[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. You should seek professional advice before taking action on any of the ideas presented here.]

Every year we provide information related to filing your taxes as an investor in LendingClub and Prosper loans. Both platforms have been around for many years and at this point not much is changing on a year to year basis. Our post last year has details which are still relevant today as you file your taxes for 2018.

You van view last year’s post on filing your taxes with LendingClub and Prosper here: https://www.lendacademy.com/lendingclub-prosper-tax-information-2018/

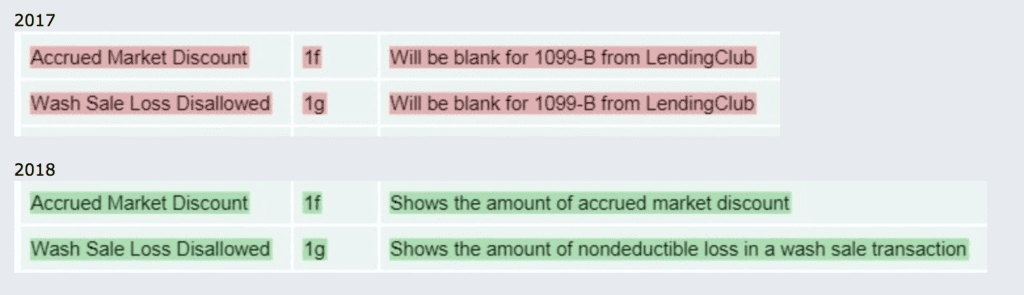

LendingClub has provided an update to their tax guide for retail investors. You can download the 2018 version of this document which will be helpful if you are new to the process. If you want to see a comparison of the 2017 and 2018 tax guide a Lend Academy forum member has created a link which shares the differences. The major changes apply to boxes 1f and 1g and are shown below.

It’s also worth noting that LendingClub works with TurboTTax and they share how TurboTax users can import their LendingClub tax forms.

Prosper has also updated their tax guide for 2018. It is available for download here.