Tuesday, the Financial Health Network released the Financial Health Pulse yearly U.S. Trends report.

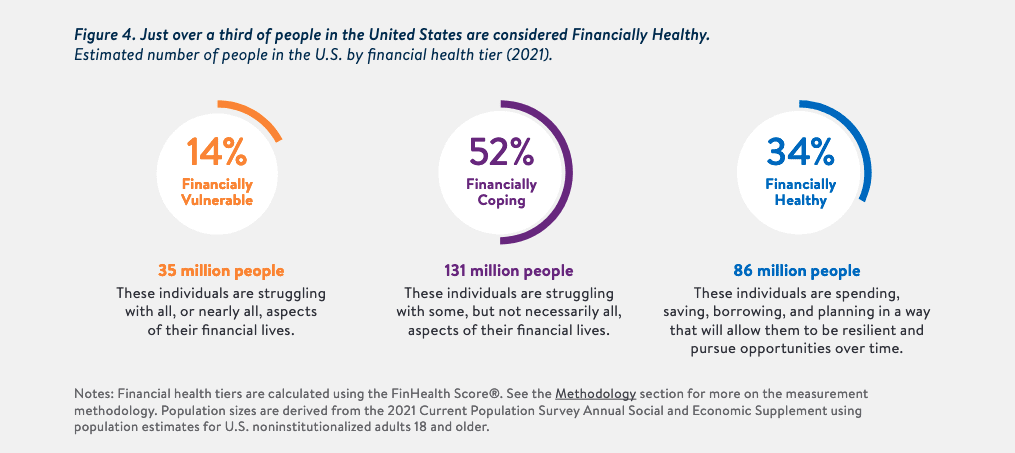

The paper found 34 percent of Americans are considered financially healthy, up two percent from last year: leaving out 187 million Americans who are still either financially coping or vulnerable.

The study is a joint effort between the Citi and Principal foundations, run through USC Dornsife Center for Economic and Social Research.

The collaborators found there is plenty of room for fintech companies to innovate and improve the lives of Americans, a nation in recovery still facing inequality.

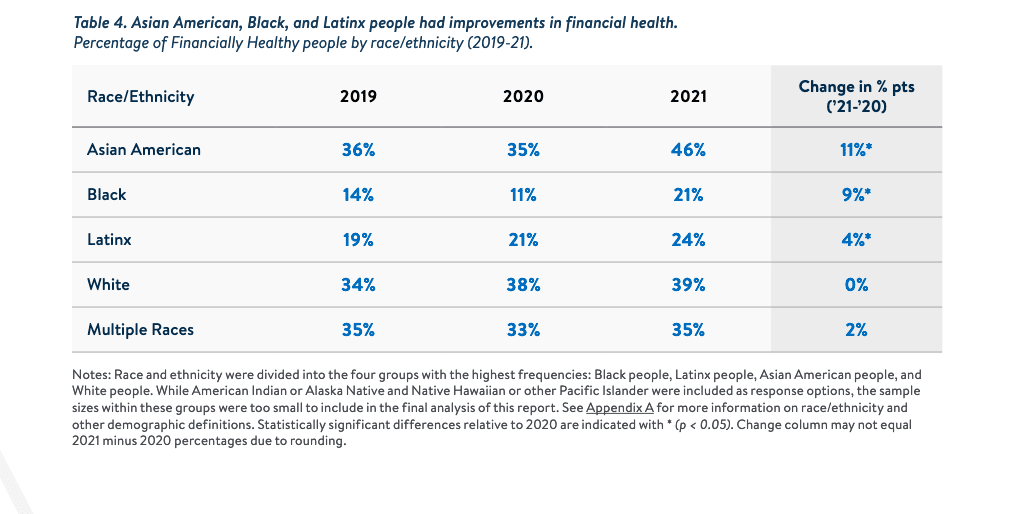

It has been a year of back-and-forth progress. Financial health improved particularly for Black, Latinx, Asian Americans, and Americans with household income under $30,000. However, the gap between men and women increased: men saw financial health improvements since 2020, and women did not.

Despite the percentage increases in financial health in particular racial demographics, inequities remain: 39 percent of White identifying people are financially healthy, with only 21 percent of Black and 24 percent of Latinx identifying people.

“The overall improvement in financial health shows that government interventions can have a powerful impact on the most vulnerable, including marginalized communities, but these gains are at risk as relief programs wind down,” CEO of Financial Health Network Jennifer Tescher, said in a release.

“It is critical that we use these insights to inform ongoing, sustained financial health policies, programs, and products that bolster these gains and better support those that are coping.”

Pandemic-related changes

The study found that the most likely reason more vulnerable populations experienced a rebound was government intervention programs, like PPP and stimulus checks, that helped people gain their feet. That effort also includes expanded unemployment benefits, the hold on foreclosures, and student loan forgiveness.

