Taking advantage of tax deferred earnings is extremely important in building wealth for retirement. The tax savings over the course of a career can become substantial. When it comes to p2p lending, there are a few aspects that make having your p2p lending allocation in an IRA especially appealing. Lend Academy readers who follow Peter’s returns are well aware that most of his accounts reside in an IRA.

The timing of this post comes as the April 15th deadline approaches for making an annual contribution for 2014 to either a traditional IRA or a Roth IRA. This deadline does not apply to 401(k) rollovers or IRA transfers. In this post, I’ll first review what makes investing in a peer to peer lending IRA so powerful and discuss the process of opening an account with Lending Club and Prosper.

Investors who are looking into investing in p2p lending often bring up the poor tax treatment as a downside to the asset class. This is a valid argument as interest payments are taxed as ordinary income and charge-offs are capital losses. The higher your tax rate is on earned income, the less attractive p2p lending returns are for the investor. In addition, deducted losses are maxed at $3,000 per year, unless you have capital gains to offset losses. For larger investors, this is another downside to a taxable p2p lending account. For more on p2p lending tax treatment, you can read our 2015 tax information post.

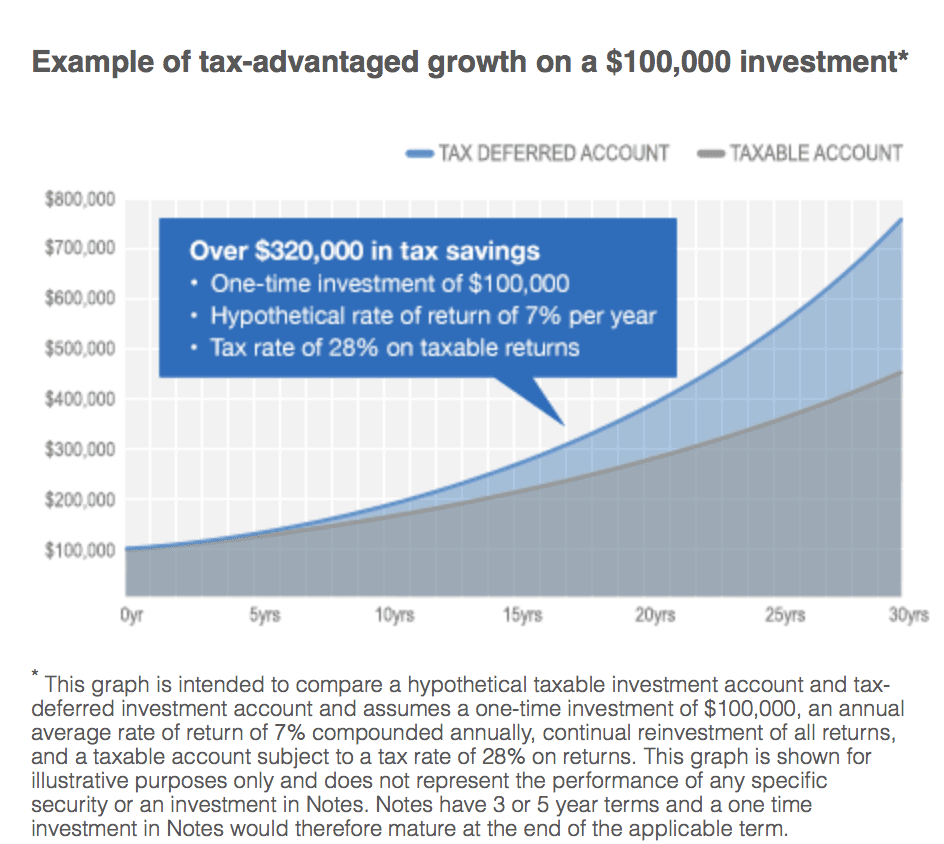

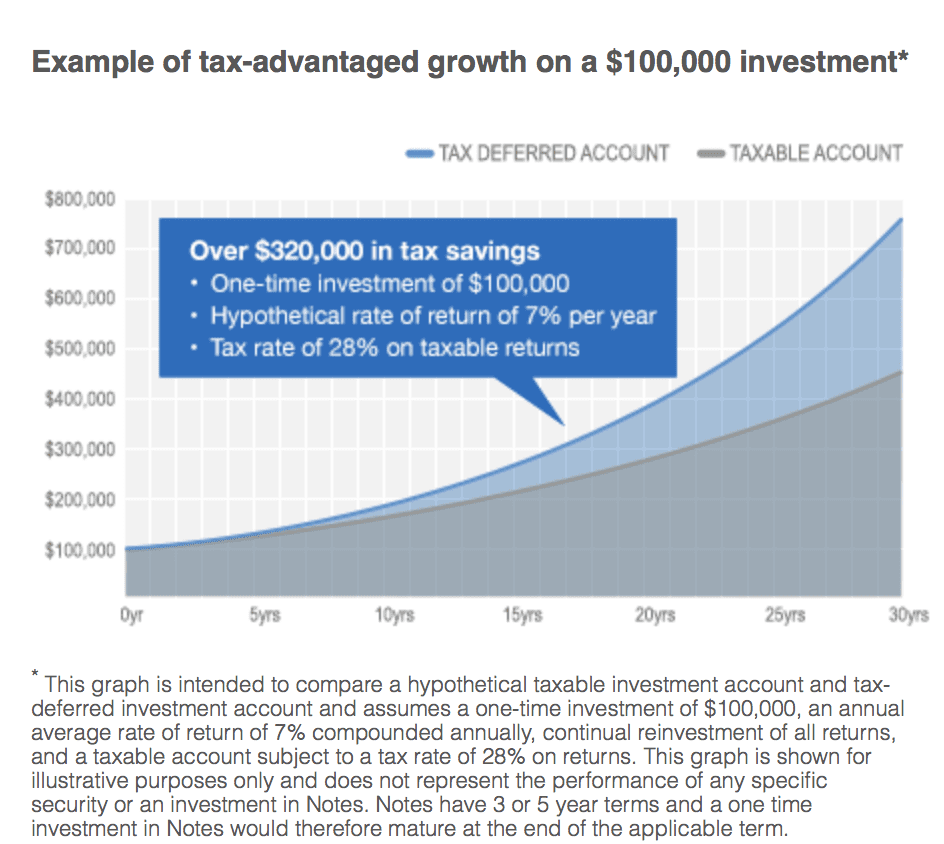

To understand the advantages of tax deferred growth, it’s important to view the alternative to compare directly. The below graph from Lending Club shows the growth of $100,000 investment over 30 years. This scenario assumes a 7% annual return and a tax rate of 28% on returns.

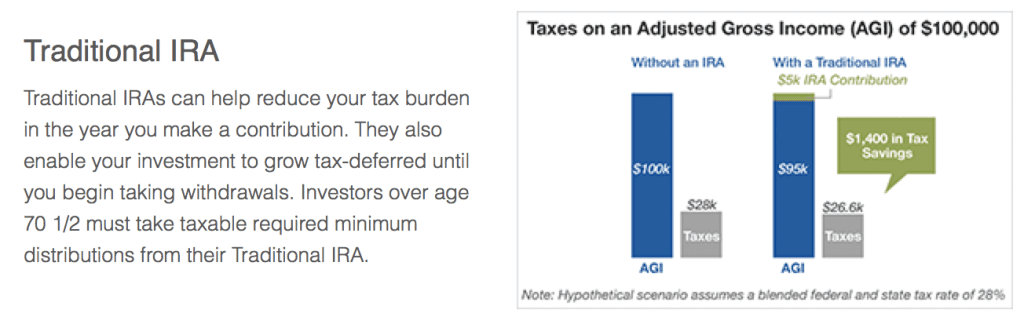

As shown above, after 30 years, a taxable account would have a total account value of around $350,000, whereas the tax deferred account would reach over $700,000. With a traditional IRA, even a $5,000 IRA contribution can amount to $1,400 in tax savings for the year. This assumes an adjusted gross income of $100,000 and a federal and state tax rate of 28%.

If you’re looking to make annual contributions to either a traditional or Roth IRA for 2014, you can contribute $5,500 annually ($6,500 if you are age 50 or over).

Opening an IRA with Lending Club

