As we wrote a few weeks ago GreenSky has been gearing up for a possible IPO. Well, on Friday it became official. Greensky filed an S-1 with the SEC and so we finally get to learn about this secretive company.

While GreenSky is certainly considered a fintech platform, they are by no means a marketplace lender. They are not even a true balance sheet lender. Here is how they describe themselves in the S-1:

We are a leading technology company that powers commerce at the point of sale. Our platform facilitates merchant sales, while reducing the friction, and improving the economics, associated with a consumer making a purchase and a bank extending financing for that purchase. We had approximately 11,000 active merchants on our platform as of December 31, 2017 and, from our inception through December 31, 2017, merchants used our platform to enable approximately 1.6 million consumers to finance over $11 billion of transactions with our Bank Partners.

The reality is that they are not a lender. Basically, they do everything other than actually lend money. They source customers, facilitate loans and even service their loans but their bank partners are the ones who actually provide the funding and own the loans. Having said that, they do show $73.6 million in loans on their balance sheet so they clearly keep some of their own loans. They explain these loans as “R&D Receivables” because their objective is “to hold these receivables only until we have enough experience with the particular products or industry verticals for our Bank Partners to purchase the receivables.”

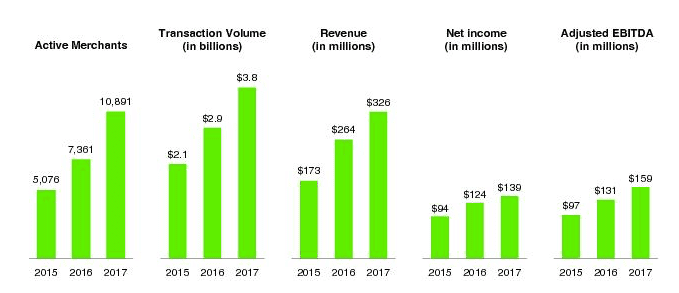

Given they are a private company and their CEO rarely gives interviews (other than this Forbes piece last year) we have learned very little about the company. We certainly knew nothing about their financials. But there is now an almost 200-page S-1 which has all kinds of interesting information about the company. Here is a graphic on some of their key metrics:

Given these numbers I would say they are probably the most successful fintech company in the lending space. Look at their margins. Last year, they made $139 million in net income on total revenue of $326 million which is an unheard of 43% net margin. They may well be the most profitable fintech company on the planet with margins like these.

As they say in the S-1, GreenSky is a technology company and with these kinds of margins it is hard to argue. They have come to dominate the point of sale market for home improvement through the innovative use of technology and smart distribution. They are focused on signing up merchants and having them use the app to drive loan volume. They even have a patent pending on this mobile app.

Interestingly, they are dealing with super prime and prime customers with a weighted average credit score of 771. That is the highest I have seen for any company in the online lending space. It is no wonder banks are the target buyers for their paper.

There is a lot to like about GreenSky. This IPO is their coming out party of sorts given how quiet the company has been. According to Renaissance Capital, a pre-IPO research firm GreenSky could raise as much as $1 billion in their IPO. It will be fascinating to watch this play out. If they can pull off a successful IPO I expect we will see more fintech companies follow in their footsteps this year.