Last week Goldman Sachs launched a new product called GS Select. Before we get into the new product I think it’s important to discuss a little bit of the history of Goldman Sachs because a lot has changed over the last few years. Originally known for servicing the ultra high net worth clients, the company has put a significant focus recently on serving consumers more broadly.

In April, 2016 Goldman Sachs officially acquired the online deposit platform of GE Capital. With it, the company assumed $16 billion of assets making GS Bank accounts available for all. According to Goldman, they have increased deposits by 151% over the last five years. Not only are they taking deposits, but they are aggressively trying to bring in new customers to the bank, consistently ranking high against their competitors in the interest rate paid on deposits accounts as Peter Renton recently explored.

On the other side of the equation they launched Marcus, their online unsecured personal loan business that competes directly with online lenders Lending Club and Prosper as well as the banks playing in the personal loans space. You can learn more about Marcus in a fascinating episode of the Lend Academy podcast episode we did with Marcus’s first employee. Not only are they one of the first banks to build an online lending platform from scratch, but the business seems to be doing well. It was recently announced that the Marcus platform crossed a billion dollars in originations in just 8 months.

Goldman’s ambitions to become a big name in lending and expanding their customer base didn’t stop with Marcus. The firm created GS Select to reach clients of nearly 4,000 independent investment advisors from Fidelity Investments. Clients will be able to borrow from $75,000 to $25 million backed by their investment portfolios. This is a service that in the past hasn’t been offered because independent advisers aren’t banks, so they will leverage the technology built by Goldman Sachs to offer services to compete with other major brokerages. Borrowers will be able to receive a loan in as little as one day.

Andrew Kaiser, Goldman Sachs’s global head of private banking stated:

We’re building a marketplace for RIAs and other financial advisers to help manage liquidity and liabilities for their clients. To the extent, down the road, that we will add more products, they will be scalable.

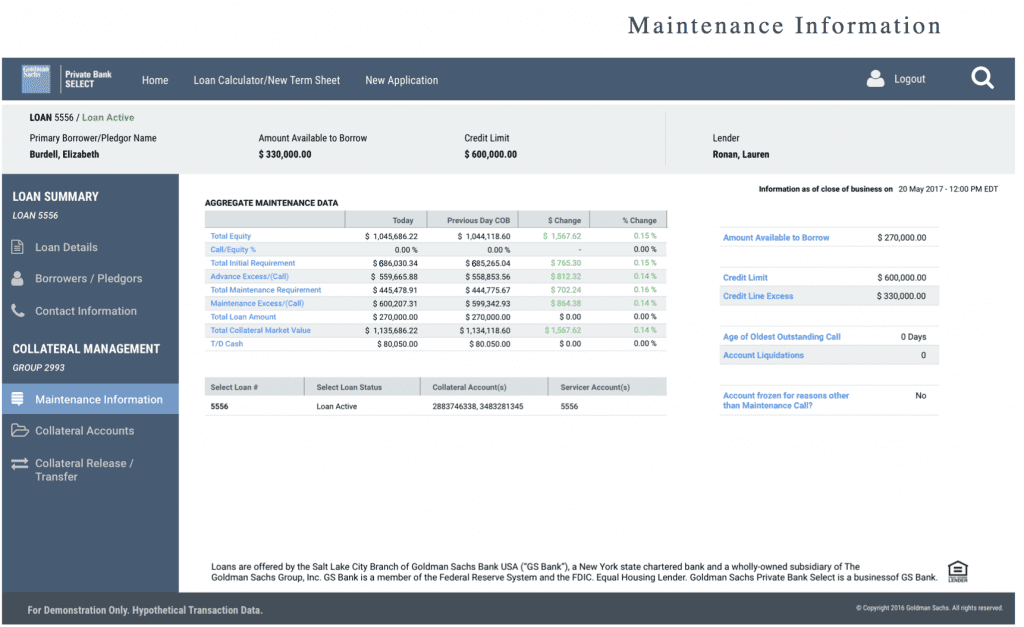

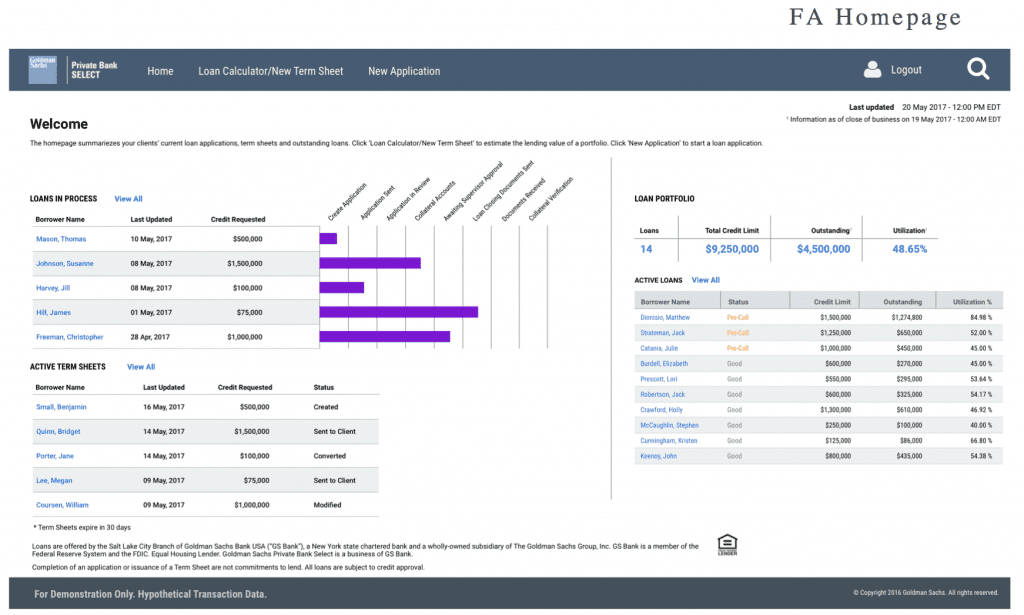

What’s interesting about this move is that it could be expanded to other RIAs and financial advisors not just through Fidelity. We’ve seen this type of model before with self described “Lending as a Service” fintech companies, but this time it’s a big bank that has built this technology. We were able to see a short demo of the platform from a financial advisor’s perspective. The below screenshots were taken from the demonstration.

[slb_exclude]

[/slb_exclude]

Conclusion

As of late we’ve been seeing a lot of news coming out from Goldman Sachs, a company that from a consumer lending or consumer banking perspective wasn’t really on our radar in early 2016. Now these initiatives started much earlier than that, but it’s interesting to see just how much things have changed at Goldman Sachs and the impact that they’ve had on the market in such a short amount of time. The market certainly is a lot different than it was just a year ago and it will fascinating to see how other big banks respond.