OpenSea.io raised $300m in their series C, launching two co-founders into the new, soon-to-be populated realm of NFT billionaires.

The firm is valued above $13 billion and has inspired more firms to sell the new digital commodities.

In response, Coinbase is creating competition after Opensea.io made $10 billion in a couple of months last fall alone. And just last week, GameStop announced it planned on building an NFT wing, sending the meme stock price up 17% in an instant, then dropping 26%.

Meanwhile, Matt Damon is on TV daring American football fans to be brave by betting on bitcoin on Crypto.com. He joins Tom Brady, Melania Trump, and Snoop Dogg in recent NFT or crypto business ventures to tap into the online ownership market.

While the marketing makes it seem like consumers everywhere are planning to buy virtual ferry tickets to the metaverse or vote in the new web3 reality, some are worried about the cost a new electronic age will have on the physical world.

A better way to cool

In response, meet Islands of Cool, a blockchain-based carbon removal project out of New Zealand that wants to make carbon offsets cool. Leanne Bats co-founded the project about two years ago, after the birth of her son.

“I’m not a greeny; I’m not a hippie. I’m not anything special in this space, but I’m just like everyone else, and I felt especially once I had a child that I had to do something,” Bats said. “I think it coupled with too little sleep, this burning desire to do something about the future because all of a sudden it became more important.”

After offering a carbon offset subscription to offset the electricity used on personal Instagram accounts, the startup launched a new idea: Combine the popularity of NFT online ownership with real-world results.

Islands of Cool teamed up with a local artist T Wei to offer NFTs directly tied to purchasing carbon offsets. Bats said she knows crypto and environmentalism are two divisive topics in one. Still, she hopes combining the two will push carbon capture from an expensive, early technology into a developed regular part of investing.

“You know this is all around reimagining or trying to reimagine climate action effectively, right?” Bats said.

Going green has to be cool

How did she go from down the rabbit hole watching documentaries about saving the world to launching an NFT carbon-neutral fundraising campaign?

She became increasingly worried about the future of the planet, and she ran into trouble. Bats said she sold her car, got a worm compost farm, and tried to go as green as she could on her own, but found that there is little one person can do in the bigger picture.

Living in a mature country like New Zealand — even if you recycle everything and reuse everything — each person takes part in hundreds of tons of carbon waste, from sources as simple as tarmac roads.

Bats said she wanted to contribute differently. Even when the world shut down during the first year of the pandemic and nearly everyone was inside for months, global emissions only dropped by about 7%.

The problem she found was that the common mantra of contemporary environmentalism was “it’s your fault.”

Going green has been branded by larger corporations as the average person’s fault, not a systemic issue.

One for all?

“When you start to study the space, you understand that it’s kind of true that your own individual footprint is not the answer; it’s the most inefficient way to put people to work,” Bats said.

“That got me thinking, ‘OK, ‘where can individuals have an impact?’ And that’s really this carbon removal space because there are two jobs: There’s turning off the footprint in emissions, and then the other removing what we’ve already put out there.”

She had a clear picture of a solution: encouraging personal recycling and sustainability while investing in tech that may hold the promise in reversing damage already done to the atmosphere.

Trusting the system, Bats believes if enough investment goes toward eco-friendly activity, one day it will be so cheap to help protect the environment that it will be an automatic expense on a firm’s accounting sheet.

The next step: she said she had to find a way to make cooling the planet, well, cool.

“But if you have a conversation with someone these days when you start talking about climate action, their eyes tend to glaze over, and they’re sort of like oh, here we go,” Bats said. “You know, no one’s making it super engaging and fun and not giving people back something for their action.”

Despite not growing up a “greenie,” she had the skills for the job.

Drawing from her background as a digital media expert working with brands like Johnson and Johnson, FC Barcelona, and now as a Web3 consultant for New Zealand Rugby’s All Blacks team, she wanted to build a brand around investing in carbon capture in a cool way.

The startup first launched Cool Points Club, offering a subscription service to offset social media energy.

