Two venture capital funds rose out of the primordial substack ooze last week, both founded by voices of the niche industry we know as fintech.

The Fintech Fund is a ‘by fintech, for fintech’ focused group, created by Nik Milanovic on the heels of his ever-popular This Week In Fintech community. The other is a US and Latin-American-focused fund called Gilgamesh Ventures led by the podcast and newsletter giant Miguel Armaza.

With their similar yet unique funds, the two embody a new exit strategy from the 2010s. After a decade of working in banking or tech, talking to entrepreneurs, mentoring startups, and building communities, it’s time to turn subscriber counts into happy investors.

Both funds are run by fintech shamans, who have worked within startups and more traditional firms and learned the business along the way. Last week, they both launched their full-time premise for the future, in a very web2 type of way: After capturing the voice of industry through digital and physical media, they lever that conversation to build a fund network that can launch any startup into the stratosphere.

Armaza and Milanovic ask the question: Could there be a better business than one that invites friends and peers to conspire toward the success of the youngest entrepreneurs among us?

From fintech fodder to funded founders

Though making SPV deals since 2020, Gilgamesh announced the launch with more than $2.7 million invested in 16 companies. The Fintech Fund, with big-name fintech partners and a growing group of peer VCs involved, has raised $10 million of its goal and has invested in 10 startups.

So how did these two go from fintech employees to well-known influencers and now fund founders?

Milanovic said he saw his start at the proto fintech Funding Circle, the U.S. version of which was founded in San Francisco in 2012. Fresh out of Stanford with a passion for solving inequality, the early fintech industry naturally drew him in.

He was lucky enough to meet with one of the co-founders and thought it was an “epic” idea for a company: helping small business owners get access to capital that they could get from banks.

“When the co-founders hired me, and it went from one employee to 600 people at a time, I left, and it was quite a roller coaster ride for five years,” Milanovic said.

“I think the most interesting part of fintech has always been helping people who don’t have access to resources: helping people access more money, get better at managing their money, and basically, lead better financial lives.”

From fintech employee to mentor

Milanovic moved to Petal, building a card service fintech, and he began writing for TechCrunch. Eventually, he left for Google Pay as the head of Business Dev, where he spent a couple of years mentoring startups with TechStars.

Just before jumping over to Google Pay, it was around that time when Milanovic said he founded This Week in Fintech.

By 2020, Milanovic was synonymous with the fintech space, capturing the bustling industry through weekly updates and soon added meetups and happy hours in cities across the globe.

“That’s where the whole community came from; a bunch of newsletter readers and people I connected with online,” Milanovic said.

“We started doing our events like at Company last May; nine months ago, and we’ve already done them on three continents, and we had over 7,000 people come to the events. So the next step for us is the most recent news, which is launching this fund for investing in early-stage fintech founders.”

Building community, from community college to Wharton

Armaza first found his way to fintech the way most people do: traditional banking. He got through community college and jumped on the Citi bank ferry ride in 2011, which brought him through to 2019 as an MUFG structured finance employee.

With entrepreneurial blood ever since launching a Facebook meme page that hit 3 million followers in 2009, Armaza said he was working with friends on the side to build Special Purpose Vehicles (SPVs).

“That was my taste of entrepreneurship over 12 years ago. Two things happened: One, I recognized that I was a kid, and I didn’t know anything. But on the other hand, what I tasted I liked, and that was entrepreneurship, that was building something,” Armaza said.

“So I joined banking because I was interested in finance, but I always had the goal in mind to eventually do something more entrepreneurial, right? And I didn’t know what that was going to look like. But that was always my North Star.”

No more corporate

Eventually, the small syndicate had enough capital set aside to form their own Angel Venture fund in 2019, and in six months, Armaza joined up with a fintech service called Pando. He joined Wharton to go after an MBA to help realize his goals. It was there that he turned his knack for going viral toward the Wharton Fintech Podcast.

While also getting a dual degree at the Lauder Institute at UPenn, Armaza said he knew one thing- he didn’t want to go back to corporate.

“So I just doubled down on fintech, when I was a Wharton, and what really changed my life was getting involved with the Wharton fintech club and starting to host the Wharton fintech podcast. Me and my co-host Ryan, we together recorded over 200 episodes, I did close to 150 and grew the podcast 13X,” Armaza said.

“Some months, it will be top 10 Finance globally. So, yeah, as you can imagine, it was a labor of love, a student-run show; no salary, but it worked really well and opened a lot of doors.”

Labor of love goes 13X

With the labor of love, and experience going viral before, Armaza grew the podcast from 10k to 130k monthly viewers. Like Milanovic, the weekly webcast also brought on a flow of deals- opportunities for Armaza to get involved with fresh startups in the community.

It wasn’t just US-based fintechs, Armaza said, but leaders from across the Americas. When he landed an interview with David Velez, the CEO of Nubank, he used it as an opportunity to launch his newsletter, to cover recent podcast guests after the fact, and build a personal brand of his own called Fintech Leaders.

