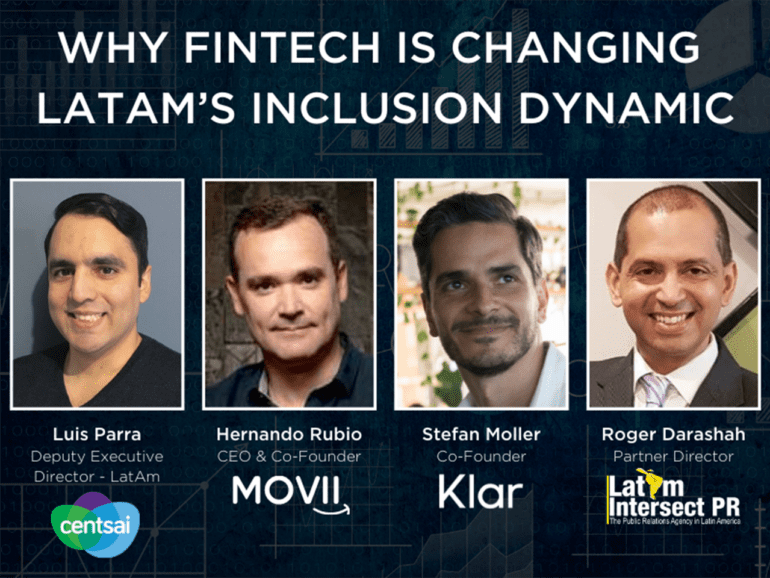

Recently, a panel of Latin American fintech executives joined the LendIt webinar series to discuss the new age of Latam fintech inclusion.

Moderator Roger Darashah, Partner Director for LatAm Intersect PR, led the talk.

Luis Parra, Dep. Exec Director at Centsai, Hernando Rubio CEO of Movii, and Stefan Moller, Co-founder of Klar, fielded questions about the “new tangibles” of the fintech environment in LatAm, drawing from the new State of LatAm Fintech Report.

The report found that the traditional playbook of developing branches and building relationships may count “for little in a world where a mobile phone is the principal’ real estate’, and word-of-mouth – often via social media – becomes the most powerful form of validation.”

Hernando Rubio CEO and co-founder Movii

Darashah first introduced Rubio as the head of Movii, Columbia’s largest provider of mobile wallets. With more than 2 million users and a recent $15 million funding round, Movii is on track to grow.

Rubio argued that LatAm’s financial inclusion is not well defined, and because of that, fintech can make up the difference. Traditional finance uses the number of open bank accounts, for example, 84% of Columbians, as a metric that shows inclusivity. However, Rubio said that access to financial products goes beyond traditional bank accounts — most bank accounts are inactive, and 90% of Columbian transactions are still in cash.

“So it doesn’t make any sense to say that at that we have an 84% rate of financial inclusion when you see all those other numbers,” Rubio said.

“That is why in my opinion, ‘financial inclusion is how engaging the bank account or the service that you’re providing is to that customer.’ How useful you are, how many transactions they’re doing: I believe that we should be redefining the way in that concept to measure financial inclusion with different KPIs.”

Stefan Moller Co-founder, CEO of Klar

Moller agreed with Rubio and added that traditional financial products are underused because they have suffered a one-size-fits-all building philosophy. So he co-founded Klar in 2019 to bridge that gap: with a Mexican challenger banking app that has grown to 700,000 users by offering more than just deposits and charging overdraft fees.

After a B funding round in July, Klar reported it was growing 60% each month in the first half of 2021.

“In Mexico, what you end up seeing, I think this is a trend that you see all over Lat Am, is that there are good and useful and affordable products, but they are reserved for a very small segment: people that are banked, have a high income,” Moller said.

The solutions that work for the previously banked leave the lower-income customers out. As a result, Tradfi can become a “little complacent” by not building products for lower-income segments. Instead, fintechs can lever this gap by lowering the cost base of accounts through innovative products and tech.

“So, if you look at lending, maybe it’s a small overdraft line that helps people out instead of having to offer a credit card or a revolving credit line with a significant amount of credit there,” Moller said.

“So modularity is also a key piece that fintechs are trying to bring into the product suite. The ‘one size fits all’ approach is also what has [brought] the miserable penetration of products and the miserable financial inclusion that exists in LatAm today.”

Luis Parra Brand Manager of Centsai

LendIt’s Todd Anderson invited Parra to discuss his stance on inclusion. Parra, who is not a fintech operator but a brand engagement director, said it’s not just product inclusion but about knowledge and education.

Centsai powers marketing and education to fintechs, Credit unions, and financial advisors in LatAm through a Software-as-a-Service platform.

“The way we believe we can take a step forward towards financial inclusion is by having financial education as a pillar in these situations,” he said.

Parra gave the example of his mother, a 60-year-old woman who trusts no one, fintech or bank alike, and keeps all her financials in cash only.

But, if the right educational product comes along and shows the safety and predictability of a product, she would change her mind and become in what Parra called a depth circle: her friends and family members.

“But we have put on a plan to achieve it. And it’s a really tight problem, not about just having access to financial institutions or access to education. There’s a socio-demographic, economic problem behind it,” Parra said.

“So that’s what I believe. At Centsai, we’re partnering with a lot of financial institutions to achieve this.”

Are ultra-valued Latam fintech Unicorns out of touch?

An anonymous user in the audience posed an interesting question that incorporated the idea that fintechs, while serving underbanked populations, might themselves become monuments to wealth inequality, given the recent valuations of some challenger banks, like the $50 billion Brazillian NuBank. Darashah conveyed the question to Rubio first.

How do CEOs and founders of fintech companies avoid being seen as out of touch by their users given that they are surrounded by wealth or surrounded by large numbers,” Darasha asked?

“[The paradox] between the valuations of the businesses and the association with wealth and wealth creation, and your end customer who is perhaps somebody at the other end of the prosperity line? The question is, how do you not be perceived as out of touch.”

Rubio said that might happen; fintechs are growing like weeds precisely because their market is underserved.

However, in the end, the use of technology to democratize financial services is valuable to all of society.

“It’s that after 150 years of banking, they have been servicing 20% of the population,” Rubio said.

“With technology, the challenge is how to serve the 80% of the population in the correct way and change the habit they have towards the way they handle their money. Numbers are showing that if you focus on it that way, you can reach exponential growth.”