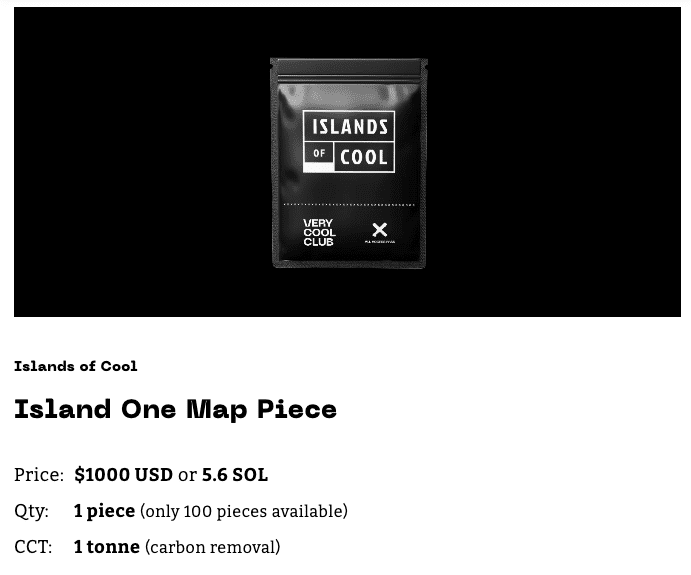

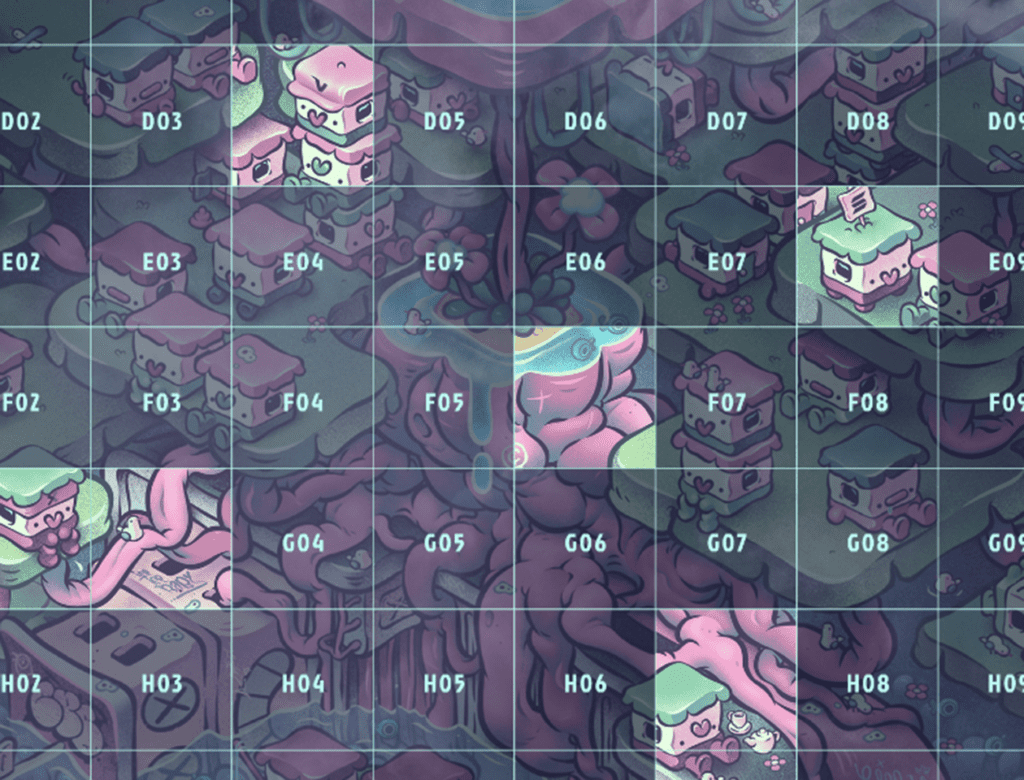

But, capitalizing on the NFT explosion this past fall, Bats and her team launched Islands of Cool in December, selling 100 sections of a picture of an island, each share for $1,000 Bats said.

“We sell each one of these pieces at the moment for ‘Island One’ at 1,000 US dollars. The carbon capture that we’re using is all called Biochar,” Bats said.

Islands of Cool partners with firms around the world to purchase carbon removal credits, like Norway-based ARE Treindustrier, and US-based Tradewater.

The project has already sold 40% of the first spots on the island, and Bats has spots set aside for industry giants like Visa.

