Today, Intuit announced the launch of a new business bank account they are calling Quickbooks Cash. This is a groundbreaking product for small businesses that use Quickbooks as their accounting tool as it offers some unique integration benefits.

Here are the details of the new Quickbooks Cash bank account:

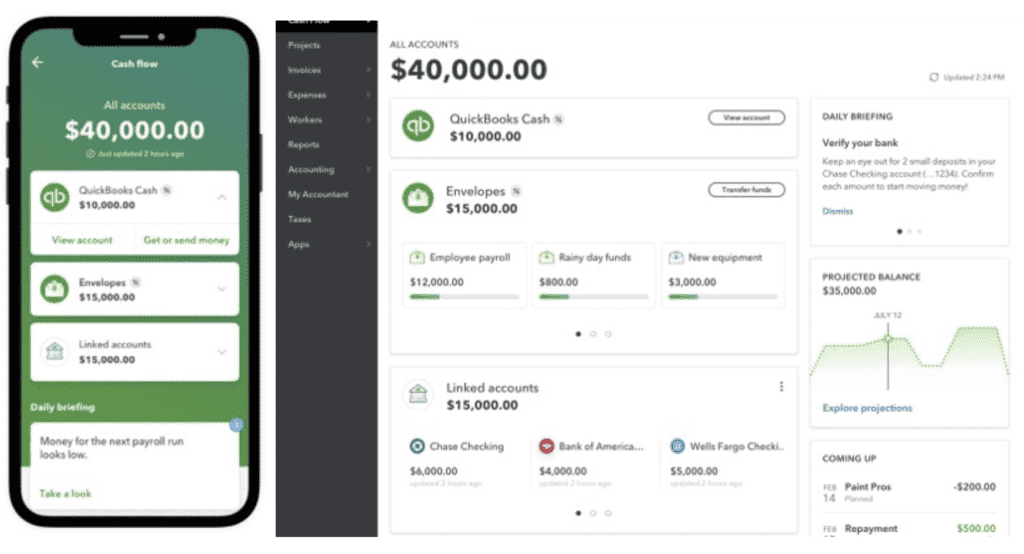

- QuickBooks Cash: A business bank account that is free to open, has no minimum opening deposit or daily balance requirements and no monthly service fees.

- QuickBooks Debit Card: A physical debit card that enables a small business to spend instantly from its QuickBooks Cash balance.

- Envelopes: Envelopes allow business owners to set aside money for specific planned or unexpected expenditures, helping ensure that their future spend is not accidentally used.

- High-Yield Interest Rate: Rate of 1% paid on all balances.

- Free Instant Deposit: Deposits processed through QuickBooks Payments are available instantly even on nights and weekends.

- Cash Flow Planner: Powered by machine learning, the Cash Flow Planner within QuickBooks Cash provides a full view of a business’s finances via a dashboard.

- Bill Pay: Small businesses can schedule vendor payments and manage all their money-out transactions in one place.

- Seamless QuickBooks Integrations: QuickBooks Cash seamlessly integrates across the QuickBooks Online platform.

I caught up with Rania Succar, SVP and Business Leader, QuickBooks Payments and Capital and Rob Daniel, Head of Product for QuickBooks Cash earlier this week to discuss the news. The first thing they said was that Quickbooks is in the best position to really help small business solve their cash flow challenges. And that is what this new bank account is all about. Small businesses need a unified tool that brings in all the financial functions of the business: Payments, Capital (lending), Payroll and Bill Pay.

From the press release:

QuickBooks Cash was created to solve an unmet need for small businesses — a way to holistically manage finances in one place, allowing businesses to get their money fast, manage finances and leverage the built-in accounting for money in and out powered by QuickBooks.

Rania emphasized that it is the strength of the ecosystem that makes this such a compelling offering for small business. Quickbooks is the #1 payroll provider in the country and Quickbooks is the #1 accounting software with 4.5 million Quickbooks Online customers and another 2.5 million running a desktop version of Quickbooks. There is no separate Quickbooks Cash mobile app, it is all run from the main QB Mobile app available for iOS, Android and, of course, on the web.

They provided the example of a small business that receives a $5,000 invoice paid through Quickbooks Payments. Because this is integrated with the Quickbooks Cash back account the money is available instantly. With a traditional bank you might wait as long as five days for that check to clear.

Quickbooks Cash has been in development for over a year and they have been beta testing for the past six months. They are partnering with Green Dot Bank on the bank account which means that there is $250,000 of FDIC protection on every account. Today, Quickbooks Cash is only available to Quickbooks Online customers but they realize down the road there is a big opportunity to move outside their customer base.

My Take

The small business digital banking offerings are heating up but there is no question that Quickbooks Cash is a compelling offering. It was just last week that Kabbage announced their new small business bank account. But as Rania and Rob were quick to point out Quickbooks Cash is available today, there is no waiting list.

Quickbooks wants to become the “operating system for small business” as they put it and a bank account is certainly key in fulfilling that vision as they have most of the other pieces in place now. They have an established foothold in the other pieces of the operating system.

It is going to be fascinating to see how this space develops. Quickbooks certainly has an advantage with 4.5 million customers who interface with their brand on a regular basis. It is not easy to get people to switch bank accounts which is why the feature set is so rich, companies need to see the pain of the transition as worth it. But for new small business launching today it is extremely compelling offering.

The innovations in small business banking bodes well for small business owners who will now be able to get a much better picture of the overall health of their business. As we start to recover from the pandemic it will be a good time to be a small business owner.