Accordingly, the vulnerable were three times more likely to receive government relief than in the healthy category. People who received mortgage or rent relief were half as likely to experience increased housing insecurity in 2021.

The Pulse also found that low-income people who received unemployment benefits were 62 percent less likely to become vulnerable. In addition, a third of people who received a stimulus check said they used it to pay off credit card debt.

“This report from the Financial Health Network offers insightful and actionable information that can help drive cross-sector collaboration to improve the financial health of all Americans,” said Brandee McHale, head of Citi Community Investing and Development and president of the Citi Foundation.

“As we continue to support our communities in their economic recoveries, it is critical that we work together to develop impactful solutions that are informed by data and strengthen our collective efforts to help close the racial wealth gap in America.”

Gains and losses

The proportion of people considered Financially Healthy increased by 11 percentage points for Asian Americans (46 percent) nearly 10 percentage points for Black individuals, (21 percent)and about three percentage points for Latinx individuals, (24 percent), and two percentage points for those with incomes under $30,000 up to 12 percent.

The data showed each of those demographics saw some of the most improvement since Pulse began recording data in 2018, but even so, overall individual financial health went down.

For example, financial health decreased for 43 percent of people living in America in the past year, and 10% moved to a lower tier of financial health.

The most significant segments of the population hit hardest were those with disabilities, without bachelor’s degrees, and those who had to take time off work to fight a severe illness.

Uneven progress, especially for women

Positive trends drove gains in the financially healthy group. Most people in the group reported improvements in their ability to pay bills, add to short-term savings, and improve credit scores.

The proportion of people who said they had enough savings to cover at least three months of living expenses grew by five percentage points, from 56 to 61 percent.

Even so, parents were disrupted by school closures and the transition to virtual learning, especially women. Women were more than twice as likely as men to stop working to take care of the kids in 2021. Of the group that stopped work because of childcare, 73 percent were women.

Women also did not see the same financial health gains in 2021 as did men. The proportion of men considered financially healthy increased from 39 to 43 percent, while women considered financially healthy stayed at 26 percent.

“While we all look forward to the end of the COVID-19 pandemic, we are barreling forward with two-thirds of the population still financially unhealthy,” director of the Principal Foundation Jo Christine Miles said.

“In particular, women continued to fall behind because of long-standing social and environmental factors that were exacerbated by the pandemic.”

The data also explores inequality from individuals who identify as disabled and LBGTQ+ as well as geographic location.

For example, LGBTQ+ individuals are less likely to be financially healthy than non-LGBTQ+ individuals and more likely to be economically vulnerable.

By geographics, people living in the Northeast and Midwest regions were more likely to be financially healthy (37 percent each) than people elsewhere, like the South. The South saw the most significant improvement but still the lowest financial health levels in the country.

Metrics

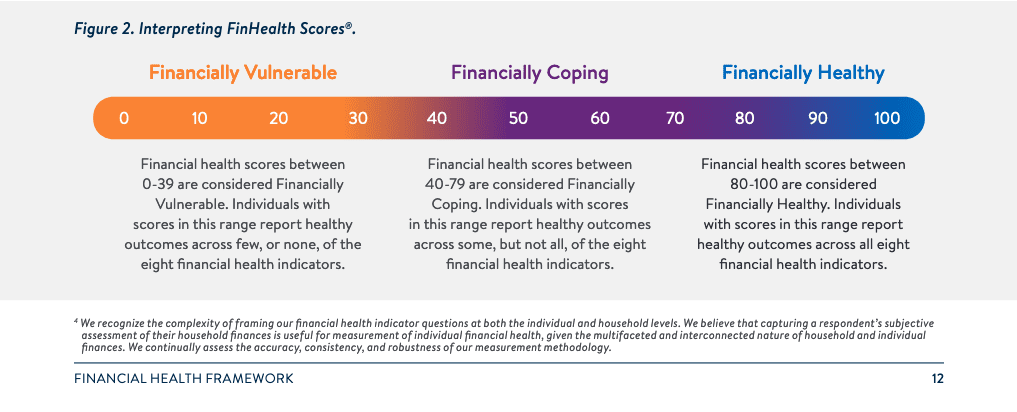

The Pulse survey scores against eight indicators of financial health — spending, bill payment, short-term and long-term savings, debt load, credit score, insurance coverage, and planning — to assess whether respondents are “Financially Healthy” “Financially Coping,” or “Financially Vulnerable.”

In 2020, the Financial Health Pulse also started using transaction data. As of September 2021, 973 individuals had linked at least one financial account, totaling 6,108 accounts across 2,608 institutions.