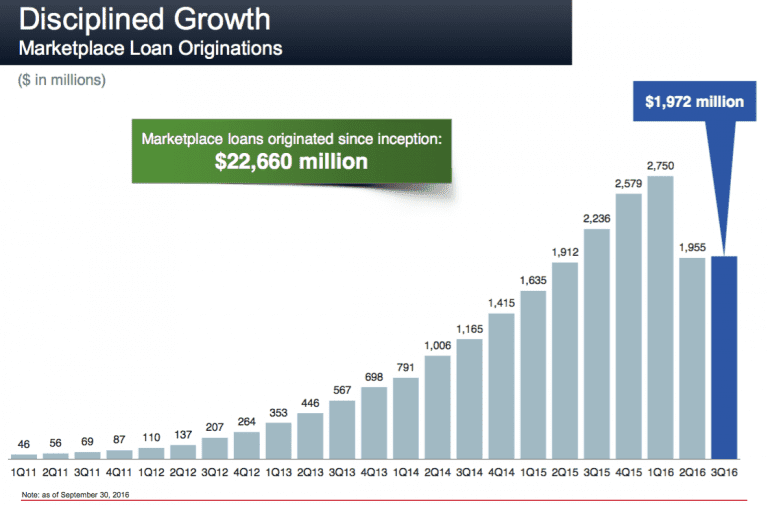

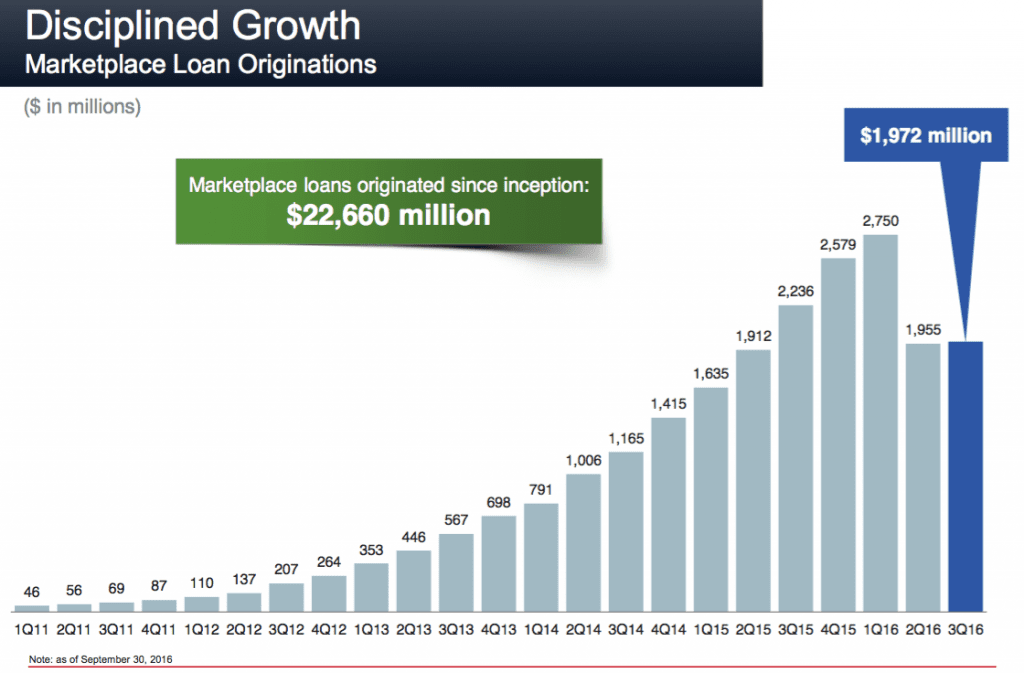

This morning, Lending Club announced their Q3 2016 earnings. In the third quarter, the company originated $1.97 billion in loans, marginally up from $1.95 billion in the second quarter. The financial highlights from the company’s press release are shown below:

From strictly an origination perspective the company did not have much growth in the quarter, but financials did improve from the prior quarter. The company highlighted $14 million of investor incentives that occurred in Q2 and $11 million in Q3. Also effecting the company’s financials were the $15 million and $14 million in expenses related to the board review that took place in Q2 and Q3 respectively.

The biggest news coming out of earnings was that Lending Club announced a large funding deal with Credigy, a subsidiary of the National Bank of Canada. Credigy will invest up to $1.3 billion in Lending Club loans and has already committed $325 million. Credigy is a consumer finance investment company which makes them a perfect fit to invest on the platform. Lending Club has long had banks investing through their platform but this is one of the few deals made public and the investment amount is significant.

