When I met with Renaud Laplanche, CEO of Lending Club, in June last year he told me that Lending Club would reach $1 billion in issued loans by the end of 2012.

At the time Lending Club’s total was under $300 million and that number was growing at less than $20 million a month. So, I thought to myself here is another overly optimistic CEO. I mean how could they average almost $40 million a month for the next 18 months when their best month ever was $18.5 million and their monthly volume was growing at barely $1 million a month.

But I am happy to report that I was wrong. This morning Lending Club crossed over the $1 billion mark several weeks before the end of 2012. While Lending Club never shares their projections Laplanche did say in a recent conversation that 2012 has been a better year than even he expected.

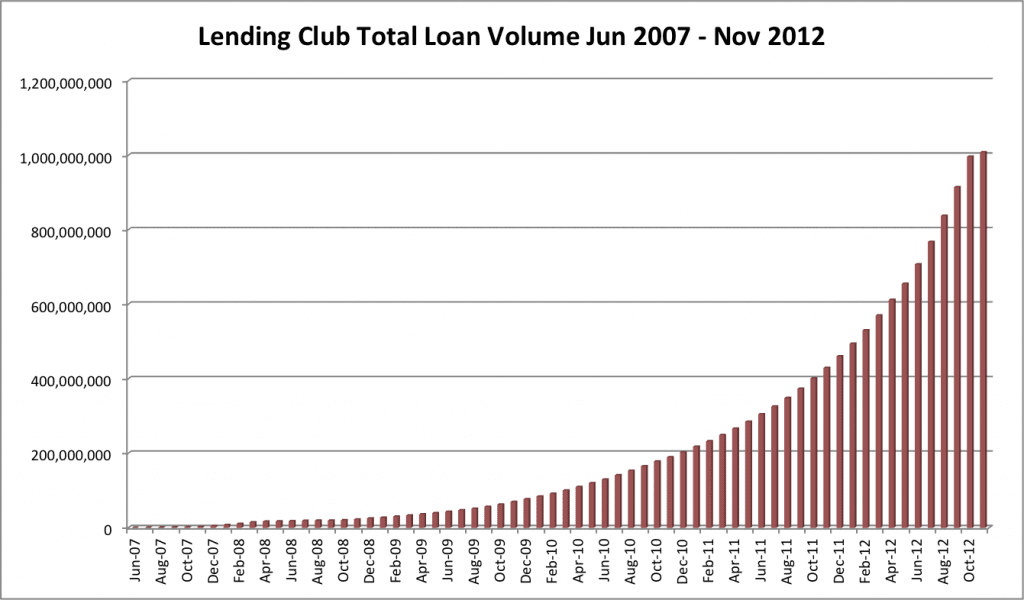

Below is a chart showing the growth in total loans issued at Lending Club since they launched in June 2007. Obviously, the current month, represented by the bar on the far right, is still in progress but you get the picture. Rapid growth.

Lending Club is Now Cash Flow Positive

The press release that came out this morning announcing the $1 billion milestone had some even bigger news. When Lending Club releases their 10-Q in the next couple of weeks they will show positive cash flow in the third quarter. While the $1 billion is a nice round number the fact that Lending Club is generating positive cash flow is far more important. I believe the significance of this news should not be understated.

I have heard from literally hundreds of investors over the past couple of years who have lamented that the p2p lending model was still unproven. Despite almost $200 million in venture capital money invested no company had shown they could make a profit. Clearly, that is about to change. While Lending Club didn’t say the quarter was profitable, just that cash flow from operations was positive, it is only a matter of time (probably this current quarter) before that will happen.

This kind of news will only fuel the growth at Lending Club and with the Holiday Season approaching I expect we will see monthly volume north of $100 million for the first time by the end of the year.

Winner of the Lend Academy Contest

Last month I held a contest to see who could guess the day when Lending Club would go over $1 billion. Four people guessed November 5th so I put each name in a spreadsheet and used a random number generator to determine the winner. And the winner is Casey C. who will win some nice Lending Club merchandise. Casey, please fill out the contact form and send me your mailing address.

Don’t Forget the Lending Club Contest

Today is the day to fund some loans at Lending Club. Everyone who makes an investment today goes into the draw to win a golf bag and $1,000 cash. The details are here. I know I will be making an investment in all of my accounts and you should too.