Lending Club offers 401(k) rollovers, IRA transfers and annual IRA contributions (Roth IRA or Traditional IRA). Lending Club’s preferred IRA custodian is Self Directed IRA Services, Inc. (SDIRA). There is an annual account fee of $100, but this is covered by Lending Club if your initial investment exceeds $5,000. Lending Club will continue to cover this fee in subsequent years if your investment in Lending Club notes exceeds $10,000 or more.

Like taxable accounts, only residents of the following states can open an IRA with Lending Club: California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kentucky, Louisiana, Maine, Massachusetts, Minnesota, Mississippi, Montana, Nevada, New Hampshire, New York, Rhode Island, South Dakota, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

More information on IRAs can be found on Lending Club’s website.

Opening an IRA with Prosper

Prosper, like Lending Club offers IRA transfers, rollovers and annual contributions. Prosper will also cover your first year IRA account fee to the custodian with a $5,000 contribution. If you have at least $10,000 invested on your one year anniversary, they will continue to pay the account fee. Prosper’s preferred IRA custodians are Millennium Trust and Equity Institutional.

Prosper is only available to lenders from Alaska, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New York, Oregon, Rhode Island, South Carolina, South Dakota, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin and Wyoming.

You can learn more on Prosper’s website.

Small Business and Self Employed Accounts

It’s important to note that Lending Club offers two types of employer sponsored accounts. One is a SEP or a Simplified Employee Pension plan. With the SEP, employers receive a tax deduction when they contribute to accounts of their employees. This type of account is available to any size of business, including self-employment.

Additionally, Lending Club offers a Savings Incentive Match Plan for Employees (SIMPLE) where employers and employees can make pre-tax contributions to a retirement account. However, this is only available for companies with less than 100 employees.

IRA Conclusion

We are lucky to have IRA options with both Lending Club and Prosper to realize the full potential of tax advantaged accounts in peer to peer lending. As this industry continues to grow, I believe larger companies will someday allow investing in Lending Club and Prosper via their 401(k) plan.