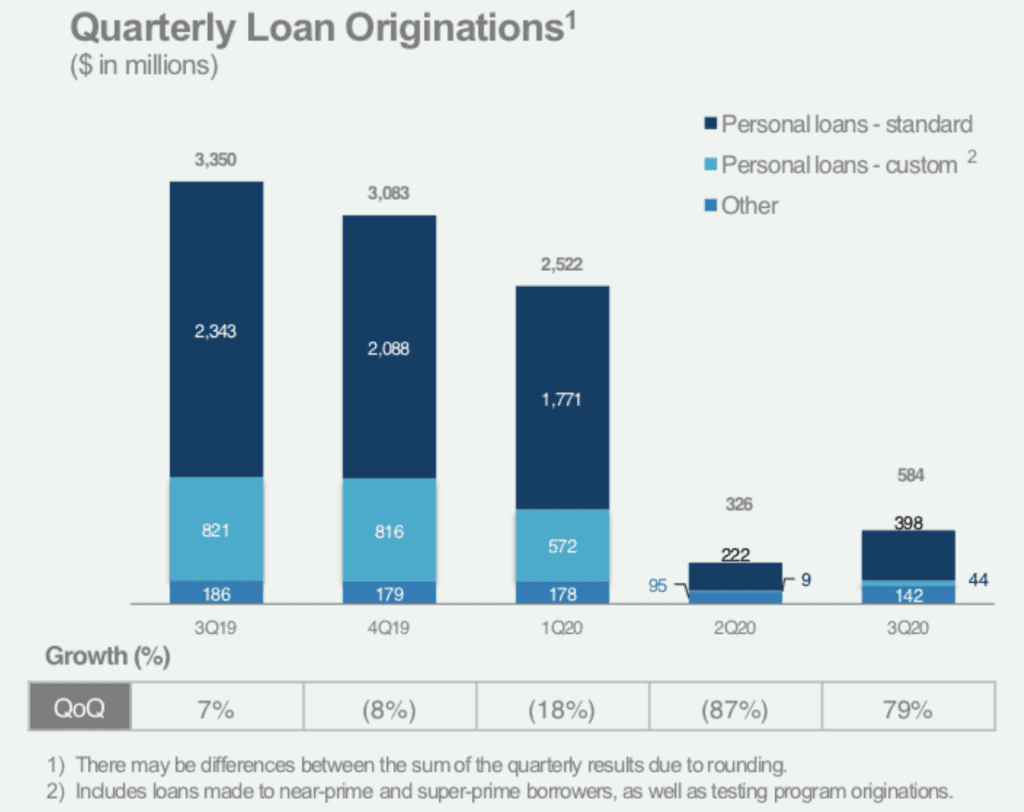

This afternoon LendingClub released their earnings for Q3 2020. They have bounced back from the lows of Q2 showing a 79% quarter over quarter increase in originations to $584 million (this is still down 83% year over year). Revenue for the quarter came in at $74.7 million which exceeded analyst expectations by almost $17 million. LendingClub’s net loss for the quarter was $34.3 million or negative EPS of $0.38, which also significantly beat expectations.

Here is a summary of their financial results:

- Loan originations of $584.1 million, down 83% year-over-year and improving 79% sequentially.

- Net Revenue of $74.7 million, down 64% year-over-year and improving 70% sequentially.

- GAAP Consolidated Net Loss of $(34.3) million ($(0.38) per share attributable to common stockholders), compared to a loss of $(0.4) million ($0.00 per share attributable to common stockholders) in the third quarter of 2019 and a loss of $(78.5) million ($(0.87) per share attributable to common stockholders) in the second quarter of 2020.

- Adjusted EBITDA of $4.3 million, down 89% year-over-year and improving 116% sequentially.

- Adjusted EBITDA Margin of 5.8%, down 13.7 percentage points year-over-year and up 68.8 percentage points sequentially.

- Adjusted Net Loss of $(23.1) million ($(0.25) adjusted net loss per share), compared to Adjusted Net Income of $8.0 million ($0.09 adjusted net income per share) in the third quarter of 2019 and an Adjusted Net Loss of $(54.3) million ($(0.60) adjusted net loss per share) in the second quarter of 2020.

Here is what CEO Scott Sanborn said about these quarterly results:

While there is uncertainty about the economic outlook in the near-term, we are managing LendingClub for long term success and the actions we are taking to strengthen our business post-COVID are bearing fruit. Our loans are performing well, investor confidence is returning, we have improved cost efficiency, and have built a substantial amount of liquidity as we work towards completing the acquisition of Radius, which remains our top strategic priority.

Tom Casey, CFO of LendingClub, had this to say:

As anticipated, we are seeing a recovery in originations from a low point in Q2 and a corresponding growth in revenue.” He continued, “We also ended the quarter with a substantial increase in cash and cash equivalents as we executed on a strategic decision to sell loans and generate additional liquidity while paying down a significant amount of debt and de-risking the balance sheet.

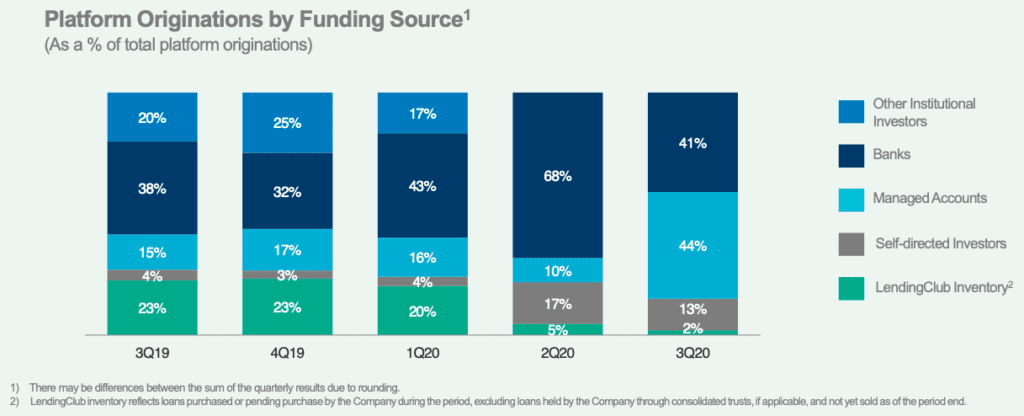

It is interesting to see the dramatic changes in originations by funding source as shown in the above graphic. Managed accounts (typically high net worth individuals, family offices and other institutional investors that invest directly in loans) have come back significantly in the past quarter and while the percentage of banks are down if you do the math banks have increased their total investment this quarter from roughly $221 million in Q2 to $239 million in Q3. We also know that last month LendingClub made the decision to close down their retail platform at the end of the year so we know that self-directed retail investors will start to fall sharply as those loans run off next year.

LendingClub reported that consumer credit continued to hold up, performing better than initial expectations. Surveys have indicated that consumers spent two-thirds of their stimulus checks on paying down debt or to increase savings. They also noted that credit card spending and high-cost revolving credit have both declined year over year.

They also reported on their all important acquisition of Radius Bank. While they couldn’t share much detail they did say that the acquisition is still on the same timetable it has been on since they announced it earlier this year. They did file their official Y-3 application with the Federal Reserve last quarter.

In the Q&A session on the earnings call Sanborn indicated they are still focused primarily on their existing customer base for originations, with this group making up up around 80% of total originations for the quarter. They will be slowly increasing marketing to new customers so this percentage will come down.

Overall, this was a positive earnings report given where they were last quarter. The stock was up in after hours trading based on this solid report.