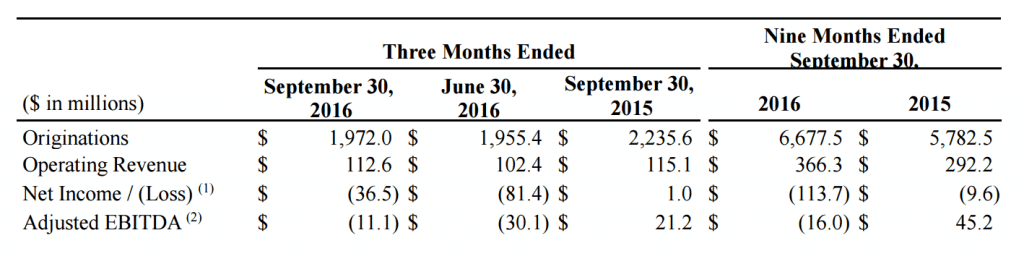

One of the other topics on the minds of investors is the funding mix on the platform. While CEO Scott Sanborn noted that they have re-engaged virtually all of their largest investors on the platform, he also said that there is a ramp up for banks to reach target investment levels. Lending Club’s target mix for bank funding on the platform is 25% and for the third quarter it came in at 13%. In the Q & A, Scott said that the return of banks spills over into the fourth quarter so I expect we will see a bounce back of bank involvement in the next quarter, especially with the newly announced Credigy deal.

Managed accounts, which includes a few of the new 40 act funds represented 55% of the platform mix, funding over $1 billion in loans. This is not surprising given they are able to move quickly at scale and were able to take advantage of the incentives offered by Lending Club. As expected Lending Club ended their investor incentives that were put in place post May 9th, using only half the amount planned. Retail investors and Other Institutional remained relatively stable over the quarter.

Below are a few questions summarized from the conference call where many analysts asked about Lending Club’s recently announced auto refinance product:

Q: Is there any additional color you can provide on the Credigy deal?

A: They will be a broad buyer of loans across the platform. We looked at a number of arrangements in our effort to secure up a portion of our funding. We feel good about where we are now combining with retail investors and other banks. The program is at market terms, but there are other economics that are reasonable that will be triggered if the full $1.3 billion is deployed, subject to other terms and conditions.

Q: As you’ve gone through the transition of implementing more compliance and legal controls, how much of this cost do you think is temporary? Are long term margins attainable?

A: We view these investments not as large structural costs. A lot of what we’re doing is automating things like document storage & validation, end to end data, change management processes, etc. While we are increasing size of audit and compliance, those aren’t big numbers that won’t meaningful move margins.

Q: What is the investor interest in the new auto finance product? How will your balance sheet be affected?

A: We are still in the early days of the new auto product. In Q4, there will be no significant impact but we believe the cash position lets us launch and learn. The balance sheet gives us flexibility and we can eventually move loans off of the balance sheet. We can give a better outlook in 2017 but are already in significant conversations with a number of investors.

Q: There is no origination fee on the new auto refinancing product, what is the revenue model?

A: There is a premium charged to the investor or a gain on sale margin.

Q: Do you think the cost of borrower acquisition will be materially different with the auto refinance product? What is your perspective of consumer overlap of auto refi and those who have existing unsecured loans?

A: It’s too early to get a full read of overall acquisition costs but the auto refinance product uses a lot of the same channels and techniques. The value proposition is also a similar: “You have a loan, you’re paying to much, and we can get you a better one.” The consumer overlap is something we are excited about as we have 1.7 million borrowers and they are users of credit. A significant percentage of them have car loans.

Q: What is the average yield or borrower cost to the new refinanced borrower?

A: The target is the used car market where we tend to see average rates in the 8% range. Savings to the borrower are estimated to be between 100-300 bps. We have issued a few loans and our first customer saved over 600 bps on their cost of credit. We look at this as saving the borrower a years worths of gas or two sets of tires, providing real value.

Conclusion

What’s going to be interesting in the coming quarters is to see how originations are affected by new investments such as the Credigy deal announced today as well as the new auto refinance product. The company is still rebounding from one time expenses but they will soon put that in the past. Investors are responding favorably to today’s news with the stock up 14.72% at $5.89.

Disclosure: Peter Renton, the founder and CEO of Lend Academy, and Ryan Lichtenwald, Senior Writer at Lend Academy own LC stock.