After Visa purchased a crypto punk for $150,000 last year, Bats wants the firm to pick up a Cool NFT for $150,001, getting a place on the island and carbon removal credits at the same time.

Twenty percent of the proceeds on each sale go directly to partner firms worldwide that capture carbon. The rest goes toward the roadmap and the artist, and if owners decide to resell the NFTs as an investment product, each new sale contributes toward buying carbon offsets.

The ultimate goal is to one-day offer points programs that enable large firms like Visa to implement a portion of every transaction toward directly funding carbon removal.

Crypto needs cool ideas

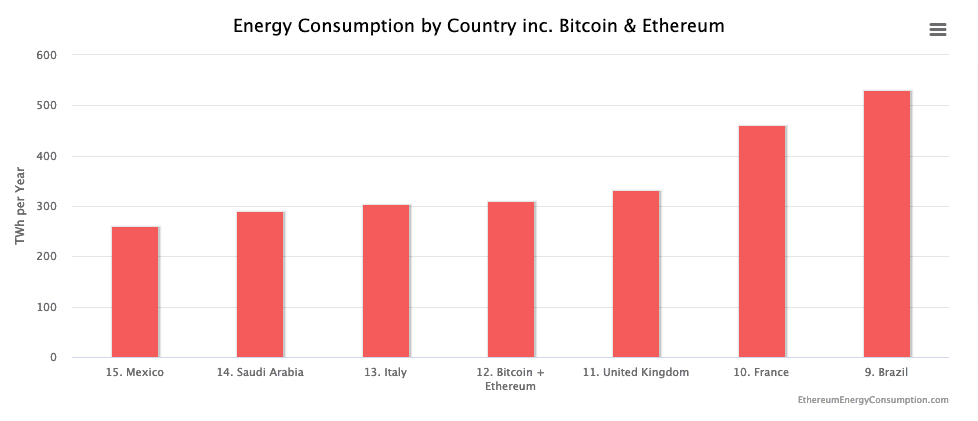

The idea to make web3 more energy efficient is not an old one after news stories rang out that the popular cryptocurrencies Ethereum and Bitcoin use a ton of electricity to approve transactions and mine new coins. By some estimates, the explosion of Ethereum transactions, like NFTs minted on the blockchain, has been very costly in terms of electricity.

Though the two most popular blockchains have no centralized network of costs, estimates on mining and transactions put the digital currencies using as much electricity a year as countries like Hungary and Thailand.

For example, through estimates from peer-reviewed studies, shown through graphics on digiconomist.com, one transaction on the Ethereum blockchain uses 238.22 kWh, the same as running an average U.S. household for more than eight days.

Bitcoin is worse, using enough energy to run a house for 77 days. Compared to Visa transactions, one bitcoin transaction uses an amount of energy equivalent to 1,075.84 kg of CO2 or 2.38 million Visa transactions.

Bats said, favorites for the promise of decentralization and the future of commerce, these crypto giants were seemingly not designed to run at the scale they find themselves.

For example, Bitcoin and Ethereum together use more energy than Italy, and just a little less than the U.K.

The blockchain is always greener

For web3 and crypto to take over where traditional finance has failed, there has to be a better model of confirming transactions that use far less waste.

That’s why Bats said Islands of Cool chose the Solana blockchain to host its NFTs. Solana was built on the premise that blockchain transactions don’t need to be so energy-intensive (or expensive.)

So in a report at the end of 2021, Solana worked with climate advisor Robert Murphy to find out the energy cost of the transactions on the network.

“And of course, when you start looking at NFTs, one of the other big players is Solana, so we’re based on the Solana blockchain,” Bats said. “Because it’s so, so much more energy efficient. It’s about 99.9% more energy efficient.”

Unlike Eth and Bitcoin, Solana found a single transaction to ‘cost’ less than two Google searches, at 1,837J of energy. Compared to on eth transaction, Solana uses about 1/68th of the power.

“Us as a CoolPoints company, we make sure we offset or remove everything that we do as well as a company,” Bats said. “Even our emails, every time we send anywhere, we make sure the grams [of carbon] are measured and removed because we started that way, because we’ve got to, this is how it should be.”

