In the past two decades, we have seen the development of financial services move to digital platforms.

In fact, for many customers, digital access to financial services is now a non-negotiable requirement. Aside from streamlining processes and improving visibility, the digitalization of the finance sector empowers customers and businesses to access services that were once out of reach.

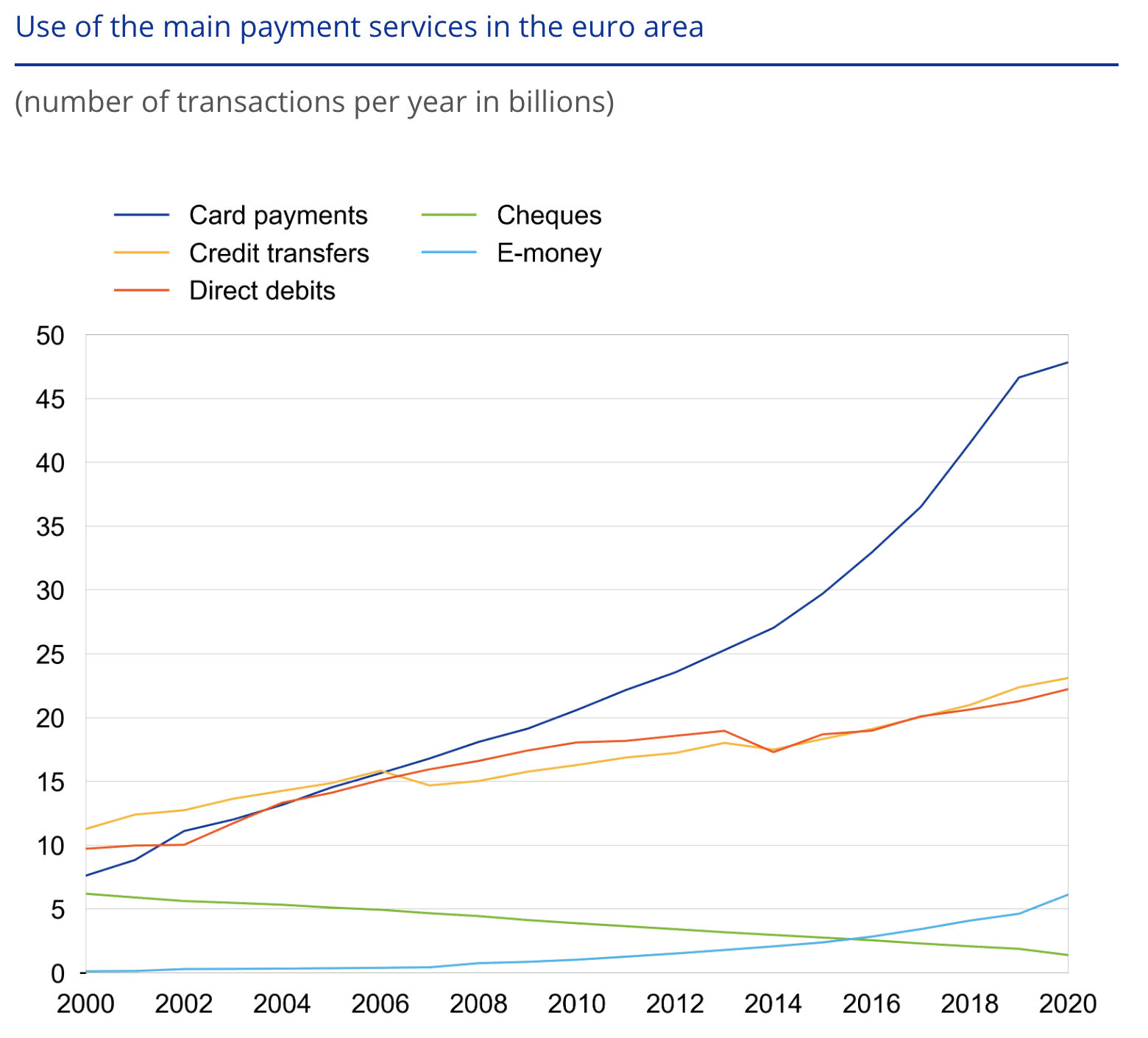

The use of cold hard cash is becoming outdated. Although remaining one of the most popular forms of payment, every year use of non-cash payment methods is steadily increasing, accelerated by the pandemic.

