It’s finally spring, and crypto valuations are sliding alongside fintech and tech stocks, capitulation for the most aggressive growth market in the history of the S&P 500.

While M&A and VC funding drop, the conversation around crypto, web3, and the metaverse future of the world grips most media outlets.

Virtual spaces with virtual currency

Last week, Fidelity released a decentralized space to educate users about banking while showing off their involvement in virtual spaces. In an SEC filing describing $7.14 billion of new investor capital pledged toward Elon Musk’s Twitter takeover, Fidelity contributed more than $300 million in funds to help the acquisition along, appearing beside crypto firm Binance.

Chanpeng Zhao, the billionaire founder of Binance, said in a Twitter post it was “A small donation to the cause.” Zhao spoke about the investment in Musk, who has posted about crypto projects like dogecoin and BAYC, a “blank check” to spend transforming the site into a metaverse space.

Twitter has become a hotspot for crypto and web3 chatter, implementing audited NFT profile pics, and exists as the main community-building space for projects outside of privately owned Discord. Though it is unclear what the new operations Musk will launch if he succeeds, the site will open up to even more web3 and metaverse communities based on past performance.

Prices are down, but optimism prevails

In the face of a recent downtrend in stock prices in tech, a blowdown of FAANG valuations, and a corresponding crypto price drop, tech influencers are showing their support in metaverse and web3. The deep feeling of creators in the space is if retail prices drop, institutional money and b2b services have more space to grow without all the noise.

Pat White, the founder of b2b crypto enterprise software startup Bitwave, said that the promise of programmable money is too good to pass up, and its infrastructure will change traditional institutions.

A self-described gamer, he has long argued crypto and online gaming will create a future where banking is synonymous with decentralization, he said, if only traditional institutions get out of their own way.

Crypto is in the earliest stages of adoption, and thousands of programmers are discovering what they can do with the first versions of programmable money. New tech in early adoption has to model itself around outdated tech to fit in at first or risk scaring customers away.

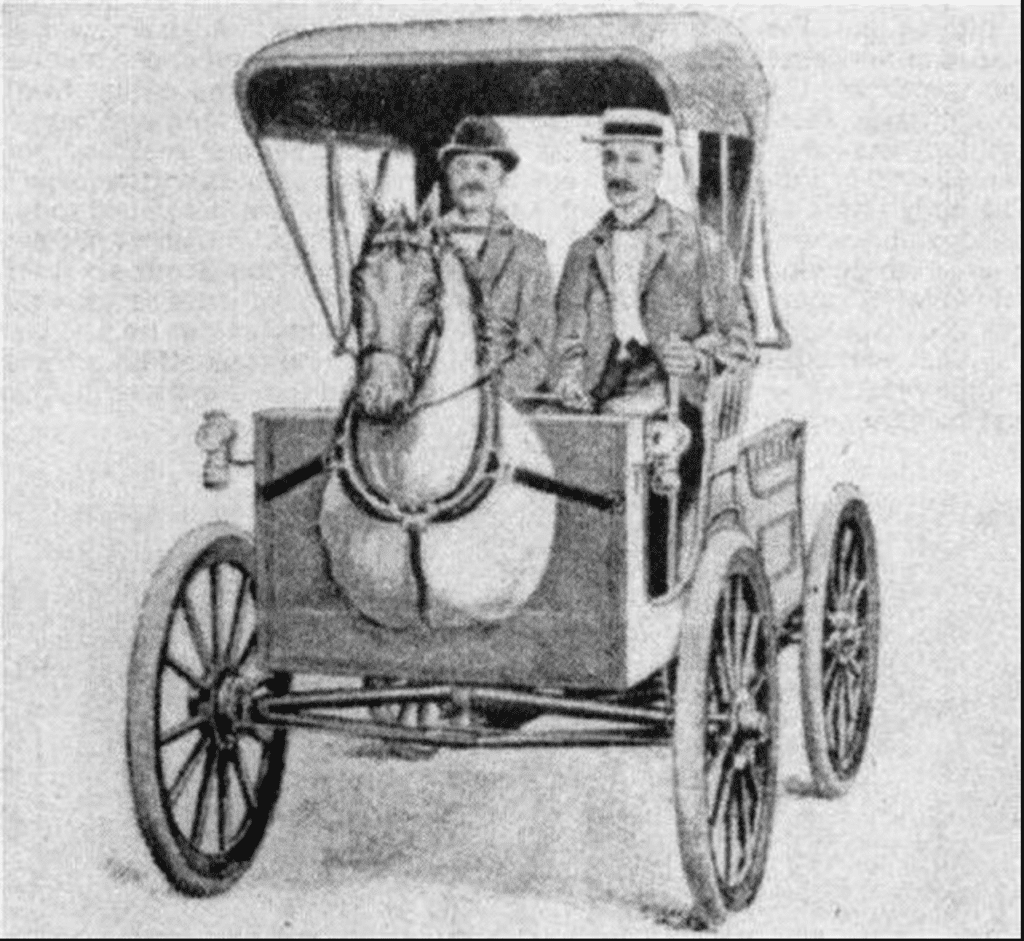

“One of the first cars that came on the road, they took like a horse’s head, and they stuffed on the front of the car,” White said. “There’s a lot of that right now; we’re in that horse’s head phase of crypto, which is we’re trying to adapt current processes to crypto.”

