From new platforms to institutional investors, there is no shortage of interest in the marketplace lending industry. However, we have yet to see such a survey conducted to gauge the true institutional investor interest until today. Richards Kibbe & Orbe along with Wharton FinTech shared today their 2015 Survey of U.S. Marketplace Lending.

We spoke to the co-authors Jahan Sharifi and Scott Budlong from RK & O as well as Steve Weiner from Wharton FinTech to learn more about the survey. They stated that the survey came about out of pure interest in the industry. They hope to help investment funds and investors get a better sense of the market. They believe the survey will help drive interest into the industry itself.

The survey outlined the growth of the industry with lenders issuing $5.5 billion of loans in 2014. They highlighted PwC’s projection that lending platforms could be issuing $150 billion or more annually within the next ten years.

They polled over 300 institutional investors with an approximate response rate of 30%. Almost half of the respondents polled work at funds with more than $500 million in assets under management, 10% had more than $10 billion and almost 40% had under $200 million. The survey aimed to to answer the following questions:

- How well do investment funds and other institutional investors actually know P2P/Marketplace lending?

- How interesting do they find the sector as an asset class?

- What do they perceive the industry’s current and future risk/reward characteristics to be?

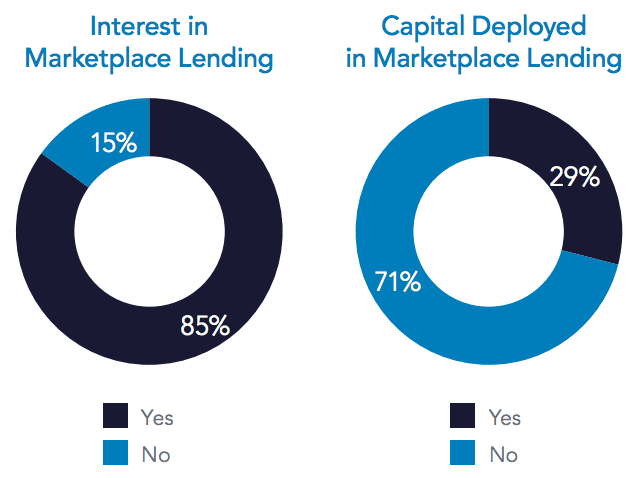

While the overall awareness of those polled was very high, only a small amount of individuals have actually deployed capital to marketplace lending. Only 29% of respondents indicated that they currently have capital allocated in marketplace lending, while 85% expressed interest in making some form of lending investment. This huge disparity between actual capital deployed and those who are interested was the main takeaway from the survey in my opinion. It bodes well for the continued growth of this industry.

One fascinating little anecdote about the above data points is that the survey discovered that while 75% of institutional investors are very or somewhat familiar with marketplace lending, 85% expressed an interest in making an investment in this sector. So even some investors who are not that familiar are looking at making an investment. Now, it’s important to keep in mind that although institutional investor awareness may be high, the overall awareness in the general public is still quite low.

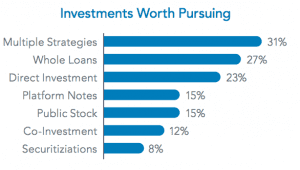

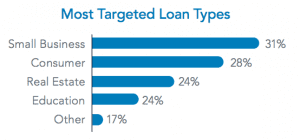

Of no surprise, a majority of polled investors were interested in pursuing a whole loan strategy. Securitizations fell to the bottom of the list as how the investors plan to access marketplace lending. Also of interest is small business loans being the most popular targeted loan types, followed closely by consumer loans.

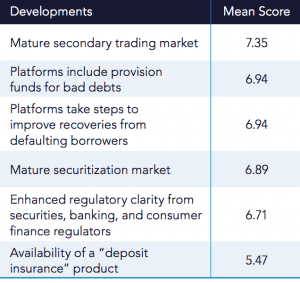

One of the most interesting pieces of information from respondents was when they were asked which developments would lessen their concern with investing in marketplace lending. A “1” indicated little to no lessening of concerns and a “10” indicated significant lessening of concerns. A mature secondary market came in at the top of the list followed by platforms including a provision fund for bad debts. These types of provision funds currently exist in the UK with platforms like Zopa and Ratesetter.

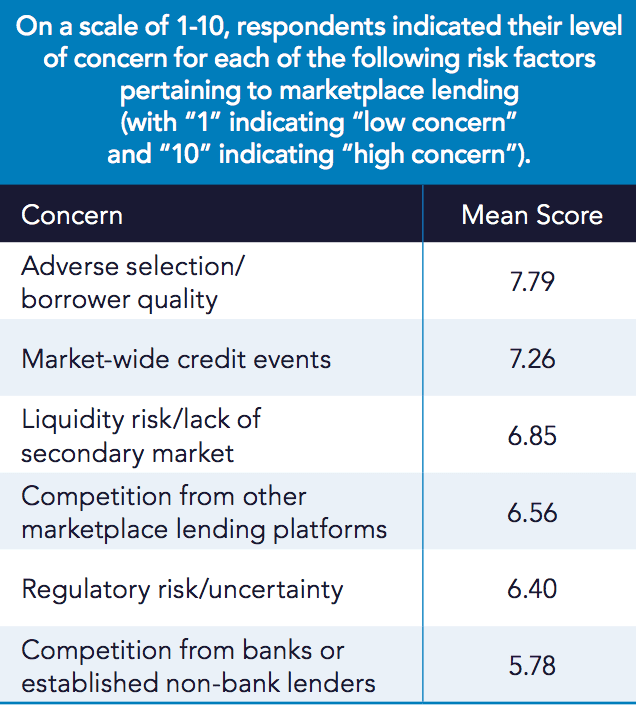

Respondents were also asked about the top risk factors pertaining to marketplace lending with “10” being of high concern. Adverse selection and borrower quality came in at the highest concern followed by a market-wide credit event, while competition from banks was the least of concern.

It’s clear that many investors are aware of this industry, but the survey pointed several areas for improvement as the industry continues to mature. Being the inaugural survey and the likelihood of a yearly survey, I look forward to the 2016 results as we are sure to see a different perspective of the industry.

View the Full Press Release