Cash is King? Perhaps not for much longer

According to the European Central Bank, the total number of non-cash payments in the euro area increased by 3.7% in 2020.

This brought the total value up by 8.7% to 167.3 trillion EUR. Of these payments, card payments accounted for 47%, increased issuance of payment cards bringing the total amount during that year to 609 million, the equivalent of 1.8 cards per euro area inhabitant. Cards, not cash, are becoming king.

Related to this, the global use of contactless transactions rose by 40% in the first quarter of 2020, according to a study conducted by Mastercard.

This has had a knock-on effect, creating pressure for retailers to offer contactless payments solutions. The National Retail Federation reported an 18% increase in US retailers providing these solutions.

This trend is not expected to decline, with Research and Markets predicting a three-fold increase in the global contactless payments market, bringing it to $51.07 billion by 2026.

On top of this, BankMyCell reported that in 2022 6.64 billion people own a smartphone, accounting for 83.72% of the world’s population.

Why is this relevant? Because according to the latest World Bank report, global bank account ownership was only 69%. Many see phones as a gateway to improving access to bank accounts and the financial services that come with them. Digital native challenger banks and Central Bank Digital currency projects (such as the eNaira) have already initiated improvements.

These statistics bring us to Deserve, perhaps marking one of the next steps in the finance sector’s digital transformation.

The Instagram to the Kodak of the credit card industry

“I think two things are happening in terms of a megatrend. One, consumers are going to mobile. Everything they are doing, they are using a smartphone, and two, enterprises are moving to the cloud,” said Kalpesh Kapadia, CEO, and co-founder of Deserve.

Deserve, a fintech based in Palo Alto, California, is turning the concept of credit cards on its head. Instead of offering just another card, they have decided the physical card itself is superfluous, introducing a credit platform with virtual cards instead.

“We are powering that digital movement because our entire credit card stack is digital-first. You can do everything related to the card using your phone, and our entire backend is on the cloud. In the middle, we have our SDKs so you can embed it into your stack.”

Digital wallets, accessible using a smartphone, are slowly rendering the need for a physical card useless. By 2024 mobile wallets are predicted to account for a third of all global POS payments, the percentage of users rising at an unprecedented rate since the COVID-19 pandemic.

The Deserve platform gives customers access to credit card facilities using an app, and a virtual card downloaded directly to their phone. This concept is not entirely new, with other challenger banks offering similar facilities; however, Deserve focuses on this as the basis for their product offering.

“You are issued a card within five minutes of applying and can use it with your phone. We are basically the Instagram to the Kodak of the industry,” said Kapadia. “If you look at the traditional industry, they use a lot of paper and plastic. We are more digital-first, mobile-first. A card is a piece of software for us. It’s not a physical entity.”

Financial products for the underserved

The company started as a response to the underserved population of international students within the U.S., which Kapadia noticed while he was undergoing his Master’s Degree.

“I came to the U.S. to study in the ’90s, and I had trouble getting access to financial products and credit cards. Many of my family and friends had also come over the years and also faced this problem to a larger extent. Although all very deserving, they were underserved,” he said.

“Many of the larger companies you see these days are founded by people who came to the U.S. as international students. So I saw that this was a highly lucrative population that was being underserved.”

Kapadia started by developing software with an underwriting algorithm that surpassed the need for security numbers and credit scores. Although banks were interested in the technology, they were reluctant to make the first step, so Kapadia decided to do it independently.

“We had a full team and saw the banks loved the idea but weren’t going to do it any time soon, so we decided to go ahead and do it ourselves,” he said. “We launched our own credit card in 2016, raising our own capital.”

The decision paid off, and by 2018 Deserve had raised a second round of capital and had three businesses looking to acquire the company.