The horse before the programable money wagon

White said the world has begun to see a glimpse at the future of money, where innovators in tech can access the tools they need to lead a revolution.

“Crypto is the answer to the question: ‘What happens if you give 10,000 or 100,000 of the world’s best programmers an API to money?'” White said. “Programmers had never really had an API to money. I know that’s sort of a silly thing to say, but really the only people with that API have been banks and government institutions. That’s not where the innovation is happening in programming.”

With cryptocurrency tools, White said programmers could program money to do anything. White said traditional institutions are naturally set up to resist change, despite the best efforts of new tech. He said banks are just paying lip service to blockchain and web3: natural evolution can only come if they make drastic changes or young firms adopt early on.

Bitwave and the awkward stage of onboarding crypto

In the awkward stage of crypto, White has made a living at Bitwave, helping firms navigate tax, accounting, and regulatory needs for crypto custody and servicing, he said, and spent a lot of his time educating on the improvements of the new tech. The problem is, under current regulatory rules, he said, crypto is both property and a payment vehicle, creating a double accounting and taxing event.

“Bitcoin and crypto, in general, are treated as property; that’s the official IRS treatment. When you do any transacting in crypto, whether revenue or spending money, it is essentially both an accountable payment transaction, but it’s also a taxable transaction,” White said, “Let’s say I wanted to give you one bitcoin. I go to my wallet, send it to you, and have to include the fair market value of that (today, it’s $40,000) as a general ledger entry. I also just sold $40K in bitcoin, and whatever the difference between that and the purchase price, I picked up as a capital gain or loss.”

Bitwave, founded in San Francisco in 2018, comes in to help enterprises solve these accounting problems, White said. The firm functions as a service provider integrated with exchanges like Coinbase and Kraken, and DeFi protocols Uniswap or Sushi swap, to tax accounting platforms like QuickBooks.

“Businesses are picking up these obligations that they have to deal with,” White said. “That’s where Bitwave comes in is to help them kind of concisely and easily deal with the various problems that they’re going to run into as a business.”

Some startup theory

White said before Bitwave, he had been in enterprise software his entire life, first at Microsoft and then moving to Cisco fortify software. He discovered blockchain nearly a decade ago, on the original forum mailing list that saw the first Satoshi white paper that White read early on. He said he knew there was an idea for a startup there.

“I said, ‘You know what, there’s going to be a startup here: businesses are going to use this technology, and it is going to be transformational. It’s going to change the world.,” White said. “When I read the paper in 2010, it was super obvious that businesses were going to need some tweaking around this, and then they and then it really was just sort of putting it off until they kind of needed it.”

He waited until there were tools in the crypto industry to build a b2b business around instead of starting a company with a solution in search of a problem. He called that the first premise of startup theory.

“Number two is the best startups tend to come from people who are at the intersection of interesting things. I’m an enterprise software guy, and I love crypto. The intersection of those two turned into an interesting startup,” White said. “This was nonobvious like five or 10 years ago. It was incredibly nonobvious that businesses would use this unless you were someone like me, who could see businesses going to love this when they realize the amount of money to be made.”

Too big to (build) rails

Even if larger institutions want to change, they are too big to go through with it, White said. Take DeFi staking, for example, where eager investors find high APY returns, far above what savings accounts provide.

Giant traditional companies are held up by thousands of workers and decades-old infrastructure, not prone or able to change quickly, White said. Competing with Defi means taking losses on purpose for a couple of years to stamp out DeFi competition or compete with higher rates.

“The innovator’s dilemma says that when you are at a big company, and you’re faced with a threat like this, it is essentially impossible to [fix it] because it would require the business to take a big hit in the short term to position themselves for the long term,” White said. “It would require a bank to say, OK, we’re going to lower our borrowing rates down to 2% to cut out DeFi.”

Luckily for fintechs, private companies can do what larger public companies can’t. Businesses need to disrupt themselves and prepare to take lower profits in the short term to rework their overhead infrastructure toward p2p models like Defi and eventually, web3 Whtie said.

“If they did it quickly and efficiently, they would have tremendous leverage over these current upstart DeFi protocols, but businesses won’t do it,” White said. “Because internal forces of the business make it too hard.”