Today, Lending Club has added some long awaited features for investors who use the Lending Club trading platform to buy and sell notes. Until today many people who traded notes on Foliofn had no idea what their actual returns were – these were often mispriced by Lending Club’s NAR calculation. No more. If you have never bought or sold notes through Foliofn then these changes do not affect you.

Below is an explanation of these changes using my own main Lending Club (taxable) account as an example.

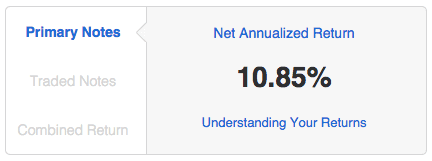

Primary Notes Return

This 10.85% number above represents the NAR return on all the notes that I have bought on the primary platform and not sold. These are now called Primary Notes. Any notes that were either bought or sold on Folio are excluded from this number.

When you click on the Understanding Your Returns link (underneath the NAR number) here you will go into the same screen as before with the dot-chart that plots similar investor returns.

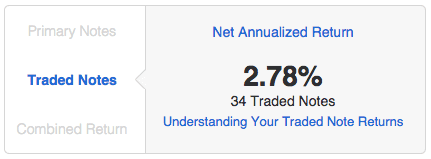

Traded Notes Return

This is where Lending Club has made some major improvements. This has been the issue. If you bought and sold all your notes at or near par then your Lending Club NAR calculation was accurate. But some Folio traders buy or sell deeply discounted notes and for these people the NAR number has not reflected their actual return. It is these investors who benefit the most with this change. Now, Lending Club has taken all the activities on Folio into account and made an accurate annualized return number for all.

You can see my return here is really low: 2.78%. This is because most of the notes I sold on Folio were late notes that I sold for a loss. There is a more detailed explanation about this on Lending Club’s knowledge base. In this article there is an excellent example that explains why the NAR was fairly meaningless for active Folio investors before this change.

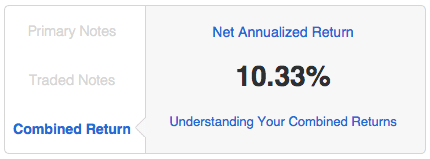

Combined Return

Above is a screenshot of my new Combined Return number. As you can see it takes my 10.85% return and combined it with my 2.85% return from my traded notes to make this 10.33% number. There is another explanation that Lending Club provides when you click on Understanding Your Combined Returns link.

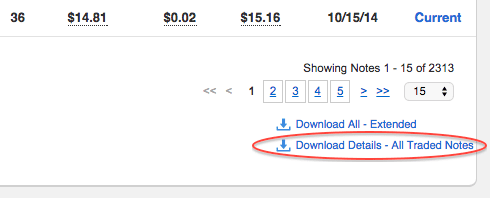

Download all Your Traded Notes

That is not the only change that Lending Club made today. Another complaint of active Folio users is that there is no easy way to analyze all their trades. This became particularly troublesome at tax time. Now, investors can download all their notes or just those notes that were bought and/or sold on the trading platform. Just click on the Notes link in the top menu of the main Lending Club account screen and then scroll to the bottom of the page. You will see the links in the screenshot above.

It is good to see Lending Club continue to make changes here to help Folio investors, the often ignored segment of Lending Club investors. But let’s hear from the active Folio users. What do you think? Are these changes useful? Let me know in the comments below.