‘Weren’t going to sell’

“We decided we weren’t going to sell the company; we were going to partner with them and help them each launch a credit card. One of them was Sally May, one of the largest student lenders in the country. They became a partner, and we launched three different credit cards with them in 2019, and they became an investor in the company,” said Kapadia.

“Around the same time, Goldman and Sachs were looking to launch the Apple Card, and they looked to us as a role model in the modern credit industry. They had spent a lot of resources and three years building a credit card with Apple and Mastercard, and they liked what we were doing, so they became an active investor.”

Deserve has since partnered with other major brands, including Visa and Mastercard. They have over 20 credit card programs for B2B and B2C companies.

“We have powered a lot of credit cards as a service,” explained Kapadia. “We do everything, end-to-end. From the day you decide you want to get into the credit card business, whether you’re a brand, a bank, or a fintech, and you come to us, we do everything for you with a white glove manner. The whole nine yards are from issuing and processing to underwriting to product management to customer service to compliance.”

A new offering to serve SMBs

The company offers multiple solutions aimed at individuals and businesses. The most recent is their Commercial Credit Card Platform, empowering banks and B2B companies to launch virtual corporate credit and charge cards. This feature aims to improve customer management of cash flow and expenses while earning rewards for their spending.

“There’s a gap in the market,” said Kapadia. “There are hundreds of banks offering cards to consumers, individuals like you and me, but very few offer cards to businesses.”

“Banks are looking for small business solutions. People who want the functionality to control access and expenditure. We offer these cards to banks that can offer them to their SMB clients. It’s like a corporate card but for SMBs.”

The service provides a platform where businesses can customize rewards on expenditure and give visibility to card usage. Customers can control access and expenditure budgets while tracking transactions.

“When I’m a bank, and I have a lot of small business clients, mom and pop shops, mechanics, restaurants, whoever. I will want to offer a credit card for their usage and offer them attractive loans.”

“American Express does so much advertisement. There are a lot of banks that have a very low cost of capital, but they don’t know how to offer this product. We are enabling that. We are creating competitors to AmEx.

“For non-banks, this can be a significant source of revenue and can enhance brand loyalty.”

Customers Bank first to take the plunge

The first bank on the platform is Customers Bank, a subsidiary of Customers Bancorp with $19.6 billion in assets. They provide banking and lending services to small and medium-sized businesses, professionals, and individuals through mobile-first apps, online portals, and physical branches. As well as this, they provide blockchain-based digital payments using the Customers Bank Instant Token (CBIT).

“When we were approached by Deserve about partnering to help bring this innovative new platform to the small business sector, we could not pass up the opportunity,” said Sam Sidhu, President, and CEO of Customers Bank.

“Together with Deserve, we are looking forward to offering an exciting and valuable product to our small business customers, combining credit with powerful expense management.”

Following industry trends into the future

The company has come a long way in a relatively short period and closely follows industry trends. Following a recent interest survey conducted by Deserve, they found a high interest in crypto integration.

Customers already have the additional option of integrating cryptocurrency capabilities into their products, offering rewards, loans, and payments using digital assets such as Bitcoin as leverage. This integration addresses part of the interoperability issue associated with crypto asset ownership and reduces the risk of value volatility that many survey respondents were concerned about.

“People love Bitcoin, but they don’t want to buy it to see it fall in value. So if we can tie rewards to Bitcoin, this is the first use case. People love to earn Bitcoin for free. The second use case is that if I have bitcoin and don’t want to sell it, I can borrow against it,” said Kapadia. “When you spend, you can earn rewards in Bitcoin. You can borrow against Bitcoin you own, and you can make payments with a stable coin.”

When asked about the future, this is only the beginning of Deserve’s digital journey.

According to Kapadia, embedded finance is the future of the payments sector, and Deserve will be following the same trajectory. “Money is becoming more and more just a piece of code. A piece of code that can be embedded into anything” said Kapadia. “Money is becoming digital, it’s becoming software, and we are powering that digitization of money.”