I signed up to the SoFi Money waiting list soon after they opened it back in June of last year. I learned earlier this month that I was now off the list and ready to open an account. So I did (you can get started with $50 by opening an account through this affiliate link).

I have had a relationship with a top 10 bank for more than 26 years. Actually, that is not completely accurate. This large bank bought the mid-sized regional bank, where I had opened an account in 1993, about 20 years ago and hence I became a customer by default. They provide an adequate experience but nothing differentiates their offerings from the other large banks. If it was easy to switch banks I would have done so years ago, so they have maintained my business not out of loyalty but out of inertia. I know I am not alone in this.

Anyway, back to SoFi Money. It is not truly a SoFi bank account because SoFi is not a bank. They are able to offer bank-like services because of a partnership they have with WSFS Bank, a Delaware based bank with a history dating back to 1832. SoFi and WSFS Bank first announced their partnership in December 2017.

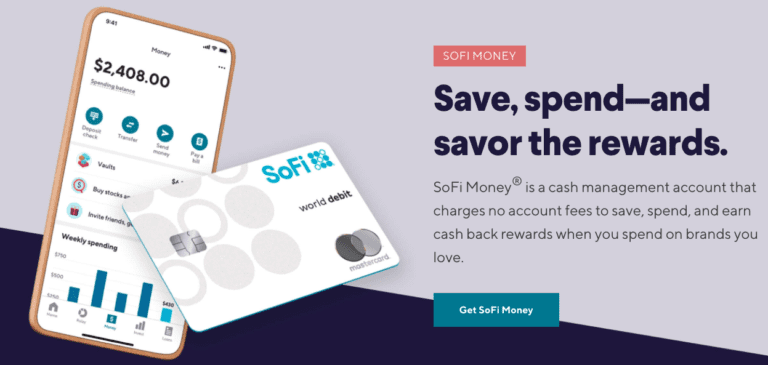

There are three main benefits that SoFi touts with the SoFi Money account:

- Pay zero account fees.

- Earn more interest.

- Free ATMs everywhere.

What appealed to me most was the interest. SoFi will pay (as of this writing) 2.25% on balances held in a SoFi Money account. Note about the small print: you will only earn this 2.25% for the first three months and then the interest rate drops to a (still respectable) 1.25% unless you do one of two things. Either setup a salary direct deposit of $3,000 or more a month or do $500 in debit card transactions each month. I am in the process of moving my salary deposit to my SoFi Money account.

I typically average more than $10,000 in my checking account and so it will be nice to earn a little interest on that money. Also, a few years ago my current bank tried to charge me $7 a month for the privilege of having a checking account with them. When I called to complain they agreed to credit my account but I still see the charge and corresponding credit each month and that irks me. Oh, and it pays exactly 0% interest.

One interesting piece I noticed when reading the SoFi Money fine print is around FDIC insurance. SoFi has partnerships with six banks thereby providing up to $1,500,000 of insurance for each SoFi money account:

The cash balance in SoFi Money Accounts is swept to one or more program banks where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC Insurance is not provided until the funds arrive at partner bank. There are currently six banks available to accept these deposits, making customers eligible for up to $1,500,000 of FDIC insurance (six banks, $250,000 per bank).

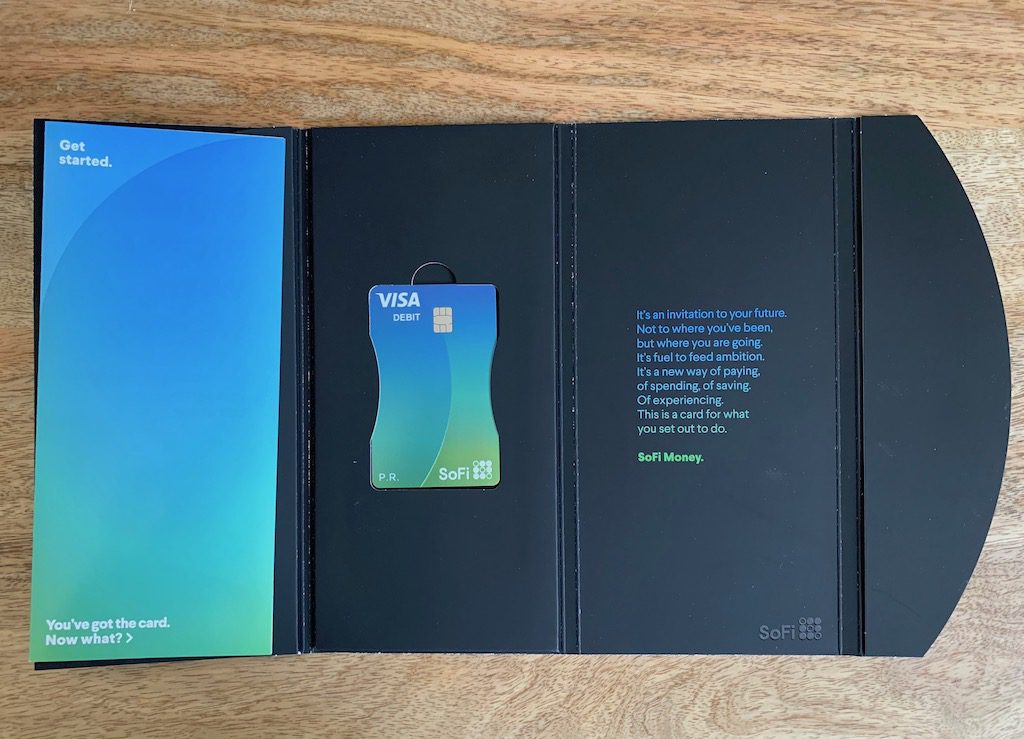

I received my SoFi Money Visa debit card in the mail a few days ago and they have clearly gone for the high end experience here. They did not send the card in a regular #10 envelope like the typical bank does, instead it was sent in a thin black cardboard box inside some kind of durable plastic envelope. Once you open the box you remove a folded black cardboard package with the debit card inside. You can see the picture above. The packaging is vaguely reminiscent of something that Apple would do if they ever sent you a debit card.

I only activated my debit card a week ago and I have had just one ATM transaction. But so far I like the look and feel of the app and I intend to use this as my primary bank account going forward.

If you are looking for a new kind of bank account you have many options today beyond SoFi. Companies like Varo, Chime, Moven, MoneyLion, Stash and Aspiration all offer digital bank-like checking accounts. Of course, there is also Finn by Chase that launched last year and Ally, Simple and Capital One 360 that have been around for a while. This year will also likely see the entry of the European digital banks in to the market here as Revolut, N26 and Monzo have all indicated their intention to launch in the US.

I think the days of the plain vanilla checking accounts are numbered. When I read that companies like Chime have more than 2 million online checking accounts and are adding more new customers than Wells Fargo it confirms my view. We are just at the beginning of this wave but in the near future if a bank wants to attract new customers they are going to need to eliminate most fees and pay interest on checking account balances. This is good news for consumers.