From there, it was a hop skip and a jump for Armaza and co-founder Andrew Endicott to organize deal flow into a fund structure. What began the same way as Armazas last VC fund, small SPV agreements, has since ballooned into a trans-continental fund ready for full launch today.

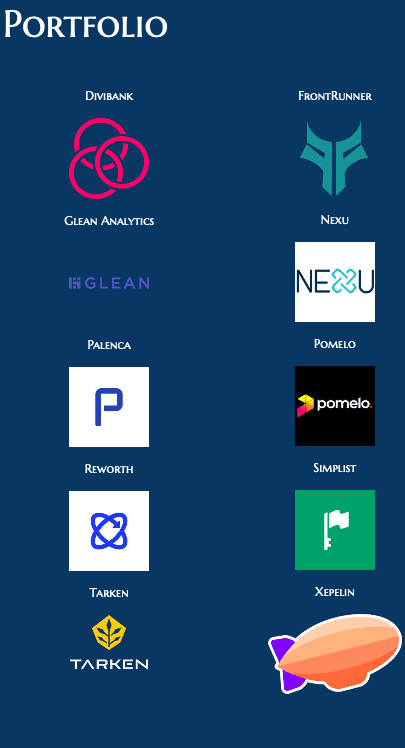

He said around 20% of investors in the fund are previous podcast guests and one-third of LPs in Gilgamesh are Wharton and UPenn alumni (LendIt CEO Bo Brustkern is also an LP). Some of Gilgamesh’s investments are in Klar, Xepelin, Pomelo, Divibank, and Frontrunner.

Endicott also brought in a wealth of connections and experiences from his time as an entrepreneur, From Harvard Law onward, running through investment banking, then co-founding Petal. At Petal, he helped hire hundreds of employees, helped raise approximately $250m in equity, but left in fall ’21 to focus full-time on Gilgamesh.

What about the funds?

Milanovic, talking to LendIt from the West Village-based apartment office, said that the fund he helped create is different than other VCs, even ones that are similarly fintech-focused.

Milanovic said that the Fintech Fund connects people who built tech and work at fintech companies to new fintech founders to recycle capital back into the ecosystem. It’s a fintech for the fintech community, almost like an incubation fund.

“We connect them with people who understand this space too, who built the stuff that they’re trying to build before, and understand what works and what doesn’t work so they can get more than just dollars; they can also get advice and support,” Milanovic said.

“Starting a fintech company is pretty hard; it’s pretty brutal. Honestly, it’s not like many tech companies where you can get into the SaaS or get into economics without knowing everything about the space, but in fintech, you need a lot of domain expertise. And so our goal is to use the fund to put people in touch with the advisors and support that they need to have that expertise.”