It’s not just crypto that needs to go sustainable

If things are going to change, shouldn’t crypto lead the way? The energy waste of blockchain is nothing compared to the traditional market, where the estimated investment by 20 industrial nations in fossil fuels by funds, bonds, corporate interest, and stocks combined puts a whopping $22 trillion total invested in environmentally damaging products.

According to Moody Investors Service, the most mature countries globally have 20% of their combined loans and investments in fossil fuels: it isn’t just a problem of damaging the environment.

As consumers and industry begin demanding environmentally sound investing options, Bats said it would soon become imperative to include sustainability in every fund.

In 2018 through 2020 alone, US-based sustainability exploded in value, up to a three-year total of $17 trillion.

In 2020, 33% of the $51.4 trillion in total U.S. assets went toward sustainable options, according to the Forum for Sustainable and Responsible Investment’s 2020 trends report.

In 2021, fund managers like BlackRock Chairman Larry Fink took notice, announcing a dramatic shift toward sustainability. Going green can be good for business as long as there are options for investors.

It only makes sense to build new sustainability options. Bats hopes to one day offer an entire carbon-negative fund, invested in a cross-section of carbon removal projects like an ETF would support in a collection of tech stocks.

Why Islands of Cool chose Biochar

Bats said that leaders in the tech space like Microsoft, Stripe, and Shopify have already dedicated millions toward carbon capture tech through portfolios of emission-reducing companies the world over.

Other web3 supports are building eco-friendly investing options too, like the popular Klima DAO that went live last year.

The most eco-conscious of the tech giants are contributing to a cross-section of carbon removal, but Bats said Islands of Cool is right now focused on one: Biochar.

The term is a lofty one, described by the USDA as an attempt to transform plant refuse like woodchips and leftovers from farming into “Black Carbon” by chemically reducing residual products into carbon-containing material.

In the case of Islands of Cool, the firm will invest the proceeds of the first island directly in companies that turn harvest leftovers into charcoal and capture excess gas. Like ash left over after a fire, that carbon is used in fertilizer and buried back in the earth.

It may sound like carbon capture by way of just burning plants, but according to the U.S. Biochar Initiative, the use of Biochar to recycle plant waste can be traced back thousands of years.

Discovered in the 1950s by a Dutch Soil scientist, the original indigenous peoples of the Amazon rainforest cultivated the world’s largest jungle through charcoal recycling.

Black earth, or Terra Preta, has been used to revamp farms in the Amazon Basin for more than 2,500 years. In modern efforts, producing charcoal can leave behind gas that can be used as a sustainable fuel source all its own.

Even using the byproduct of making charcoal as an energy source is an old idea. In Europe in the 1940s, the wartime shortage of petrol led car manufacturers to use wood boilers to run cars — engines would cook wood into charcoal and capture the gas to propel the machines.

There were more than 550,000 transformed cars and trucks in Germany and France alone.

For these reasons and more, Islands of Cool chose Biochar, one of many sustainability options highlighted by the non-profit CarbonPlan that Bats said is like her guidebook toward sustainability.

CarbonPlan lays out the many options major firms like Microsoft and Shopify use with the aim of sustainability.

Why use blockchain in the first place?

“First of all, we decided on going to integrate blockchain is because we wanted it to be collectible,” Bats said. “But we also needed a way to verify our carbon. How can someone trust us when we say that like yes, you can believe us. We wanted to show people and make sure that you know that was actually as transparent as possible.”

Now, each Island of Cool NFT is directly linked to a wallet that holds carbon removal tokens. There is a balance that anyone can see on the site that shows the amount of NFTs sold and the corresponding tokens.

The contract is written so that there is no way to print tokens without purchasing an NFT, Bats said.

What’s next from the Island of Cool

After January and the sale of all of Island One, Bats said the roadmap is filled with events and she could only talk about a few.

Coming this year, Island of Cool will launch Island Two, alongside a profile picture NFT collection called Inhabitants of Cool, like the world-famous Bored Ape Yacht Club pics.

All the while, proceeds will go directly toward carbon removal; Bats calls the NFTs “carbon sponges.”

“So as these things are bought, sold, and traded, they did pull down more carbon, and if you look at the likes of you know some of the really popular [projects] which we have dreams of emulating: board apes itself have traded over a billion dollars since April,” Bats said.

“Which is ridiculous, but even a portion of that going towards carbon removal would be the biggest fund ever to remove carbon.”