On Monday, Lending Club explained to retail investors how they could participate in their upcoming IPO. They did not choose Loyal3 as many people expected, but instead their shares will be available through Fidelity.

I admit I have not been following this closely this week. I have been in London for the LendIt Europe conference and have been very much pre-occupied with that. Anyway, Ryan over at Peer & Social Lending has an excellent write up of how to register for the IPO – you can read all the details there.

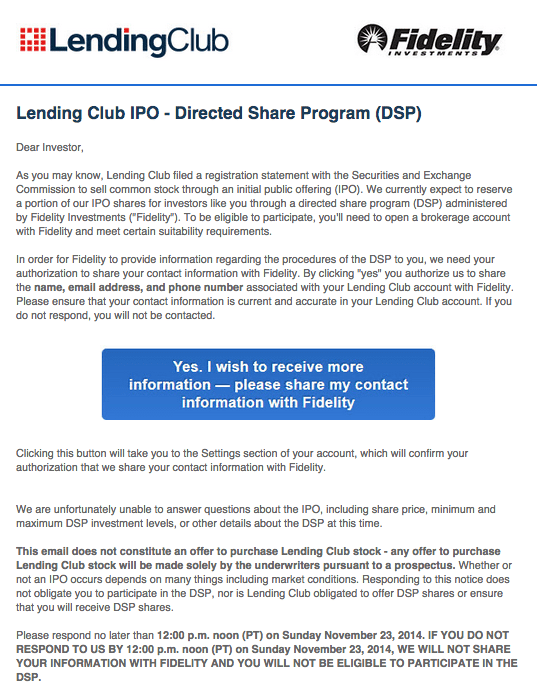

There is a deadline to register – it is 12 noon PT this Sunday, November 23. So, I wanted to let you know as soon as I could. Below is a graphic of the email that was sent out by Lending Club on Monday that has more information.

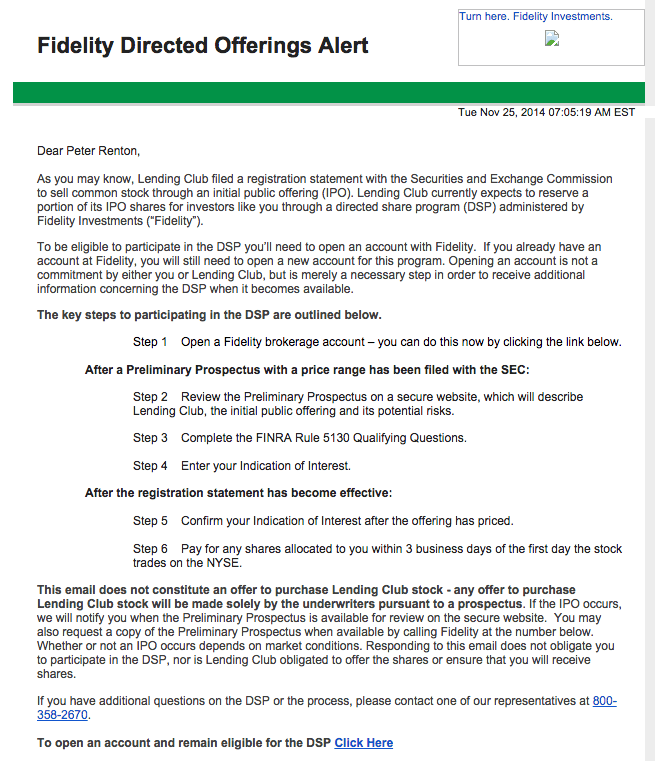

[Update Nov 25, 2014: I just received the following email today from Fidelity with steps needed to participate in the Lending Club IPO Directed Share Program. You will only receive this email if you had followed the steps above by last Sunday.]

[Update Dec 1, 2014: Lending Club released a new S-1 with more details about the IPO.]