A new company called Croudify recently announced that their secondary market platform for Lending Club was launching in beta. The company describes itself as a secondary trading platform that allows you to find the best listed notes based on analytical models that they have built. I spoke with Abhishek Agarwal, Croudify CEO, to learn more about the product and also signed up for a beta account myself.

What made Croudify’s platform possible was the creation of Lending Club’s secondary market API last year. In fact, Croudify was the company that worked closely with Lending Club as they were developing the secondary market. Abhishek stated that after beginning work on their product in 2015 they eventually compelled Lending Club to build the API which was eventually made public.

One the key challenges of creating a valuable platform on top of Lending Club’s secondary market is the amount of data that needs to be collected and subsequently the cost associated with collection and storage of the data. This data is used to build Croudify’s pricing models. Croudify currently pulls FOLIOfn data every 5 minutes, which takes the company just one minute to index. According to Abhishek, the infrastructure cost for this is about $8000 per month.

The team at Croudify has an immense amount of experience in data analytics. Abhishek and their Data Scientist, Mauricio Santana both spent 10+ years building data/risk models for Bank of America. The platform, along with the analytical model they have built provides recommendations of notes to purchase on the secondary market, taking into account all data points on the loan as well as aspects such as prepayment and the markup/discount of a note. They hope to eventually provide portfolio automation for both the the primary market and secondary market for both retail and institutional investors.

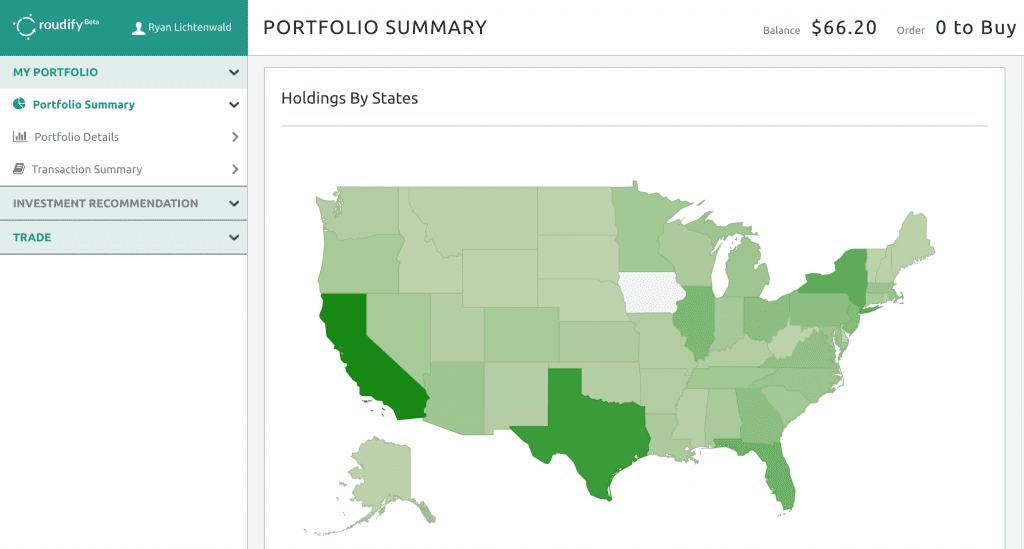

Logging into Croudify you are presented with a portfolio summary which includes a snapshot of your loan portfolios, holdings by states (pictured below) and the percentage of your loans that are performing.

