[Editor’s note: This is a guest post from Dmytro Spilka. He is a tech and finance writer based in London. Founder of Solvid and Pridicto. His work has been published in The Diplomat, Investing.com, IBM, Investment Week, FXStreet, Entrepreneur, and FXEmpire.]

Mortgage software company Blend Labs launched its IPO last week, generating $360 million and a valuation of more than $4 billion. Although these numbers seem impressive for a fintech startup still less than 10 years old, Blend’s ambitions show that the fintech ecosystem is ramping up its battle to overtake traditional financial institutions.

Blend made 20 million shares available at a price of $18 each and is listed on the New York Stock Exchange under the symbol BLND.

As a fintech that specializes in utilizing big data and automation to leverage end-to-end customer journeys for mortgages and other banking products, Blend has achieved widespread recognition in the world of real estate. The company was named as one of HousingWire’s 2021 Tech 100 winners and has grown since its 2012 formation to become an industry leader in mortgage tech.

Blend’s white label technology is what powers mortgage applications through the websites of leading banks like Wells Fargo and US Bank – its offering was also integrated with CoreLogic in 2019 for an easier level of access to borrowers’ credit.

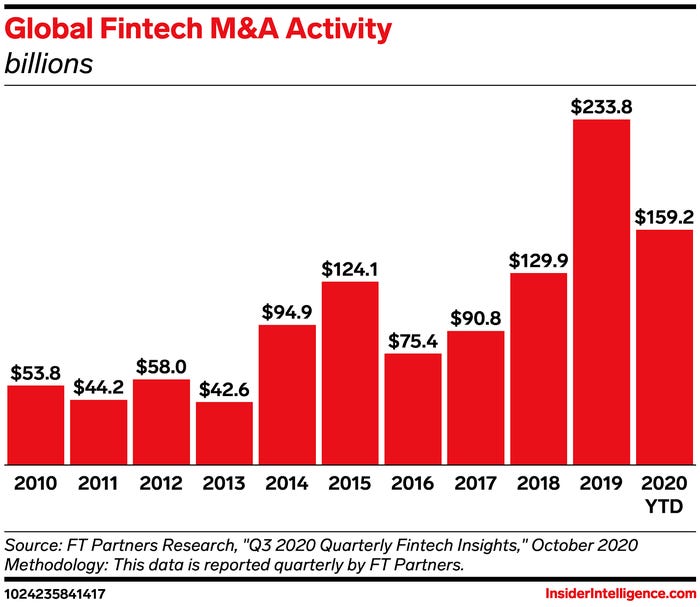

(Image: Insider)

As Q3 2020 data published by Insider shows, global fintech merger and acquisition activity has accelerated rapidly over the past decade to $233.8 billion in 2019 – a full $100 billion clear of the next best year prior. 2020 was also shaping up to be a wildly successful year at the time the data was collected despite Covid-19 uncertainty dominating Q1 and Q2 of the year.

This exponential growth in the fintech landscape is already ringing in wholesale changes across the world of finance. As the technology continues to mature and adoption becomes more of a natural process, we could see fintechs mount a challenge to the financial status quo. In fact, data suggests that such changes are already underway.

The Fintech Revolution

Prior to the Covid-19 pandemic, Experian released a Fintech Marketplace Trends Report that found that competition in personal lending between traditional financial institutions and fintechs is increasing with fintech companies more than doubling their market share over the course of four years to 49.4% – up from 22.4% back in 2015.

The data also showed that the unsecured personal loan category had grown rapidly in the same timeframe, as new loan organizations were 1.3 million in volume in March 2019 compared to 656,000 in March 2015.

As well as that, the pandemic affected the investing patterns of retail investors. According to Maxim Manturov, the head of investment research at Freedom Finance Europe, “The pandemic supplied additional reasons for the retail investment market to grow. To support the economy, most countries adopted stimulating policies, which brought both the loan and deposit interest rates to historic lows. As an alternative to low-rate deposits, many started investing their savings into stock markets, which posted significant gains last year despite the lockdown and the production slump”.

Due to the greater ability of fintech lending options to consider greater intricacies when it comes to borrowing, firms can not only lower the outright costs but also mitigate the industry’s reliance on credit scoring as the main determinant of loans. This enables borrowers with no past credit scores or poor credit ratings to access personal loans – whether it’s backed by traditional lenders or more modern digital lending platforms.

Although this doesn’t signify that the standards of credit scores have been fully erased, it means that fintechs have the potential to comfortably judge applications on their wider merits. Today’s typical fintech borrower has an Experian Vantage Score of 650 – compared to the 649 FICO held by traditional bank borrowers. Although a lender with good credit may want to consider the credit options available to them – like approval for credit card offers with 0% purchases and balance transfers – the level of flexibility that fintechs are capable of generating users on an individual basis is a significant step towards a fairer financial ecosystem.

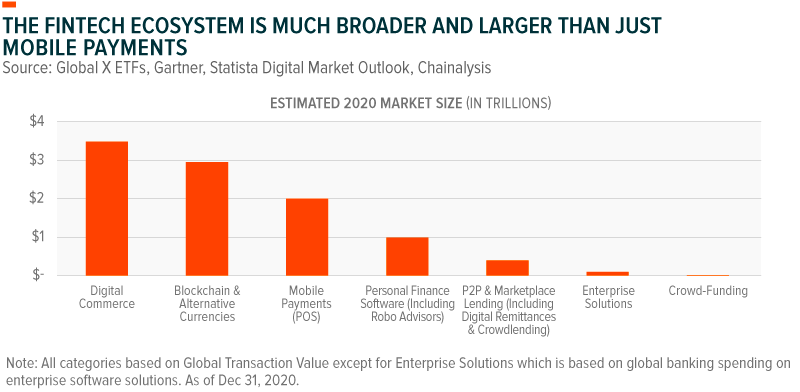

(Image: Seeking Alpha)

Seeking Alpha data indicates that the fintech revolution isn’t limited to personal loans, with a clear transition from traditional credit cards towards digital wallets and buy-now-pay-later payment formats already underway.

By eliminating the use of credit cards and driving adoption of digital wallets that can be stored on smartphones, fintechs have opened the doors to a wide world of possibilities for the public. Rather than having to visit a bank or fill out an online application to gain access to a credit or debit card, the whole process can be encapsulated on a mobile device.

Payment innovation has seen companies like PayPal and Stripe change the way individuals conduct their business, make purchases and leverage transactions online. The rate of growth driving fintechs over the past decade caused the business models behind leading payments companies to alter somewhat towards facilitating professional payments tools for merchants.

The innovation that drove Square’s growth focused on bringing a connected online payment experience into everyday life with a point-of-sale system, helping to ease merchant on-boarding in a similar way to PayPal. Modern fintechs also allowed merchants to engage in a straightforward back-end system for managing their business – whether they’re focusing on accepting payments, email marketing, customer loyalty programs or employee payroll.

As the decade progresses, we’re likely to see payments solutions go increasingly in-house so that companies become their own Stripe or Paypal. This new era of fintech can pave the way for companies across a range of industries facilitating their own payments and saving money in paying third-party service providers. It may also create new opportunities for more innovative customer experience models.

This unleashes the full potential of digital finance, and even encapsulates the possibility of greater levels of cryptocurrency incorporation in modern banking and lending practices. Although Blend’s $360 million IPO appears to be a strong statement of intent – it’s merely the tip of the fintech iceberg.