I always talk about the importance of diversification and that investors need at least $2,500 and preferably $5,000 to be well diversified. But what if someone just doesn’t have that kind of money to invest? Should they even consider p2p lending?

While $500 is only enough to invest in 20 different loans I think it is acceptable to start here if that is all an investor can afford. But I think a conservative investment strategy is in order.

Invest in the Lowest Risk Loans

With only 20 notes you want to avoid defaults at all costs. If you get one default immediately you will have lost 5% of your original investment. That is very tough to recover from.

So, I would focus on the very lowest risk loans, which means A-grade loans at Lending Club or AA-grade loans at Prosper. While you won’t be able to earn double digit returns with this kind of investment you will reduce your possibility of defaults greatly. And if you are only investing $500 that should be your goal.

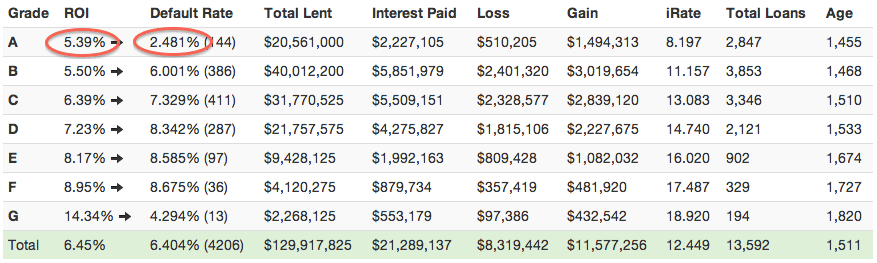

Take a look at this graphic below (click on the image to view it in full size). This is from Nickel Steamroller and it shows the returns on completed 3-year loans for all loan grades from 2007 through July 2010 at Lending Club. Take a look at the two numbers inside the red circles. A-grade loans earned 5.39% for investors, not a bad return. But the second column is even more important for a less diversified investor. The default rate on those loans was only 2.481%.

Now, if I was making this investment I wouldn’t choose just any A-grade loan, I would apply some filters here to further reduce the likelihood of defaults. Let’s just take some simple filters anyone can use and apply it to this same batch of loans:

- Inquiries = 0

- Income >= $7,500 per month

- Loan type: credit card, debt consolidation

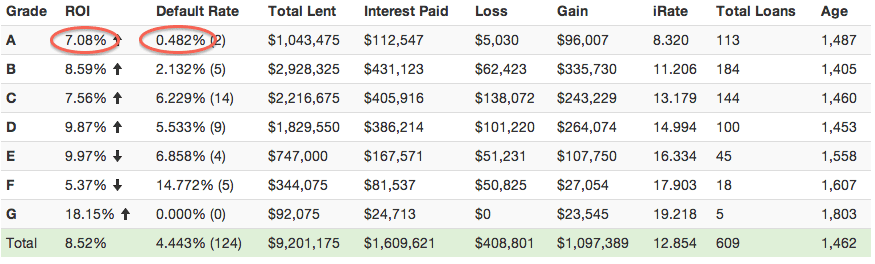

If we run the same query with those three filters applied then you can see how the estimated ROI increases but more importantly in this case the default rate drops dramatically to 0.482%. Now, I should point out that the sample size here is pretty small – we are only looking at 113 A-grade loans from this period. But if you take a larger sample size by selecting a more recent time period you will see a similar trend. My point is that with some prudent filtering you can reduce your chance of defaults even with A-grade loans.

I truly believe that everyone should have a p2p lending investment account. Even if an investor only has $500 to invest they can get started. Then as they add to their account they can slowly expand their horizons beyond A-grade loans into some of the lower grades. But I think it would be unwise to do that until they have significantly more invested.

What do you think? I would love to hear some other opinions. If you only had $500 to invest what would you do?