Since Christie’s first NFT auction at the beginning of 2021 with Beeple’s Everydays: The first 5,000 Days, the global hype surrounding the NFT market has exploded.

According to the Art Basel Global Art Market Mid-Year Review of 2021, 48% of High Net Worth (HNW) collectors were interested in buying digital artworks over the next 12 months, including 52% of the Gen X collectors surveyed.

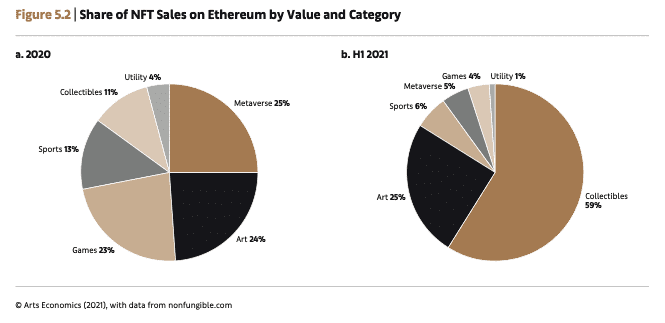

The value of investment into the NFT art market has also increased significantly, jumping from $31 Million to $755 Million.

During 2020 and the beginning of 2021, Covid-19 posed a potentially catastrophic threat to the art market.

Well-established art institutions such as the Tate welcomed less than 10% of their usual visitor traffic during 2020/2021 due to Covid 19 restrictions.

In the case of the Tate, this meant a fall from 8,264,000 visitors across its four galleries to 591,000. Closures also hit smaller galleries and art fairs. In the UK, the share of local galleries collectors dropped from 70% to 54%.

Figures like this are problematic to the art industry as most sales are conducted via gallery and art fair visits.

Art made for the people, by the people”

NFTs: the financial potential of a democratized art world

Optimism returns

In general, the players within the art market are optimistic for the future. Exposure to art sales via online methods seems to have boosted public interest, with 38% of artwork sales generated from new online sources. According to the data, art collection also seems more valued in later generations of collectors, the Art Basel report stating that 35% of millennial collectors had more than 30% of their wealth held in art, 10% more than their Gen X peers and more than double the level of Boomers.”

It seems that the Art Market has embraced the new medium of NFTs, with major auction houses offering regular NFT auctions and galleries minting their own.

For example, Saatchi Art released an NFT project, The Other Avatars, in January 2022. The British Museum has their La Collection (a series of art auctions selling NFTs of classical paintings), and Christie’s has their Christie’s Encrypted auctions. All of which showed promising sales, with Saatchi’s offering selling out in 20 minutes.

For many, NFTs and virtual exhibitions are the answer to boosting the art market. Heralded as the key to the democratization of the art industry, many see NFTs as the monetization of artwork that can be brought into the hands of the artists themselves. However, there is also a large amount of skepticism.

Critics are making the point that the NFT market is more about the theoretical value rather than the artwork itself and that it is “merely a bubble waiting to pop.”

The rationale is based partly on past collectible crazes, such as the Dutch Tulip Craze of 1637-1638, The Andy Warhol Cookie Jar craze of the ’80s, and The Beanie Baby craze of the 90s. All in their time involved the collection of objects, many to resell at a higher price. However, left too late, and these collectibles were rendered worthless.

Artists disregarded

There is also concern that artists behind NFTs are disregarded, with the bulk of income going to platforms and entities that sell them. During the second half of 2021, the most popular NFT selling platform OpenSea recorded a 786% increase in value to $13.3 billion in January 2022.

The platform offers artists “creator earnings” of up to 10% for secondary sales for the artists but takes 2.5% of every sale transacted. This is in addition to fees incurred when carrying out several operations such as listing the first NFT, accepting an offer, and gifting an NFT to another user.

Other than OpenSea, people create smaller platforms focusing on the fine art market, offering terms for artists that mirror traditional art sales. Saatchi Art, for example, offers artists their standard 65% earnings (the same as their conventional art sales) and royalties for secondary sales.

In response to this issue, artists themselves are setting up marketplaces. The Redkite NFT marketplace, founded in late 2021 by a team of art industry experts and contemporary artists such as Ben Eine, focuses on maximizing the earning potential of NFTs for artists.

Offering two types of NFTs, standard and asset-backed (where the NFT tokenizes a physical artwork), artists and collectors are offered a variety of royalties associated with their NFT.

Traditional NFT sales provide a 70% commission for artists with 5% royalties from secondary sales. At the same time, asset-backed NFTs also offer royalties for rental the physical artwork to galleries and the prospect of increased earning potential if a famous collector buys the physical artwork.

Democratizing access to art

These marketplaces encourage the general public to engage with contemporary art and emerging artists. Redkite, in particular, sees NFTs as “Allowing artwork that previously could be owned only by those who could afford the entire work to be owned fractionally by many people. Not only does this provide access to more people, but it also allows collectors to easily diversify their holdings of different artworks and artists, without investing a fortune.” as stated in the whitepaper document for the platform.

With this in mind, the growth of the NFT art market is potentially exponential, relying not only on HNWs as a source of sales but also on the millions of art enthusiasts that visit galleries every year.