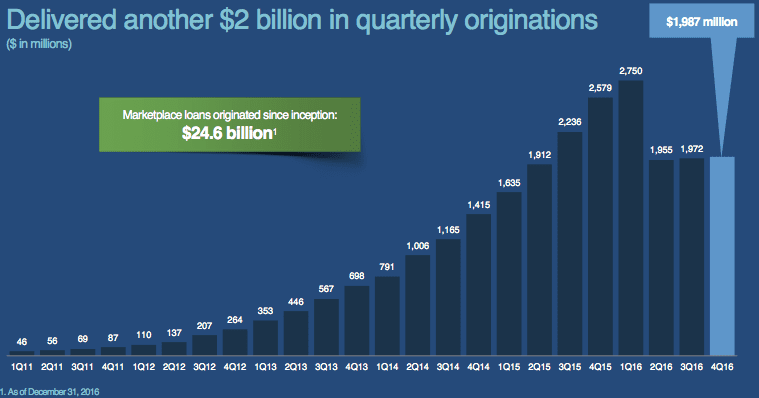

Lending Club has released their Q4 2016 and 2016 year-end results. The company originated $1.987 billion in loans, up 1% from Q3 2016 of $1.972 billion. The most significant news of the earnings release was that bank participation totaled 31% of the platform in Q4 2016, up 18% from the previous quarter which shows that the banks are back. In the Q & A section of the earnings call, CEO Scott Sanborn stated, “We’ve got back on a bank by bank level all of the people we were hoping to have back.” This also happened quicker than Scott had expected. Also worth noting is that the company achieved this goal without investor incentives in Q4 unlike in Q2 and Q3 2016 where loans were offered to investors at a discount.

Last quarter the company announced a $1.3 billion deal with Credigy, a subsidiary of the National Bank of Canada. Certainly this increase is in part due to that deal and in the Q & A, CFO Tom Casey made a remark that the Credigy deal represented 10 points of the growth, although he clarified later he hadn’t done the math and this was a ballpark number. This proves that bank participation was not solely driven by Credigy’s investment which is great news for Lending Club as diversification is so important with a marketplace model. The company has made significant progress in attracting banks, approaching Q1 2016 levels where bank participation hit its peak.

What you’ll also notice looking at the chart below is that the Other Institutional category dropped 5% sequentially, from 18% to 13%. This category of investor includes investment banks, hedge funds and fund managers who typically seek higher yields. Lending Club has tightened credit and adjusted pricing which has had an effect on these investors. According to Lending Club the January 2017 credit update affected approximately 6% of the borrower funnel which means Lending Club is originating less of the higher risk loans. This shift is attributed to performance and also to banks taking up available inventory as discussed previously. Bank’s interest in loans continue to be concentrated in the high quality A & B grade loans.

Also on the investor side of the equation, Lending Club discussed the opportunity of new revenue streams, namely a sponsored securitization program. Lending Club completed their second securitization in December 2016 and we learned of a new securitization with Jefferies totaling $300 million on January 7, 2017. They plan to partner with financial institutions to control the transparency of the underlying assets. Lending Club will use some of its capital (up to $100 mn) to participate in the securitizations by warehousing the loans until the securitization takes place and the loans are sold. Although this will have an effect on the company’s balance sheet it will only be temporary as Scott clarified that they do not plan to hold loans on their balance sheet long term. One analyst asked how the profitability differs from selling whole loans to banks versus selling loans in a securitization. Tom Casey and Scott Sanborn mentioned that securitization results in higher revenue but the securitization channel is really about diversification of funding sources and allowing other types of investors to participate in securitizations as opposed to just driving revenue.

I think the other key theme coming out of the earnings call was that Lending Club is now ready to shift it’s focus now that 2016 is behind them. Scott Sanborn noted that the company is ready to leave the remediation and recovery phase after an enormous investment in that effort. The focus going forward is more on the borrower side of the business to further growth, become a more balanced marketplace and shift resources to other priorities. Scott also noted there were more opportunities on the investor side and they are actively looking to participate in deeper partnerships and make strategic use of their capital. Although there is clearly room to grow on the borrower side, Lending Club now has close to 2 million borrowers equivalent to one of the top 20 banks in the country.

Not surprisingly Lending Club did not provide much of an update on the new auto refinance product but they have now expanded from just California to 27 states. They have not marketed the product heavily but plan to do so in 2017. The company plans a $5-10 million investment this year. Revenue as well as originations with the new product are not meaningful for the company at this point. The team was also asked about the competitive landscape. Scott agreed that the landscape has changed but they now have nearly 10 years of experience and can say yes to a broad range of borrowers. The platform infrastructure is in place and the team feels good about their ability to compete with new players entering such as Goldman’s Marcus.

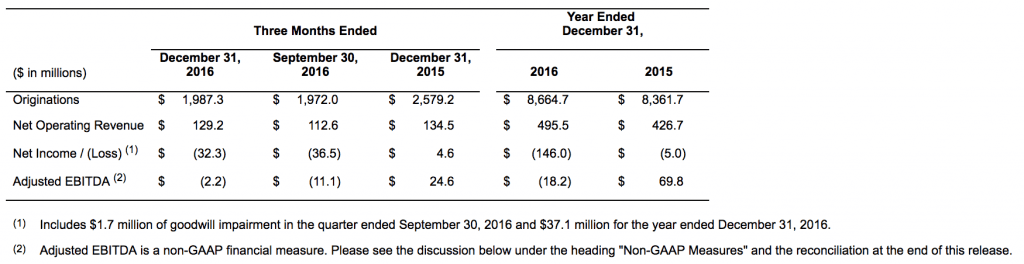

Lending Club’s financials for the quarter are shown below.

Conclusion

While growth from an origination perspective has still yet to materialize it’s clear from listening to their recent earnings call that the company put a tremendous effort into attracting investors in 2016. I believe they have succeeded here and the team noted strong demand from capital markets. They have also attracted more banks back to their platform in a much quicker time frame than expected.

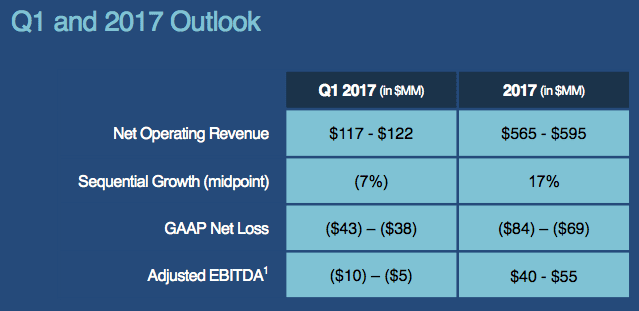

Now the question is whether they can spur some growth in 2017 on the borrower side of the equation. The company also provided guidance for the first time in several quarters which should give investors some idea of what to expect going into 2017.

Disclosure: Peter Renton, the founder and CEO of Lend Academy, and Ryan Lichtenwald, the author of this article both own LC stock.