Venture Capital (VC) investment is essential to the startup ecosystem.

During 2021 VC investments in fintechs reached new highs, a 153% increase on the previous year before dripping towards the end of Q4. According to Pitchbook, 2022 is on track to maintain the upward trend.

Although all VC funds have their unique take on investment, Kindred has a different take reaching beyond the usual scope. Approaching the market with its “equitable venture” concept, the fund focuses on investing in founders and building a community that directly benefits from its operations.

“Being a founder is incredibly hard and challenging,” said Maria Palma, General Partner at Kindred, who focuses on Fintech and Web3 investment. “The founding partners set up Kindred because they felt like founders weren’t being served by venture capitalists the way they should be in Europe.”

“If you look today and look at operators, I think 60% of venture capitalists in the US are operators, and in Europe, the number is 8%. This doesn’t necessarily mean you’ll be a better investor or not, but I think it does give you empathy for the journey.”

‘The earlier, the better’

Kindred focuses on pre-seed and seed funding, in their terms specifying “the earlier, the better”. The fund is founder centric, meaning that investment is decided based on the founding team, regardless of whether they have a product or operations team.

“We’re very team-centric and like backing the right founders in the right markets,” said Palma. “The whole point is just to care about the founder experience throughout.”

“We pay for coaching for founders for the first year that they’re involved, and if they want, we help them connect to other founders as their company scales. Instead of just helping them recruit, we actually invest in their teams.”

“We’ve found people at the earliest ages; they’re really stages where building a product is not a requirement. There isn’t as much risk difference from a risk-adjusted reward perspective as you would think between pre-seed and seed. The difference between the two is that you’ve built a little bit of product, you’ve hired a few people, and you get a 5x valuation for that.”

“The truth is, have you discernibly proven out the risk of the model? Probably not. If you didn’t back a team that could credibly do that in the first place, you backed the wrong team.”

The partners get to know founders through multiple meetings while carrying out market diligence in the background.

Focused more on the founders’ knowledge of the market and the problem they hope to address, partners workshop with the applying startup’s founding team. Through this approach, they assess the founders’ take on the business and their problem-solving process.

“The market diligence can change a lot,” said Palma. “We follow a typical diligence process, but there’s absolutely no requirement for what you have to build.”

“If you’re the person I want to back after this process, we don’t need to see a deck or an MVP. We know you’ll build that if you have the right founding team.”

Large future investment into fintechs likely

Although Kindred invests in various sectors, fintechs make up a proportion, set to increase in the future with Palma’s focus on the area. “I spend 80% of my time in fintech, Crypto, and Web3,” she said. “We currently back seven fintechs, but it will probably grow over time because I spend a lot of time in that space.” Their first fintech, Paddle, recently reached unicorn status.

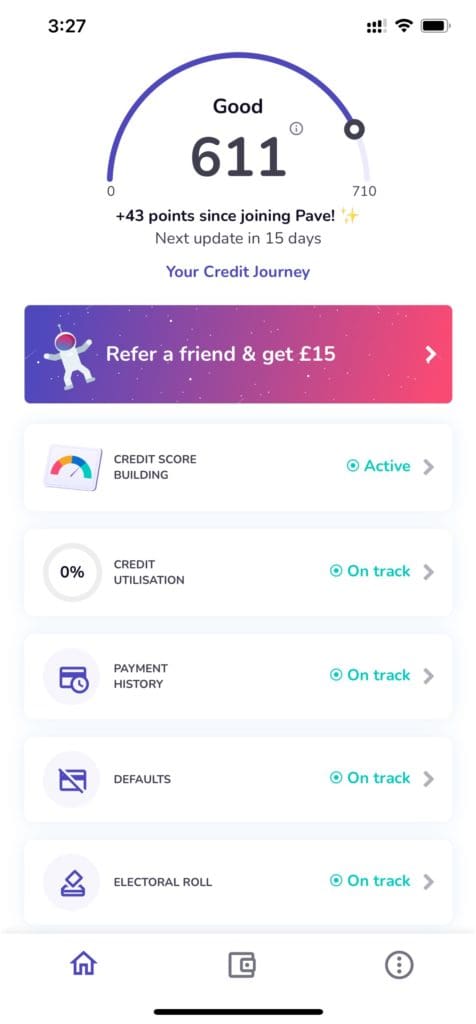

Another fintech that has received Kindred investment is Pave, a company focused on building credit scores. Although initially working in the B2C space, the company recently released Fuse, aimed at the B2B market.

“As we’ve all been seeing, there’s quite a big macro-economic shock that I think we’re starting to go through, which means heightened income volatility, and access to credit challenges,” said Sho Sugihara, CEO, and Co-Founder of Pave.

“There are also challenges for businesses to assess customer credit profiles in this climate. In traditional credit, scoring is done looking at past behavior, and the future is increasingly unpredictable.”

“Our open banking analytics enable that future kind of predictive analytics on what the consumers’ cash flow and credit profile will evolve to look like. It’s based on income and expenditure assessment, and then giving quite bespoke indicators that you can feed into your scorecards to model for credit risk and more of a predictive way.”

Kindred started its relationship with Pave in 2018, becoming its primary investor. “We went for dinner with one of the partners, and there wasn’t a single question about the business,” said Sugihara. “It was all about us as founders, why we were building the business, why we cared about it, and why was it so important to us to do this.”

“Within a week, we met all of the partners and then received their offer a week later.”

Although they had received a few offers, Sugihara said that Kindred’s personal approach, combined with the partners’ efficient and thorough due diligence to reach a decision, attracted him and his co-founder to accept their offer.

Kindred continued to be heavily involved as Pave grew, leading to the company’s expansion into the B2B space earlier this year. “They were thought partners throughout,” said Sugihara. “They provided that sounding board to brainstorm both from a market size perspective to go to market to expansion, velocity, potential, and dependability. Helping us assess the best approach we could take to scale Pave.”

Kindred hired Palma to lead their fintech investments, and there will likely be further investment in the space in the future.

“Maria brought incredible expertise in fintech to the fund,” said Sugihara. “She’s now my go-to person for fintech trends. I think that she brought a tonne to the fund as well. When it comes to content specific network and knowledge.”

Equitable venture results in equal gains

In addition to the application process’s founder-centric approach, the fund also takes successful applicants on as equal partners.

“Founders are at the heart of everything we do,” continued Palma. “It started by sharing. Each general partner has the same carry share. We take a proportion of that carry, which is 20%, and we share that with the community.”

“On acceptance, founders become a part of the fund. They share in the upside of all the companies in the fund they are a part of, not just the company that they are building. It creates a sense of community and helping one another.”

Sugihara said, “I think it creates a stronger sense of support, which is where it’s most valuable. Kindred sets up “forums” where founders of the fund meet and socialize.”

“I don’t think everyone is doing startups for cash outcomes. It’s much more about the people you meet on the way, who you connect to, and who you share your highlights and lowlights with and make friends with. I think they’re very good at doing that and creating a sense of proximity or closeness within, within the founders within the portfolio.”

Aside from the community aspect, the equitable venture model adds security for the founders. Gains from the fund continue despite the failure of the startup.

“Founders appreciate that we’ve done something completely different,” Palma concluded. “The promise of continuing support despite the failure of a startup shows that we understand. It creates a different community.”