Business.com's 2022 payment processing study reveals several marketplace disparities, beginning with credit cards and P2P payments.

Eric Satz soon realized there was a problem. The year was 2014 and he was trying to use his IRA...

It has been almost four weeks since LendingClub closed down its retail investor platform and cash is already starting to...

There is big news out of LendingClub today for their tens of thousands of retail investors. They have given notice...

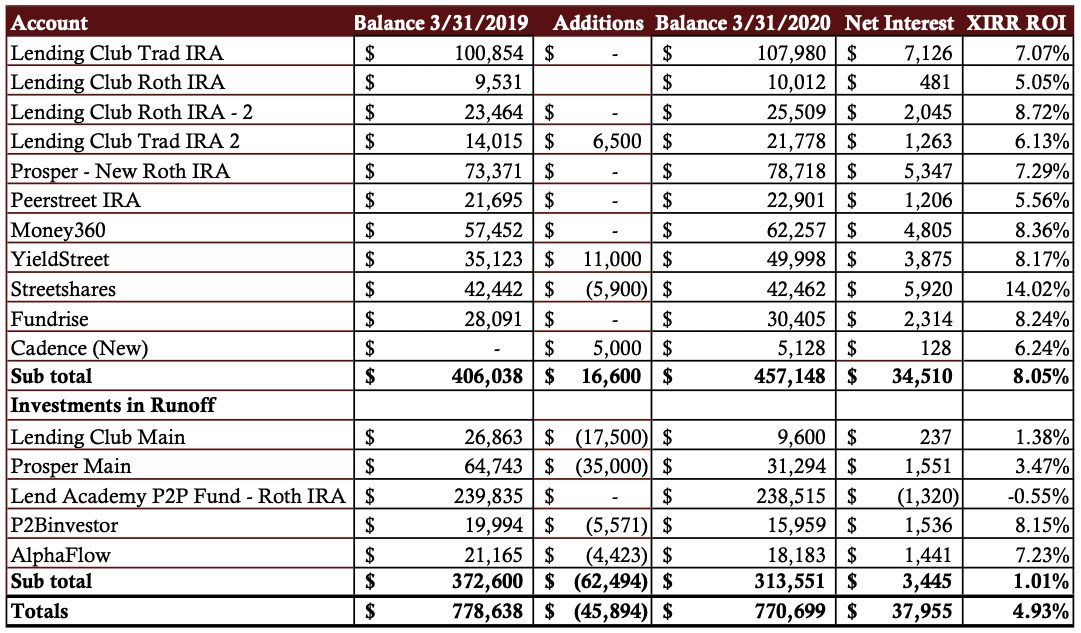

Many of you have emailed me to ask whether I am still doing these quarterly investment reports. The answer is...

There has been a lot of uncertainty over the last 2 months, especially for fintech lenders. OnDeck found themselves in...

When it comes to fintech M&A and fundraising there is no better person to talk to than Steve McLaughlin. McLaughlin...

[Editor’s Note: In part one of this two-part series, Jason Jones, co-founder of LendIt and current CCO of Centrifuge, explains...

We have recently learned that Bernardo Martinez is stepping down from his role as US Managing Director of Funding Circle....

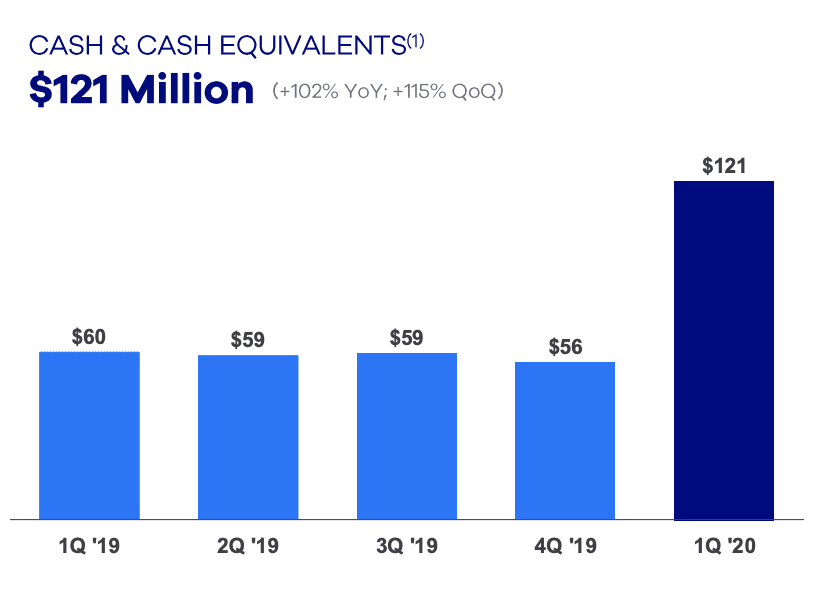

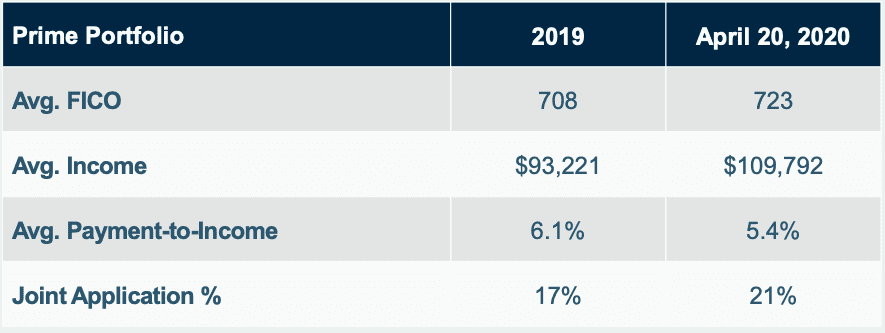

Today LendingClub announced their Q1 2020 earnings. Lenders in the US are being hit hard by the coronavirus and we...