Banks, fintech, and credit unions spend millions on the sales funnel to get random people into making new accounts, and after all the hard work, they stop the effort there.

Brands lose up to half of the new accounts within the first year, according to Digital Onboarding SVP Adam Westley: Money walks right out the door.

“The market data would say, and when we talk to customers, we find anywhere from 25 to 50% of the accounts they open in the first year go dormant or close,” Westley said. “They’re spending all this money on making that workbook perfect and then completely forgetting about actually ensuring they keep them.”

He said brands end to compete with each other and internally to make the onboarding process perfect but neglect building guardrails that keep customers in-house once they get there. Westley said that stopping people before they run out the door is the easiest way to grow revenue.

Lost in translation

In the past years, the digital account game exploded when fintech became a household name, and everyone pushed to get online. The problem is, Westley explained that the infrastructure that kept banks adept at competing for in-person customers at branches did not translate well to mobile or in-browser.

“When you used to open an account in a branch, you meet a human being, and they explain the different services, set you up with a direct deposit, get you your debit card, and walk you through critical steps,” Westley said. “Well, when you open accounts online, that experience doesn’t exist; most banks use a series of emails on a regular schedule to get customers: Things are not very personalized, just sort of generic.”

Westley said after the onset of the pandemic, the style of the time was online first. Internally, companies pushed their online account opening guys to build more but did not lay out plans to take care of a new breed of customers. Then, when new subscribes, and added accounts metrics are through the roof, customers start to leave. He said what once were the profit leaders turned into loss leaders. That’s where digital account openings come in.

“After what they pushed on the online account opening guys, they say ‘what’s gone on here; you’re opening these accounts, we’re not making any money off this, this is a loss leader now,” Westley said. “We become a good way for them to bridge that gap and close that criteria down. If their loss [from new accounts] was 30%, we could get it down to 15% or 10%.”

He said cutting a loss in half is easy to overlook but the easiest way for a CU bank or fintech to increase revenue.

‘Your job’s not done there’

The solution the firm builds aims to turn new account holders into primary users, Westley said, because a new account does not just mean a victory.

“We build customized microsites that are dependent on the type of product or services that customers opened up and on different data points that we can get from credit unions and banks to personalize that journey,” he said. “Most banks and credit unions would say a newly opened account is successful. And we would say it’s not because an account does not equal a customer, it does not equal a relationship: your job’s not done there.”

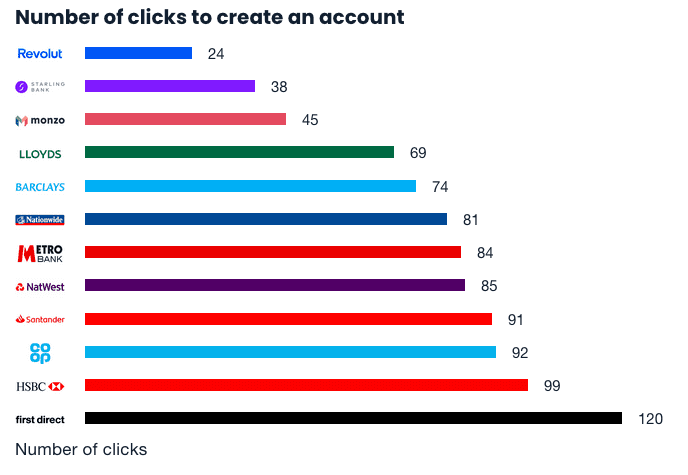

As exemplified in this viral graph from UX writer Peter Ramsey in may 2020, challenger banks and traditional banks have been in an arms race for the quickest account open for years. Revolut won out with the fewest mouse movements to open. Ramsey found that mobile access, especially during the pandemic lockdowns in the UK, was a massive plus.

Arms race

“Two-thirds of the banks forced me to go to their website at least once to get an active account. Some of them let you apply for an account through their app, but then you couldn’t create your online banking credentials unless you log in through their website,” Ramsey wrote. “And it’s worth noting that parts of Nationwide, Metro, Santander, and Natwestwere not even fully responsive on mobile.”

He found that some traditional banks, like Barclays, had transitioned well to a mobile-first market.

“What the challenger banks—and to their credit, Barclays—have done is consolidate all of their processes. Sure, this is considerably easier when starting with a blank canvas, as these new banks were, but nonetheless, it makes a significant improvement to the experience,” he wrote.

Unfortunately, Westley said even the fastest to open don’t hold on to customers.

Engagement

Westley said it all comes down to engagement and offering in-person service, even if over the phone. Leveraging data behind customer experience has been a significant focus, he said. For example, after partnering with a local bank, they found that 30% of all calls to their 24/7 call line were questions about finding an account number for direct deposit.

A fix for that problem is as easy as adding a secure way to view an account number or a secure pop-up window with 2fa that Digital Onboarding designed.

“If you’re spending all that money to acquire customers, utilize your products, open the account, and then you’re spending money on your technology stack to put that customer into your business,” Westley said. “That’s where the sort of the rubber meets the road, right? When we sit with clients, we realize that an account is not a customer, and an account is not a member: If they’re not using products and services, then it’s just the cost of your book.”