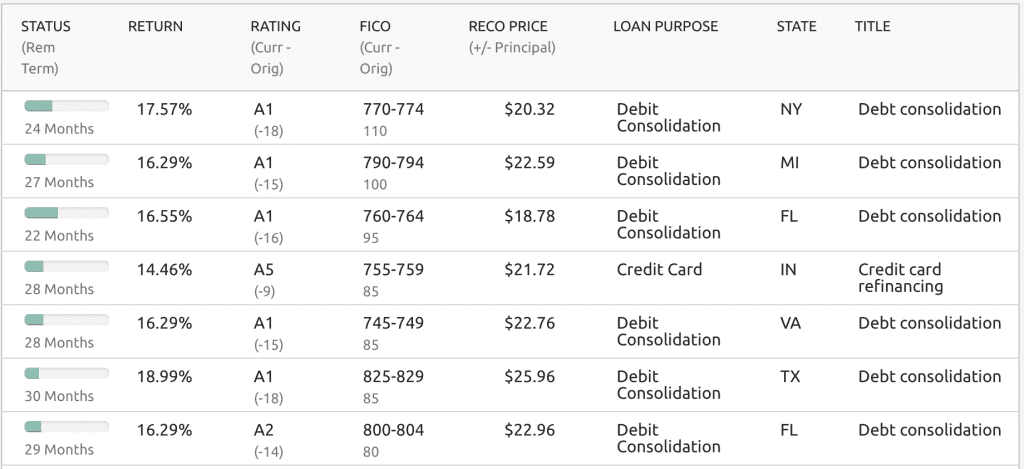

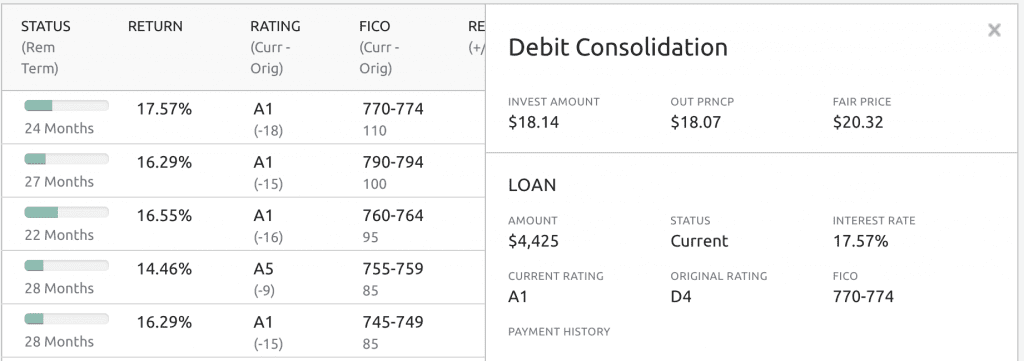

Digging into the portfolio details section will provide you with stats on currently listed notes. Croudify calculates the recommended price of each note based on their analytical models.

Clicking on a note shares further information.

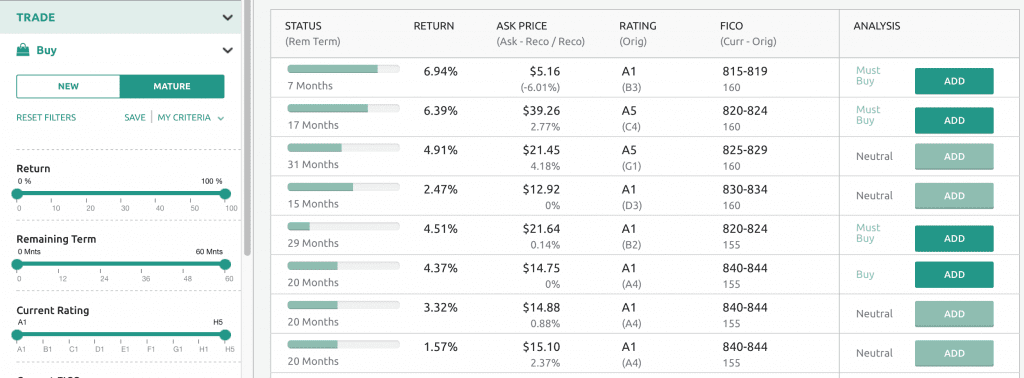

Finally, on the trade tab you will see active primary (new) and secondary market (mature) loans which are available for purchase. You can further filter the loans shown by using the criteria on the left side. Below is a screenshot of viewing secondary market loans. On the right side is Croudify’s analysis of loans for sale on the secondary market which will state “Neutral”, “Buy” or “Must Buy”. Clicking on an individual loan will share more details including Croudify’s recommended price of the loan. Underneath Ask Price is the percent difference between this and Croudify’s recommended price.

Conclusion

What’s interesting about Croudify is that they are currently focused on furthering the secondary market ecosystem. A lot of progress has been made over the last year with the introduction of Lending Club’s API but there is still more that can be done. While many tools have created analytical models, Croudify goes further by providing recommended pricing to the end user. If you’re interested in checking out the Croudify platform you can signup for a free beta account here.