Today LendingClub announced their Q1 2020 earnings. Lenders in the US are being hit hard by the coronavirus and we are now getting a sense of how significant the impact may be. We were already aware of moves LendingClub has made which included cutting about 30% of their staff which was announced two weeks ago.

LendingClub led off the call with the actions they are taking under five guiding principles. This includes:

- Keep employees safe

- Preserve liquidity

- Protect investor returns

- Support members

- Stay on track for the Radius acquisition

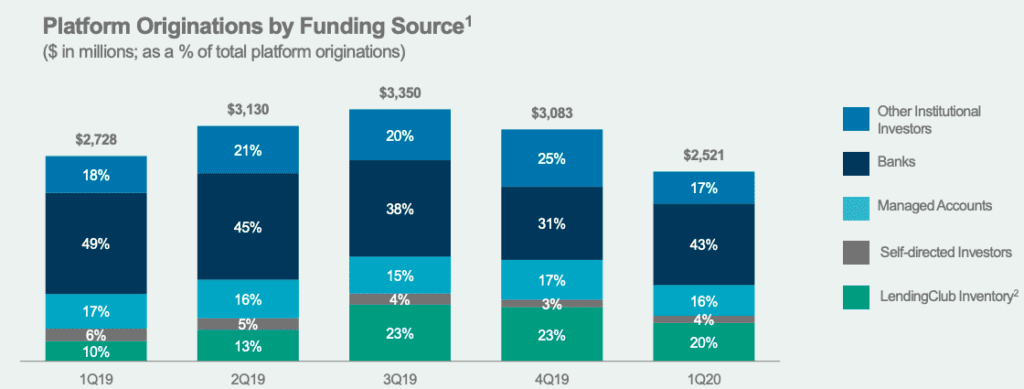

GAAP net losses for the quarter were $(48.1) million. The significant decrease was the result of a fair value markdown of $(101.7) million. Just over half of the fair value markdown ($64 million) was LendingClub reevaluating loans that are held for sale by the company at fair value. Loan originations were $2.5 billion, down 8% from the prior year period and revenues dropped 31% to $120.2 million from the prior year period (because of the fair value markdown).

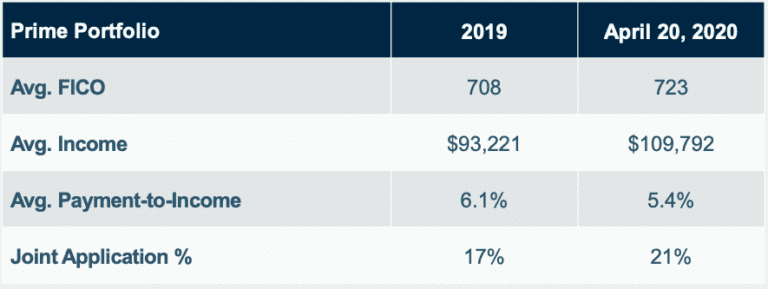

While it was an expected tough quarter for the company the results included less than a month of the US being largely shut down due to the coronavirus crisis. LendingClub expects originations to fall 90% as they have further tightened credit criteria. Investors are also pulling back on funding personal loans. LendingClub’s moves in originations is best illustrated by the below data shown in the earnings presentation which demonstrates just how much the borrower demographic has improved (at least on paper).

New originations are being focused on existing members that have positive payment histories. While it is impossible to predict loan performance, LendingClub’s transition over the last 18 months towards serving higher quality borrowers is likely to pay off compared to their peers.

The company proactively started to make changes even before investors started scaling back allocations. Borrowers are able to receive a 2-month payment deferral plan under the skip-a-pay program. As of April 30, 11% of outstanding loans were enrolled in the skip-a-pay program. For those not enrolled LendingClub is not seeing any loan degradation. Not surprisingly loan prepayments have also decreased which is a drag on investor returns. Going forward, LendingClub intends to provide additional graduation and forbearance programs as borrowers look to bridge gaps in income.

LendingClub, like many companies, is in cash preservation mode. As previously mentioned LendingClub cut 30% of staff that were working in non-core expansion initiatives such as auto and projects such as a planned migration to Amazon Web Services. Variable expenses which includes vendors, contractors, marketing spend, discretionary spend and real estate spend saved $50 million off LendingClub’s quarterly expense base. Employee cuts and salary reductions for senior leadership will save another $20 million.

Fortunately for LendingClub, they have been in a strong cash position for some time and ended Q1 2020 with $550 million in estimated net liquidity. According to cash flow stress testing the company has enough liquidity to get them through 2021. It is interesting that with LendingClub’s new cost base along with cash flows from servicing fees and their loan portfolio, they are able to cover cash flow expenses from operations even assuming a $0 origination scenario.

On many investors’ minds is the Radius acquisition which was announced a few months ago. This statement was included in the earnings deck:

Under multiple scenarios considering various maturities, triggers and recourse we believe that we have adequate liquidity to weather the storm and complete the acquisition of Radius bank

While CEO Scott Sanborn wouldn’t go into detail he did say that talks continue to be productive with regulators and they are highly engaged. It seems the company is committed to moving this process forward though one investor on the earnings call did ask about whether the company should pursue being purchased to which LendingClub responded that they feel good about where they are and are well positioned. The transaction is estimated to be completed in roughly one year.

Conclusion

It is hard to make any predictions on LendingClub going forward as there is nothing to compares with this crisis. What we do know is that LendingClub is likely in a better position than most given their borrower demographic and cash on hand. The next quarter will be very different as LendingClub prepares for a dramatically lower loan volume. It’s going to be very interesting to see how this crisis plays out not just for LendingClub but for all fintech lenders.