We heard on Monday that newly public fintech company, GreenSky, has partnered with American Express in a wide ranging deal. While we have seen some interesting fintech/bank partnerships over the last few years this is one of the most significant. It is also one of the first examples of a company that facilitates installment loans partnering with a large credit card company.

I reached out to both GreenSky and American Express to find out more. But before I get to our conversations there let’s tease out the three ways in which GreenSky is partnering with American Express.

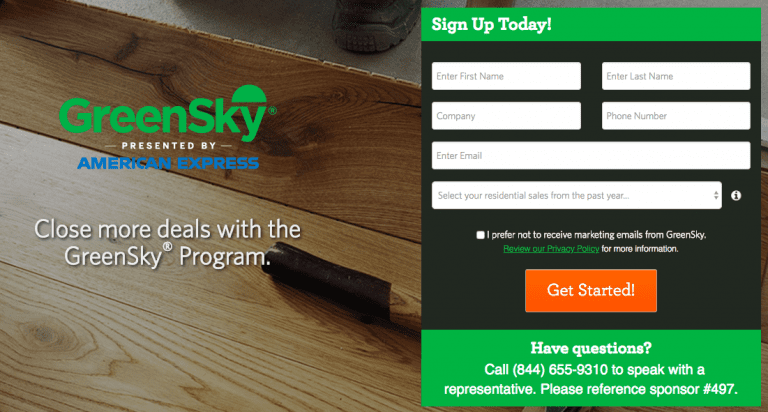

- Select American Express merchants will be able to offer financing through GreenSky

American Express merchants will be able to offer GreenSky point of sale financing as an option for consumers. This will happen in the two main verticals where GreenSky operates: home improvement and elective healthcare. Merchants are able to offer financing through the GreenSky Merchant app available for Android or iOS.

- American Express consumer card members can apply for an installment loan

This is a pilot project that will be available in the home improvement category in five U.S. cities initially. Consumers will be able to apply for an installment loan through their American Express login. The technology for this program will be provided by GreenSky and development is still ongoing before this will be a production offering.

- Access to American Express vPayment

American Express vPayment is a virtual payments solution that provides a virtual account number for each transaction. In this system a token can be provided to a customer for a single use. This obviously makes the digital payment more secure and reduces fraud risk.

When I spoke with Gerry Benjamin, the Vice Chairman of GreenSky, he was quite excited about this new multifaceted partnership with American Express. He said that at GreenSky they have long admired American Express as a company. He pointed out that there are 155,000 residential home improvement merchants in the U.S. that do more than $1 million in annual revenue. GreenSky only has 4,000 merchants that fit that profile. Virtually all of the other 150,000+ home improvement merchants that GreenSky aspires to work with accept the American Express card. So, clearly this partnership provides a lot of runway for GreenSky.

The merchant program will be up and running very quickly as everything is in place today. There will be an omni-channel approach to the marketing of this system with American Express taking the lead marketing this to their own merchants. Depending on the merchant, sometimes GreenSky will be involved in the sales process, sometimes it will be driven mainly by American Express. As for the funding of these loans, GreenSky’s bank consortium will be providing all the capital.

The consumer lending part of this partnership will not be launched immediately. There is some technology development that needs to be finalized to allow American Express cardmembers to access a GreenSky installment loan via the American Express online portal. They will be able to search for local merchants that will accept the GreenSky solution, as well as find merchants outside the GreenSky network and apply for a consumer loan online. As for funding of these loans, American Express will be providing all the capital.

I reached out to Courtney Kelso, Senior Vice President in the Global Commercial Services division at American Express, and the point person on this project. When I asked Courtney about why they decided to partner with GreenSky this is what she said:

We are always focused on expanding our relationships with merchants across the U.S. and helping to fuel their growth. Teaming up with GreenSky, which offers unique point-of-sale lending technology, is another way that we’re helping merchants in the home improvement and elective healthcare space to drive more sales and satisfy the evolving needs of their customers.

One thing I was curious about was the possibility of cannibalization of their credit card business but Courtney made it clear that was not a big concern. They want to be able to provide their customers with a broad suite of choices and have them select the solution that makes the most sense for them.

My Take

When I first heard this news on Monday morning I was most impressed. I have long admired GreenSky as they are one of the most successful companies in the online lending space. They have become the dominant player in their niche and built a highly profitable business in the process. To have them secure this partnership while still a relatively small company is quite an achievement.

As for American Express, they must have been impressed with the GreenSky offering. With their resources they obviously could have built a technology solution themselves but they decided to partner with GreenSky instead. It will be very interesting to see how much traction this partnership gets but clearly it is a big win for GreenSky.