Another month is in the books and it was more of the same from the two leading p2p lenders, Lending Club and Prosper. Combined they issued a total of $185.6 million in new loans in June up from $173.1 million in May. They are now on an annual pace of $2.2 billion in new loans, numbers that would have been unthinkable just 12 months ago. Keep in mind that both companies combined for just $871 million in new loans last year. The growth in 2013 has been amazing.

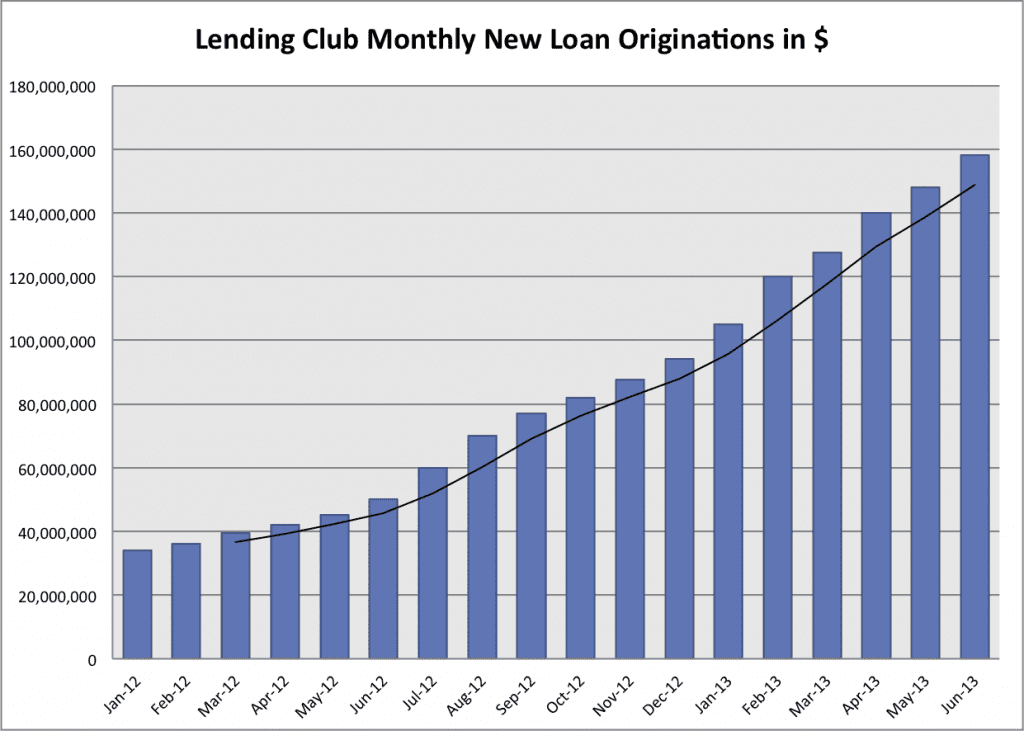

Lending Club Issues $158 Million in New Loans In June

June was another solid month for Lending Club. As Scott Sanborn, Chief Operating Officer, said on the p2p lending panel at LendIt last week Lending Club is committed to maintaining controlled growth. They have a huge amount of investor demand right now and they could probably put several hundred million dollars to work immediately if they wanted but that would cause stress on many areas of the business. So, they are maintaining this 6-10% monthly growth rate that seems to be working well for them.

Digging into the numbers a little we see that Lending Club issued 10,899 loans for an average loan size of $14,503. Last year in June Lending Club issued $50 million in new loans so they have more than tripled their loan volume in the last 12 months.

While investors are still gobbling up loans quickly at Lending Club, this month loan inventory was much better than in previous months. For a lot of the month investors had more than 500 loans to choose from at any one time and I even noticed today at one point there was over 700 loans available. It is becoming a little easier for investors to put their money to work.

The other change this month at Lending Club was an interest rate and expected default rate adjustment. Interest rates on some of the lower risk loans went down and the higher risk loans went up and it looks like expected default rates increased across the board. I will have more on expected default rates in a post next month.

Below is Lending Club’s 18-month chart. The black line in the three month moving average.

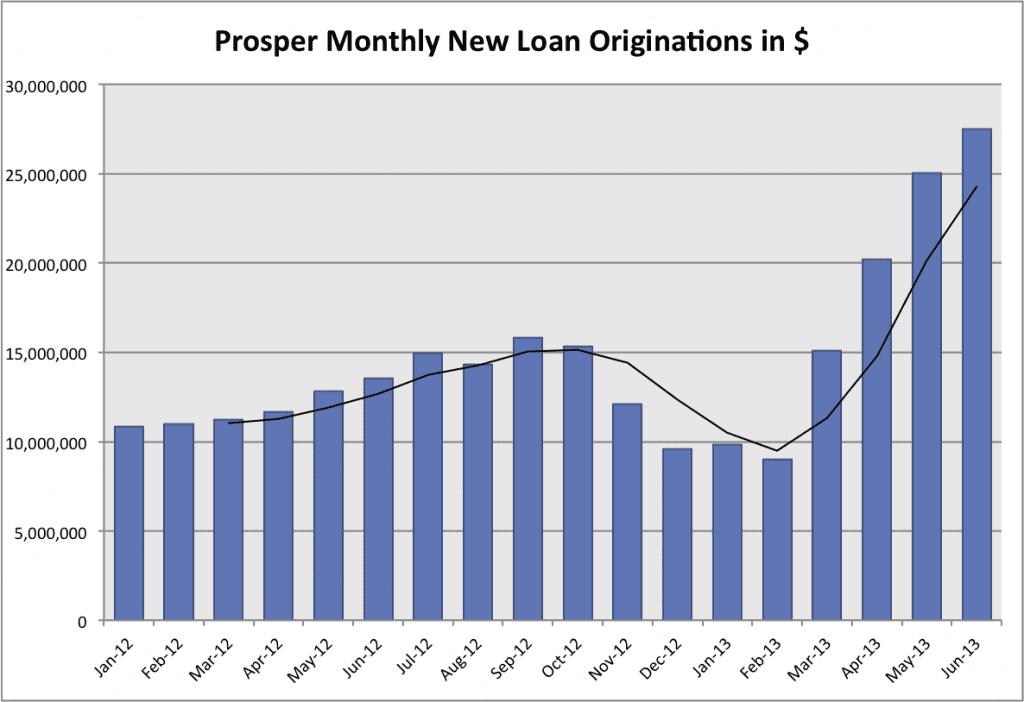

Prosper Issues $27.5 Million in New Loans, Up 10% From May

Prosper kept on their upward trend that began in March albeit at a slightly slower rate. After three months of $5 million monthly increases in loan volume in June volume increased $2.5 million to $27.5 million. What many people don’t realize, though, is what an impressive achievement that growth really was.

Earlier in the month I was chatting with Aaron Vermut, President of Prosper, as he shared some technical problems they were having that were detailed here. At the time he lamented the fact that this could mean far fewer originations than planned for in June. For more than a week Prosper’s verification team had to operate with a manual system due to issues with their third party CRM software. But they resolved the problems and as Aaron said in an email to me this afternoon, there was “lots of teamwork involved in meeting that June number.”

With this increased growth loans on Prosper are not staying around nearly as long as before. And their loan inventory has suffered particularly in the last few days. But from my perspective I have still managed to put more money to work at Prosper this month than in any month this year. And I expect we will see loan inventory build up in coming days.

Below is Prosper’s 18-month chart with their hockey stick shaped three month moving average.