Financial literacy is an issue and one that doesn’t seem to be going away.

According to the OECD International Survey of financial literacy, only 52% of adults can be considered financially knowledgeable. Looking at other surveys, the results are even more alarming.

“In the adult population throughout the EU, just under 50% do not understand basic financial concepts,” said Phillip Haglund, founder, and CEO of Gimi.

“We can also see that the financial literacy level is lower among young adults. In Sweden, there has been a high increase of young people ending up at the enforcement agency and not being able to pay their bills.”

Despite the global rate of financial inclusion rising, financial literacy rates have remained at a steady low point. Fintech is providing the world with easier access to financial products, but there is still an issue in the knowledge surrounding them. Some studies have found that increased digitalization has increased the risk of consequences for low literacy.

The problem is not restricted to certain areas. Although in some areas of the world, levels are particularly low, within Europe, citizens considered to be financially literate only make up half the population. People under 20 and above 70 and women and people from low-income areas are the worst affected.

Aimed at improving the lower end of the scale is Gimi, which has partnered with ABN Amro to release a financial literacy app for children aged 7-13.

Financial education needs to start young

“It is in childhood, we set in our relationship and habits around money,” said Haglund. “For most of the children, we talked to, their first interactions with money is that they use their parents’ credit cards.”

“They have seen their parents pay with them in stores; they don’t really understand that there’s a limited resource behind that. They don’t see the money that is being spent. So it’s tough for them to understand that.”

“This continued access to a perceived unlimited cash flow can sometimes last throughout childhood. Then, suddenly, when they turn 18, they need to handle all their personal finances. They need to learn how to do declarations and taxes and all those things. I don’t think children are prepared for it. 80% of children don’t think they are prepared to handle their own money when they come out of school. The school system, in general, is falling way behind right now. And I think it’s unfortunate that financial education is so neglected.”

Low levels of financial literacy can affect relationships with money on all levels. From day-to-day expense budgeting to choosing loan providers, actions based on a low understanding of financial processes can have long-lasting consequences. Low credit scores made by early decisions of young adults are hard to recover from, and in times of economic crisis, savings can be essential.

With the rise of digital services and crypto investments, these risks are even more acute.

“A recent survey in Sweden showed 50% of 10-year-olds have bought something in video games,” said Haglund. “Financial literacy has always been an essential skill, but it’s increasingly important now.”

“There are cryptocurrencies, and you can do microtransactions. It’s just another world of money today, and it’s a lot harder to navigate. Perhaps, 15 years ago, you didn’t need to have as many financial skill sets as you need today.”

Gimi’s solution

“We have a target of educating 10 million children by 2025,” said Haglund. “As of today, we educated 500,000 children in the Nordics.”

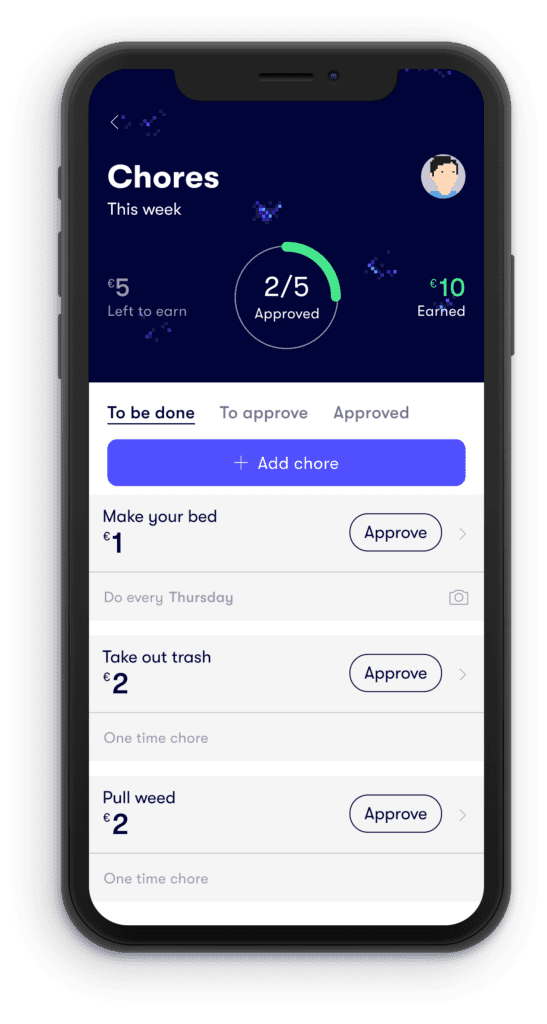

The app connects to the bank account of the parent or child, facilitating the allocation of an allowance periodically. This first step is included to encourage budgeting.