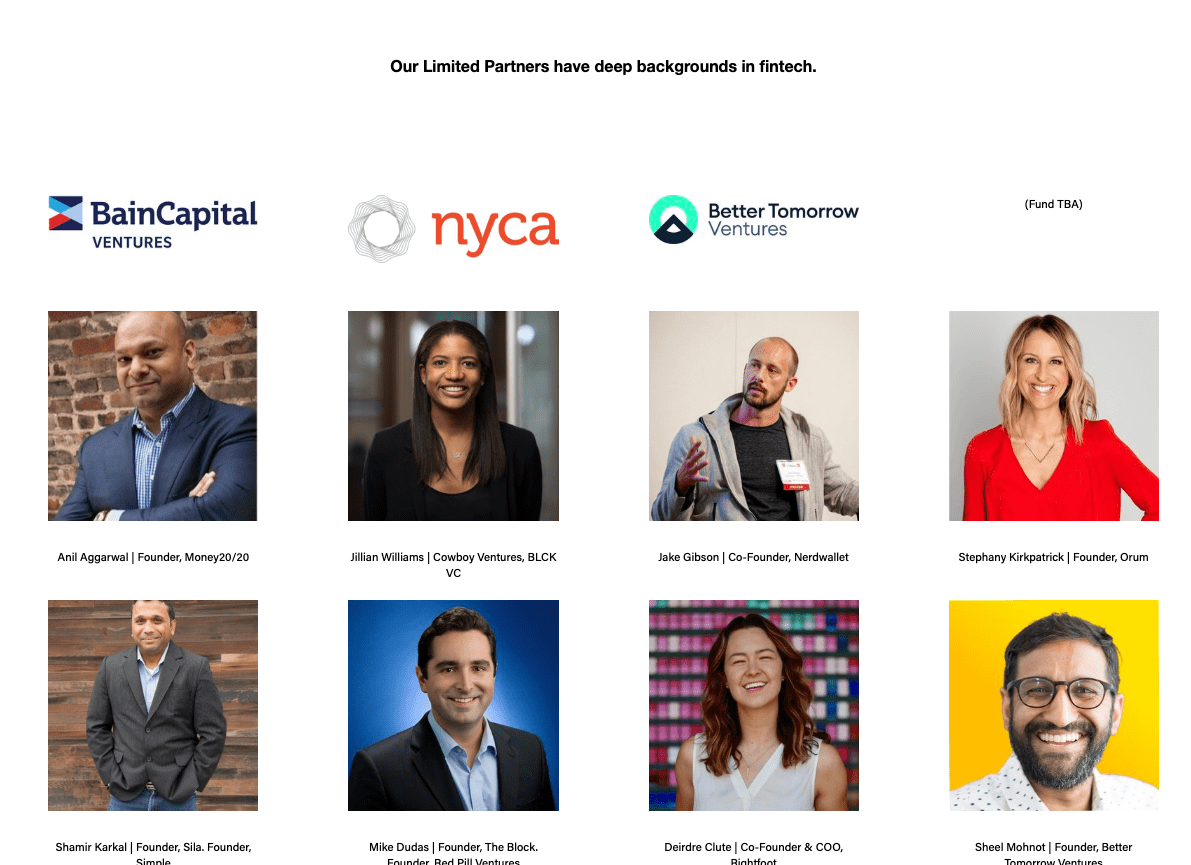

Backers with a purpose

Fintech Fund has already raised its $10 million goal, even with players that would typically be ‘competitors.’

VCs are LPs in the fund, including Better Tomorrow Ventures’ Sheel Mohnot, Sriram Krishnan, from Angel Collective Opportunity Fund, Jake Gibson, Cowboy Ventures’ Jillian Williams, and many more. There’s also NerdWallet co-founder Jake Gibson, The Block’s Mike Dudas; even LendIt’s own Peter Renton found a place as an LP.

Milanovic said collaboration is critical, and VC is changing: the standard sharp-elbowed approach to valuation and competition is not constructive for early-stage investing.

“I don’t think you need to shut other investors out to maximize your own potential as a fund,” he said.

Instead, what really benefits tech founders, is high-quality talent in the investor base. Milanovic said that the most challenging part of raising this kind of fund is finding suitable partners.

“If I wanted to go out there and just maximize the amount of money I was getting, you know, I could raise, probably $25 million fund from more undiscriminating investors. But that’s not the goal here, just to find money and maximize the amount. The goal is to really create a super tight ecosystem of ambassadors who are all fintech-focused, and all doing fintech stuff themselves.”

A fund for the Americas, and more to come

Armaza, in his part calling in from Sao Paolo, Brazil, described his fund as one that focuses on all of the Americas, with a lot more inclusion of Latin American startups than most.

Gilgamesh is backed by fintech and industry leaders from the US, LatAm, and Asia, like Peter Fernandez from 99, Marcelo Lima from Monashees, Ignacio Canals from Migrante, and representation from Mexico’s NOA Capital, Encore Bank, and Foundation Capital.

“Although we are seeing several interesting deals from Africa, from Southeast Asia, and even Europe, those are markets that we don’t understand as well, as we do the Americas,” Armaza said.

“I’m not going to say I don’t understand them. But I certainly have a much better grasp of the financial space and what’s going on in fintech, in the US, Brazil, Mexico, and so on. So it’s about doubling down on your strengths.”

He said don’t be surprised if “we incorporate other regions in the future.” But, for now, the focus is LatAm, where there are great local funds with exposure to multiple startup industries, but few specialized in just one, Armaza said.

LatAm means local

“Fintech founders, their first calls are to their strong regional funds, along with specialized funds,” Armaza said. “We have built great relationships with local funds. Some of our investors are GPs and founders of local Latin American funds. By the way, we would probably never invest without a local partner.”

Meanwhile, on the US side, the market is large and diverse but still has a ton of opportunity, Armaza said.

“A lot has been done over the last decade, but if you look at several verticals of the economy, they are still being run by fax, you know, by mainframe computers from the ’70s,” Armaza said. “And I lived through it when I was with large banks, and I was happy to see that fintechs were digitizing part of it. But there’s still a ton to be done.”

The hardest part, Armaza said, is that there is so much being done, and it’s easy to get pulled in so many directions. However, the key to running a fund is focus.

“For us, it’s building relationships. Every day, I can’t tell you the number of conversations that I’m having, with partners in the ecosystem, obviously, entrepreneurs, and then his fellow VCs, other investors, and then just subject matter experts,” Armaza said.

Gilgamesh is for entrepreneur heroes

Coming from banking, startup, and podcast reporter backgrounds, Armaza feels the pull of each facet of his interests, and balance is vital. But that combination of skills led him to co-found Gilgamesh, named after the first hero of humanity because he said entrepreneurs are heroes.

“So when I jump into a call or a meeting, with an entrepreneur, I empathize with fundraising, I empathize with rejection, and building a platform,” Armaza said.

“The name Gilgamesh is the first epic of humanity. This hero went where nobody dared to go, that did bold and brave things. And for us, those are entrepreneurs. I have unlimited respect for entrepreneurs. You know, it’s very hard, there’s a disaster happening every day, and you got to keep your head up, and it inspires your team and project confidence on the outside while you’re struggling. And you’re fighting a battle every day.”