[This is a guest post from Brock Blake. Brock is the Founder and CEO of Lendio, a marketplace for small business loans.]

Born out of the critical need for capital created by the great recession, in less than 10 years the alternative lending industry is estimated to grow into a $1 trillion industry (Charles Moldow, “A Trillion Dollar Market: By the People, For the People.”).

Many of the new business financing products have a higher than average cost of capital in order to service businesses with higher risk profiles, who can’t qualify for conventional SMB loans.

While most applaud the new-found access to capital that is provided through these new lenders, critics of this young industry say that the higher costs put undue stress on SMBs and will end up hurting them. On the other hand, advocates say that even though the costs may be higher, these loans still help SMBs start, maintain and grow their businesses.

This heightened scrutiny puts alternative lenders in a precarious position: how can they assist SMBs with needed capital while not pushing struggling businesses over the edge with unrealistic debt obligations?

I firmly believe that the overwhelming majority of alternative lenders are providing benefit to borrowers, but it’s also clear that SMBs may not be fully grasping the cost of capital, and that the communication gap between lender and borrower may be fueling doubts regarding the intent of the alternative lending space. This is why the alternative lending industry needs to move to close the communication gap between lenders and borrowers, and to do so by using all relevant metrics to articulate the cost associated with a loan as clearly as possible.

Here are two questions lenders need to consider to effectively communicate the cost of capital.

1. Does this loan provide benefit to the borrower?

Specifically, what does the business owner need the money for, how quickly do they need it, and will the financing improve the borrower’s situation?

The borrower’s situation is important for several reasons. First, the only way for an SMB owner to evaluate the cost of capital is to consider it against the cost of NOT getting capital: what is the cost of not bulking up inventory, or of not making a critical hire? If the upside from getting the capital in a timely fashion is just incremental, the cost of capital needs to be considered carefully to make sure that the benefits outweigh the limited upside. On the other hand, this could be less of a concern if the upside is significantly greater than the cost. Second, borrowing money for cash flow for several weeks or months is very different from taking out a loan that will be paid back over years and is secured by an asset that can be sold (which is why credit card rates are so different from rates on mortgages). What’s most important to a borrower who needs an infusion to help manage a temporary cash flow situation is not the same as what’s important to a borrower investing in heavy equipment that will depreciate as it’s paid for over years. And third, while we’ve all heard the truism “time is money,” to an SMB owner that may literally be true. The flexibility to act on an opportunity or implement a strategy in a timely fashion may pay for itself in the short or long term.

Fortunately for the business owner, the alternative lending industry has opened a whole new world of loan options to help solve the cash needs of the business that owners didn’t have access to previously. These products not only help smooth cash projections, but SMBs are also able to seek funds on short notice when they find themselves in a cash crunch. The flexibility and the speed at which these loans can be funded is an important need that the alternative lending industry is meeting. While the typical time for a business to obtain funds through traditional lending sources is 60-90 days, alternative lenders are able to provide funding in 2 to 10 days. That being said, it is critical that the lender take the time to understand the borrower’s situation and priorities — learning about what’s most important to him or her.

2. What loan terms are most relevant and beneficial to the borrower’s situation?

A couple of weeks ago, I was on a call with another key player in the industry when he asked me, “Does Lendio always recommend the lowest APR product to the business owner?”

He was shocked when I responded with “no.”

Most would think that the lowest APR product is always the best loan product for the business owner. However, that’s just not the case. Sometimes, the best product for the situation of the business owner is the largest loan size. Other times, the best product for the borrower’s situation might be the most collateralized, lowest payment, or even quickest to fund. The point is, the borrower’s situation should drive the type of loan product, not (necessarily) the lowest APR.

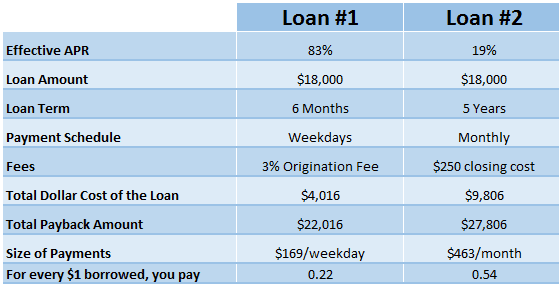

Here, a concrete example will help. Consider these two loans:

Most people are familiar with APR. While its goal is to standardize the cost of capital in order to allow borrowers to compare different loans, loan structures differ and when they do, APR may not best represent the true cost of a loan.

Consider a SMB seeking working capital to meet a sudden increase in inventory demand for the next few months. If the SMB was presented with the two options above, but only given APR and Loan Term as data points, they would likely be wary of accepting loan #1 even though it has less than half the Total Dollar Cost and better fits the situation in which they plan to use the loan. The fact is that for business owners with short-term needs for working capital, it often makes sense to choose shorter-term loans over longer-term options even though loans with a term under a year will show significantly higher APRs.

This comparison reveals the challenge that’s created when the cost of capital is expressed only through one metric. While APR can be the best way to compare the cost of credit on a long-term loan such as a car loan or mortgage, it may not be the best way to show the true cost of capital on a small business loan.

One Size Does Not Fit All

Today, the alternative lending industry offers a dynamic set of loan products including term loans (both traditional and short-term), business lines of credit, loans for startup companies, equipment purpose loans, various SBA loans, accounts receivable financing, merchant cash advances, and peer-to-peer loans. The variety enables SMBs – including those who may have lackluster credit scores or lack sufficient credit history to qualify for conventional loans – to find loans that can best fit their situation. Compared to 2009, this is a great place to be in: capital is generally available, and in a variety of forms, and not just for those with pristine credit; lenders have devised products for businesses with less than perfect credit as well. In this new, more complex world, we’re all struggling with how best to communicate the true cost of credit to SMB borrowers, so that they can make informed decisions that keep their businesses healthy and growing. Rather than taking a one-size-fits-all approach, we need to recognize and consider each borrower’s individual situation, and which data points are most relevant to them.