Gamification is then implemented, allowing children to keep track of their spending and determine whether spending choices are “good.” Parents can set chores that give children a chance to earn more, and children can set savings goals that are easily tracked.

“We’ve done studies with universities, especially on the savings feature, and we see that it has a proven impact on their savings behavior. It actually increases the amount of money they’re saving and their consciousness about it,” continued Haglund.

In addition to the spending and saving features, Gimi also includes educational videos. Subjects covered include fraud awareness, online spending understanding, and the history of money.

“We’re also trying to partner with banks,” he said. “We think that by transforming the bank market and including education features as part of children’s bank accounts, we can have a huge impact. So we’re trying to create partnerships with prominent high street banks throughout Europe.”

Gimi is also an advocate for increased financial education in schools.

They have been heavily involved in writing motions for the Swedish government and growing research on young people’s financial literacy.

Effects on the broader economy and society

“There’s a high monetary cost for the whole society when people end up in personal bankruptcy,” said Haglund.

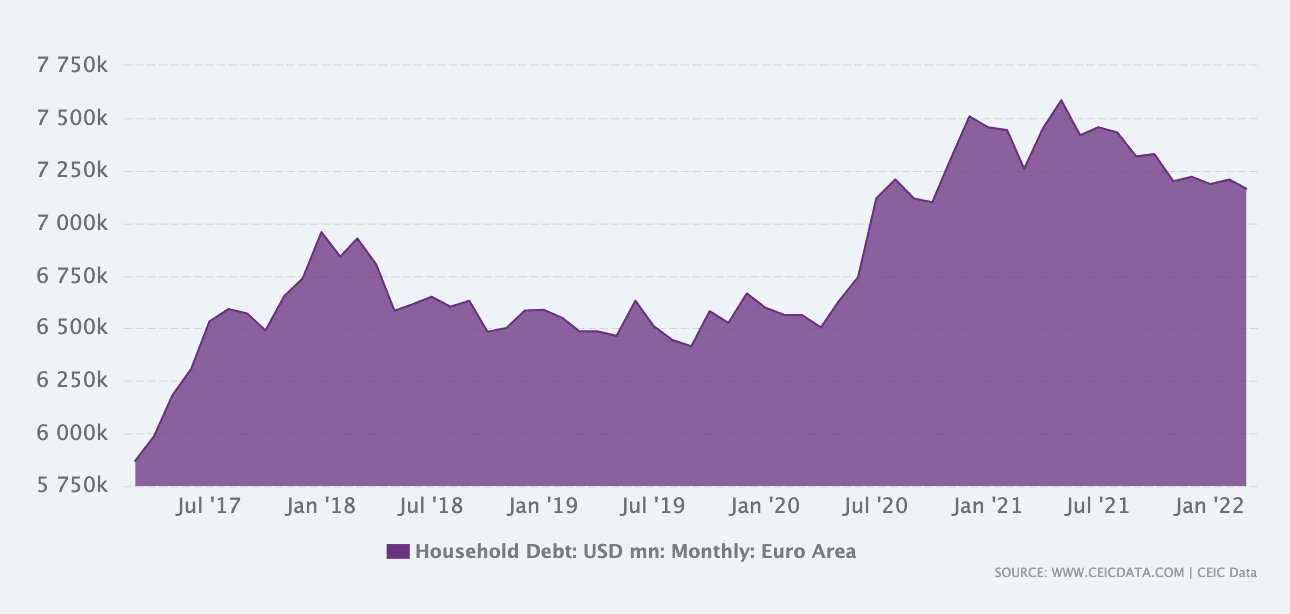

According to CEIC, European Union Household Debt accounted for 52.1 % of the Nominal GDP in Dec 2021, and European Union Domestic Credit reached 24,949.8 USD bn in Dec 2021, representing an increase of 3.3 % YoY.

In addition, loan losses are forecast to rise to a five-year high of 3.9% in 2023, although they will remain lower than the previous peak of 8.4% seen in 2013 during the eurozone debt crisis.

However, the effects of low financial literacy could go beyond monetary issues.

“There’s also another perspective, and I think that’s significantly more crucial,” he continued. “It’s the fact that how we handle personal economy is just how we handle resources. Today, the whole world is just eating up the planet’s resources, and it has to do with consumption.”

“There’s another lesson we are teaching with the app, just the simple understanding of the difference between needs and wants. We need to understand what we need. And I don’t think that people need so many of the things we are buying today.”

“There are high levels of overconsumption, and we are at the highest level of debt globally that we’ve ever been. And we keep on using credit quite unconsciously. So I think financial awareness has a lot to do with sustainability and how we think of consumption.”

“It’s a super simple lesson. I think that increasing awareness around money and our consumption patterns will increase awareness regarding sustainability.”